The S&P 500, that curiously self-aware collection of 500 American companies, managed another year of upward trajectory in 2025, adding a respectable 16% to its tally. This followed two years of similarly enthusiastic climbing, fuelled by the intoxicating promise of artificial intelligence (AI) – a technology that, let’s be honest, mostly seems to excel at writing marketing copy and suggesting things you already knew you wanted. (It’s a bit like having a very polite, slightly overzealous digital butler.) The current enthusiasm, naturally, benefits both those crafting these digital intelligences and those eagerly deploying them, mostly because it creates the illusion of progress, which is, after all, what investors truly crave. Earnings potential is, as always, a vaguely defined concept, but a comforting one nonetheless.

And so, we find ourselves in the early days of 2026, with this particular bull market continuing its improbable journey. It’s a bit like watching a particularly determined snail attempt to circumnavigate the globe – statistically unlikely, but happening nonetheless. (One assumes the snail has a good travel agent.) However, even in this optimistic climate, a rather persistent fact lingers: markets, unlike certain politicians, do not ascend in a perfectly straight line. A downturn will occur. The question isn’t if, but when, and whether 2026 will be the year of reckoning.

The State of Play in 2025

Before we delve into the potentially gloomy future, a brief recap of 2025 is in order. The S&P 500 did, indeed, advance, but not without a few disconcerting wobbles. March and April saw a rather undignified tumble, led by those very growth stocks that had previously propelled the index skyward. The culprit? Concerns over U.S. import tariffs. The logic, as near as one can decipher it, was that these tariffs would somehow diminish the earnings of even the largest tech companies, despite their best efforts to outsource everything to avoid such complications. (It’s a bit like trying to stop a tidal wave with a teacup.)

Fortunately, President Trump’s negotiations – a complex dance of diplomacy and vaguely threatening tweets – and certain exemptions for companies investing in domestic manufacturing, managed to soothe investor anxieties. Growth stocks, regaining their composure, resumed their upward climb. Later in the year, however, a new worry emerged: the possibility of an AI bubble. (A bubble, naturally, being a precarious sphere of inflated value destined to burst at the most inconvenient moment.) This caused a temporary dip in November, but companies, with remarkable resilience, bounced back, promising even more astonishing AI demand and, of course, ongoing earnings growth. We now find ourselves in the midst of the latest earnings season, where investors will scrutinize every utterance from tech giants, desperately seeking confirmation of the AI narrative.

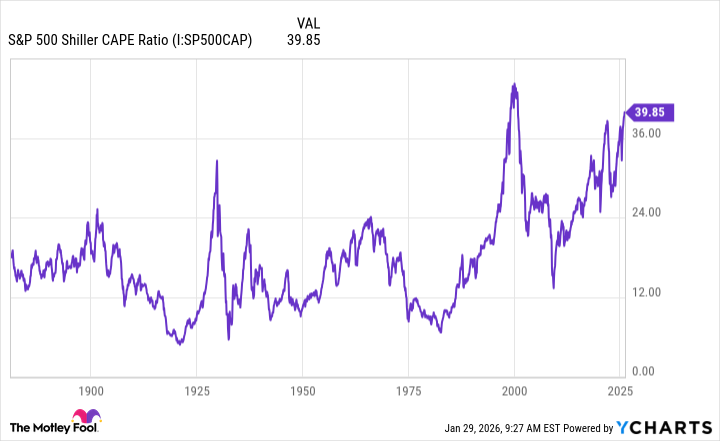

Which brings us back to the original question: after three years of double-digit gains, is the S&P 500 poised for a crash in 2026? To address this, it’s prudent to examine a metric that’s been quietly causing concern: valuation. The Shiller CAPE ratio – an inflation-adjusted measure of stock price relative to earnings – reveals that stocks are currently trading at levels seen only once before in the index’s history. (Which, statistically, isn’t that reassuring.)

A Glimpse into the Past

Let’s examine historical precedents. What happens when valuations reach such lofty heights? The chart below provides a rather sobering answer: they tend to fall. And, unsurprisingly, the S&P 500 tends to follow suit. (It’s a bit like gravity – a fundamental force that’s difficult to ignore.)

However, the nature of these declines isn’t always consistent. Sometimes, as after the dot-com boom, they can be prolonged and agonizing. Other times, the drop is swift and relatively painless. (Like a particularly efficient dentist.)

Therefore, history suggests that, given current valuation levels, the market may be ripe for a correction. This doesn’t necessarily mean a catastrophic crash, nor does it guarantee a prolonged downturn. We might see a dip in valuations, but the S&P 500 could still finish the year with a positive return. (It’s a bit like falling with style – not ideal, but preferable to plummeting headfirst.)

The depth and duration of any potential pullback will likely depend on the strength of AI demand, continued earnings growth, and, of course, the inevitable geopolitical surprises. (Because, let’s face it, the universe has a fondness for throwing curveballs.)

Even in the worst-case scenario – a full-blown market crash – there’s a comforting historical precedent: the S&P 500 always recovers and advances. This suggests that the most sensible strategy for investors is to remain calm, focus on quality stocks, and adopt a long-term perspective. (It’s a bit like navigating a particularly turbulent galaxy – hold on tight, and trust the navigational computer.)

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 📢【Browndust2 at SDCC 2025】Meet Our Second Cosplayer!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2026-02-01 02:14