The Chinese automotive landscape… a vast, churning sea. In 2025, it accounted for a full thirty percent of global sales – a figure that dwarfs all others, leaving the American, Indian, Japanese, and German markets as mere tributaries. A sobering thought, isn’t it? That so much hangs in the balance, so much potential… and so much risk. And within this immensity, we find Nio, a name whispered with a mixture of hope and, increasingly, apprehension.

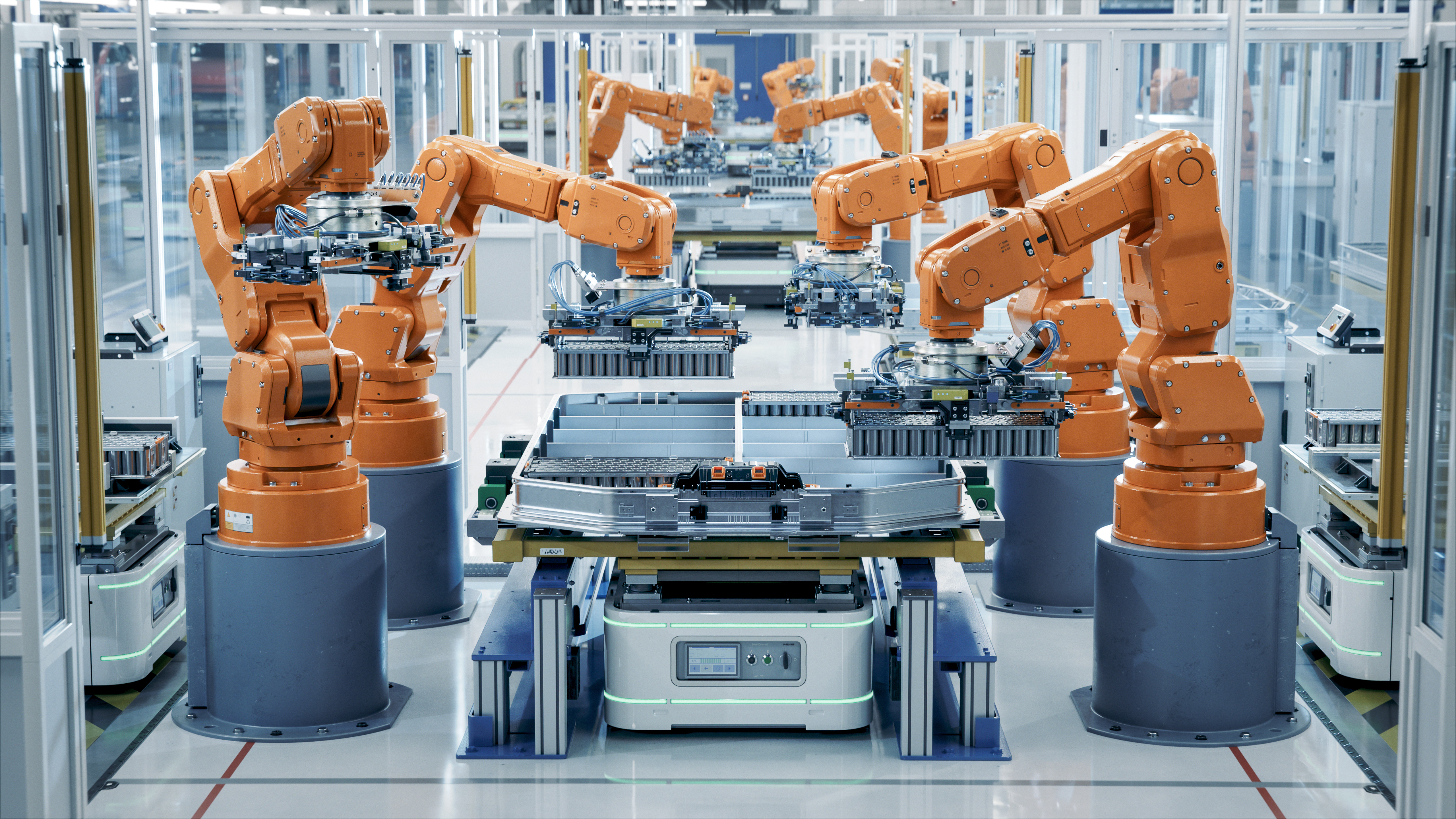

The rise of the “new energy vehicle” – the electric car and its hybrid kin – has been remarkable. By the first half of 2025, these vehicles comprised over half of all new car sales in China. A revolution, some proclaimed. A bubble, others muttered. The truth, as always, is likely a tortured compromise between the two. It naturally followed, then, that companies like Nio, purveyors of these futuristic machines, would be ripe for investment. A tempting proposition, to pluck a share for less than five dollars. But the market, my friends, is rarely so… straightforward.

The answer, surprisingly, is no. The Chinese automotive realm isn’t simply growing; it is transforming. A brutal consolidation is underway, a winnowing of the weak. And Nio, for all its promise, finds itself precariously positioned. Price, you see, is a phantom. It suggests value, but rarely embodies it. A glittering facade masking a deeper, more unsettling truth.

A Small Fish in a Very Large Pond

Let me confess, I harbor a certain fondness for Nio. Their designs possess a… boldness, a flair. The EP9 supercar of 2019, a fleeting vision of automotive excess, still lingers in the memory. And the battery-swap network, a clever solution to the range anxiety that plagues electric vehicles, is undeniably innovative. But affection, alas, does not equate to a sound investment. Sentimentality has no place in the cold calculus of the market.

The fundamental flaw lies in scale. Since its inception in 2019, Nio has delivered just shy of one million vehicles. A respectable number, to be sure. But consider this: BYD, its primary competitor, sold over 4.6 million cars last year. More than four times Nio’s cumulative total. A gulf so vast, it feels almost… existential. Nio strives, it struggles, but it remains a shadow cast by a giant. And while Nio hasn’t yet tasted profit, BYD managed a net profit of $2.9 billion in the first nine months of 2025. A chilling disparity.

One might argue that the sheer size of the Chinese market offers ample room for all players. A comforting thought, perhaps. But the reality is far more unforgiving. The Chinese EV market, once a beacon of boundless opportunity, is bracing for a reckoning. 2026 looms, a year of potential turbulence.

Fitch Ratings predicts a decline in passenger vehicle deliveries throughout 2026. The withdrawal of government subsidies, a cruel twist of fate, will undoubtedly dampen demand. And the rising cost of lithium, the lifeblood of electric batteries, adds another layer of complexity. Yet, a glimmer of hope remains: a $9 billion stimulus package, allocated to vehicle trade-ins, may provide a temporary reprieve. But such interventions are merely palliative, treating the symptoms while ignoring the underlying malaise.

Consider, too, the slowing pace of EV sales growth. In December 2025, growth stalled at a mere two percent – the slowest rate in nearly two years. A warning sign, flashing red. And, most damningly, Nio failed to break into the top ten manufacturers for sales that same month. The market is consolidating, tightening its grip. The top ten players now control ninety-five percent of all EV and hybrid sales. Nio is not among them.

Without the crutch of government subsidies, burdened by rising battery costs, and operating at a loss, Nio faces a perilous future. It is simply too small, too fragile, to withstand the coming storm. The “Big Three” – BYD, Changan, and Geely – have already established their dominance, with annual sales exceeding one or two million units. Nio, for now, remains a distant contender, a flickering candle in a hurricane. The question isn’t whether Nio will survive, but whether it can somehow, miraculously, transform itself into something… more.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2026-02-01 09:43