One does rather tire of the breathless pronouncements regarding Artificial Intelligence. The hype, you see, is quite exhausting. However, even a cynical observer such as myself must concede that the relentless march of these… digital brains is creating certain opportunities. Everyone is, naturally, fixated on the purveyors of those flashy graphics cards – Nvidia, AMD, and the like. Perfectly predictable. One prefers to look a little deeper, don’t you think?

The truly interesting development, the one everyone is overlooking in their frantic scramble for the latest gadget, is the impending crisis in memory. Quite simple, really. One can build all the computational power one likes, but it’s utterly useless if the data can’t get to it. And that, my dears, is where Micron Technology comes in. Rather clever, really.

The Bottleneck, Darling, is Memory

Goldman Sachs, those perfectly respectable number-crunchers, are forecasting half a trillion dollars being flung at AI infrastructure this year. Most of it, naturally, will go to the usual suspects. But as these digital behemoths grow, they require more than just processing power. They require… storage. And high-bandwidth memory, specifically. Micron, it seems, is rather good at that. They’re predicting a market of around $100 billion by 2028. Not bad, not bad at all.

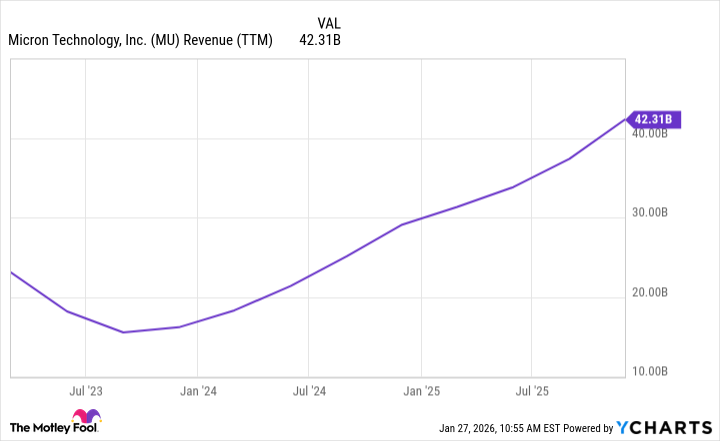

Considering Micron’s current revenue is a mere fraction of that potential market, one suspects they might just be onto something. A rather obvious observation, perhaps, but one rarely hears voiced amidst all the shrieking about GPUs. And with demand already exceeding supply, they’re in a perfectly advantageous position to… shall we say… adjust their pricing. A most civilized solution, wouldn’t you agree?

Is It Too Late to Join the Party?

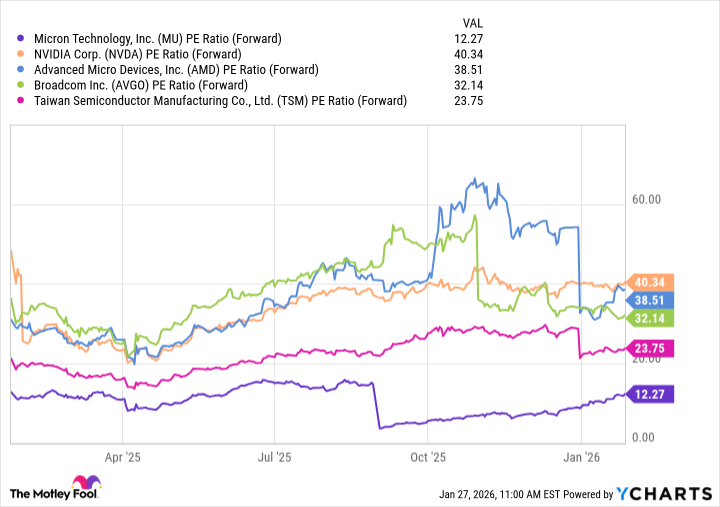

The stock has, admittedly, had a rather exuberant run. Nearly 300% in a year! One usually avoids such obvious successes, naturally. But Micron, you see, is… different. It’s still, remarkably, undervalued. Compared to its peers, at least. Most semiconductor companies are trading at exorbitant multiples, but Micron… well, it’s practically a bargain. A delightful anomaly, really.

Analysts are predicting earnings per share will triple this year. A rather impressive feat, wouldn’t you say? If the stock were to trade at a more reasonable multiple – say, 25 times earnings – the share price could easily double. One shouldn’t, of course, get carried away with specific price targets. The real point is that Micron is poised for substantial growth, both in earnings and valuation. A perfectly sensible investment, wouldn’t you agree?

One imagines the usual crowd will continue to chase the latest fads. Let them. We, however, shall quietly accumulate shares of a company that actually does something useful. A long-term hold, naturally. One doesn’t dabble in speculation, you see. One invests. And one expects a rather handsome return. It’s all frightfully simple, really.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 📢【Browndust2 at SDCC 2025】Meet Our Second Cosplayer!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2026-02-01 02:44