The market, that fickle beast, has gorged itself on gains these past years. Three years of plenty, they say. But a man can smell the coming frost. The broad indices may boast, but look closer. The staples – the things a man needs, not merely desires – have barely stirred. It’s in these overlooked corners, among the dust and the everyday, that a quiet hope can take root. A hope paid out not in grand promises, but in the steady drip of dividends.

There are those who chase the soaring eagles, the tech darlings. Let them. I look to the workhorses, the companies that have weathered storms for generations. The ones that haven’t forgotten the weight of a loaf of bread, or the cost of a clean shirt. These “Dividend Kings,” they call them. Companies that have raised their payouts for half a century. Fifty years of keeping faith with the men and women who entrust them with a portion of their meager earnings. It’s a rare thing, in this age of fleeting loyalty.

Consider Procter & Gamble and Kimberly-Clark. Two giants, yes, but giants built on the backs of countless small transactions. A tube of toothpaste here, a roll of paper towels there. The sum of a nation’s daily needs. A man could invest thirteen thousand in each, they say. Thirteen thousand… a considerable sum, earned through long hours and quiet sacrifice. But if done wisely, it could yield a thousand a year in passive income. A small shield against the rising cost of living. A little breathing room in a world that offers precious little.

Procter & Gamble: The Weight of Tradition

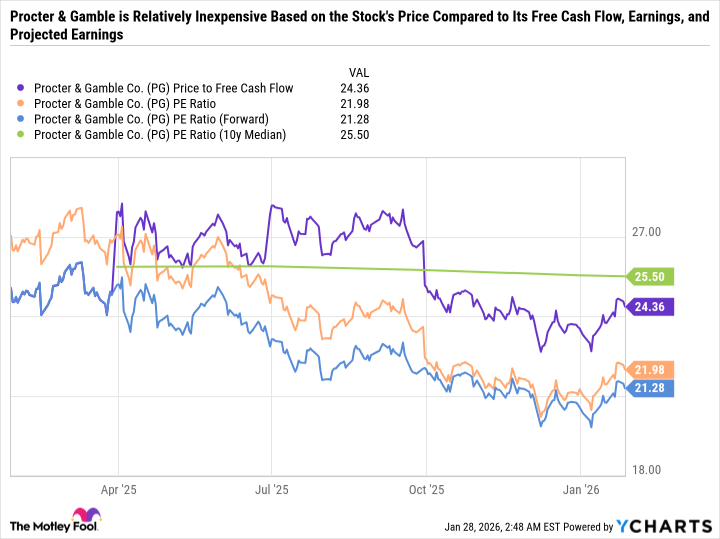

P&G… a name synonymous with household staples. They’ve seen it all – depressions, wars, booms and busts. Yet, even a titan can stumble. Last year brought a chill wind, a loss of value, a descent from grace. They blame restructuring costs, flat sales. But a shrewd man sees more. They relied too long on raising prices, squeezing every last penny from the consumer. A dangerous game. A man will only pay so much before he seeks alternatives. They acknowledge this now, under a new leader. They speak of volume growth, of focusing on value. Fine words. But it will take time. A long winter, perhaps. Still, they possess a strength few can match. Decades of brand loyalty. A mountain of cash flow. A dividend yield that offers a small measure of security in these uncertain times.

A man could do worse than to place his trust in such a company. It’s not glamorous, but it’s solid. Like a well-built table, it will endure.

Kimberly-Clark: A Gamble on the Future

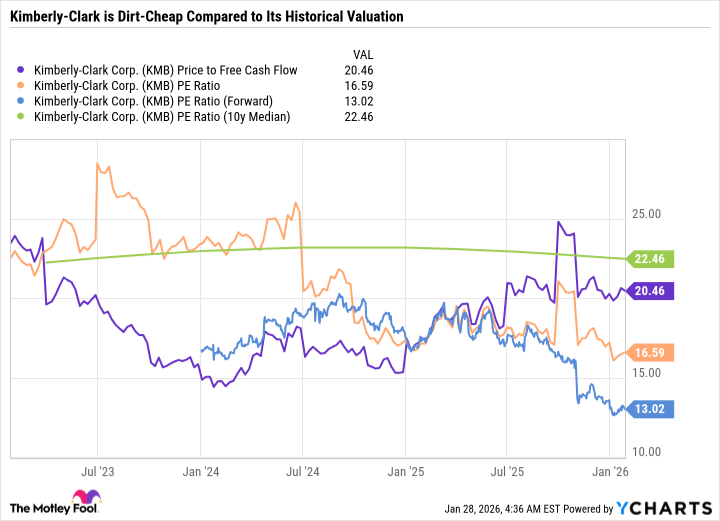

Kimberly-Clark… another pillar of the everyday. But they’ve been struggling. Mediocre earnings, flat sales, a lack of momentum. They’re attempting a bold move – an acquisition of Kenvue. A gamble, really. Combining paper towels and toilet paper with Band-Aids and cough syrup. A strange brew. They speak of synergies, of cost savings. But a man knows that such things rarely materialize as promised. Still, there’s a glimmer of hope. They’re setting the bar low, acknowledging the challenges ahead. They’re thinking long-term, recognizing that the consumer is weary. And they offer a juicy dividend yield – a lifeline for those who seek a steady income. The stock is trading at a low, a reflection of their struggles. But a patient man might find value there.

It’s a risk, yes. But every gamble holds a measure of potential reward.

Two Beaten-Down Kings: A Quiet Corner of the Market

P&G is the safer bet, the more established power. But Kimberly-Clark offers a greater potential for turnaround. Both are struggling to grow, a reflection of the broader economic slowdown. But they both generate enough cash to cover their dividends. A man could choose one, or split his investment between the two. A 50/50 split would yield an average of 4%. A small return, perhaps. But in these times, a small measure of security is a treasure indeed. These are not the stocks that will make you rich overnight. They are the stocks that will help you weather the storm, one dividend payment at a time.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2026-02-01 13:22