The realm of Artificial Intelligence, a stage most modern, doth present a spectacle of ambition and expenditure, wherein fortunes are won and lost with the swiftness of a well-turned phrase. Amongst the players, none commands more attention than Nvidia, purveyor of those graphical engines – GPUs, as they are known – which, forsooth, have become the very sinews of this digital drama. Yet, even the most lavish productions require a shrewd accounting, and the cost of such brilliance doth give pause to even the most ardent patron.

Thus, a rival enters the scene, Broadcom, a company of a different cut. Rather than offering a versatile instrument for all manner of digital feats, they propose a specialized tool, a bespoke creation tailored to a singular purpose. A curious strategy, one might think, to forgo the broad appeal for a more concentrated effort. But as any discerning theatre manager knows, a well-crafted prop, though limited in scope, can prove far more effective than a sprawling, ill-defined set.

The question before us, then, is this: which of these companies deserves the investment of a prudent soul? Let us examine their performances with a critical eye.

Broadcom’s Gambit: A Challenge to the Grand Stage

Nvidia, as we have observed, offers a GPU capable of myriad tasks, a veritable jack-of-all-trades. This flexibility is, of course, a virtue when one seeks to accommodate a diverse repertoire. However, for those productions demanding repetitive precision – the ceaseless rendering of inference, if you will – such versatility can prove a wasteful extravagance. It is akin to employing a full orchestra to play a simple tune.

Broadcom, with its Application-Specific Integrated Circuits – ASICs – adopts a different tack. These are instruments crafted for a singular purpose, honed to perfection for a specific role. They are, in essence, the dedicated specialists of the digital theatre, sacrificing breadth for depth. The most celebrated example is Google’s Tensor Processing Unit, a secret weapon in the pursuit of AI mastery. Others, including OpenAI, are now commissioning similar creations, suggesting that this focused approach is gaining favor. Whether this be a passing fancy or a lasting trend remains to be seen.

But let us not mistake novelty for genuine superiority. The true test lies in the numbers, and here, Nvidia still holds the spotlight.

Nvidia: The Reigning Star, Though at a Price

Analysts predict a staggering 52% revenue growth for Nvidia in its fiscal year 2027, a figure that doth inspire both admiration and a touch of skepticism. Considering the company’s already considerable stature – a market capitalization of some $4.5 trillion – such expansion is truly remarkable. Broadcom, too, is expected to achieve a similar rate of growth, but it begins, shall we say, from a more modest position. This parity in expectation, however, only serves to accentuate Nvidia’s dominance.

For as any seasoned impresario knows, the larger the production, the greater the challenge of maintaining momentum. In this regard, Nvidia’s projected revenue of $323 billion dwarfs Broadcom’s $133 billion. To grow so swiftly amidst such competition is a testament to Nvidia’s skill and, perhaps, a touch of good fortune.

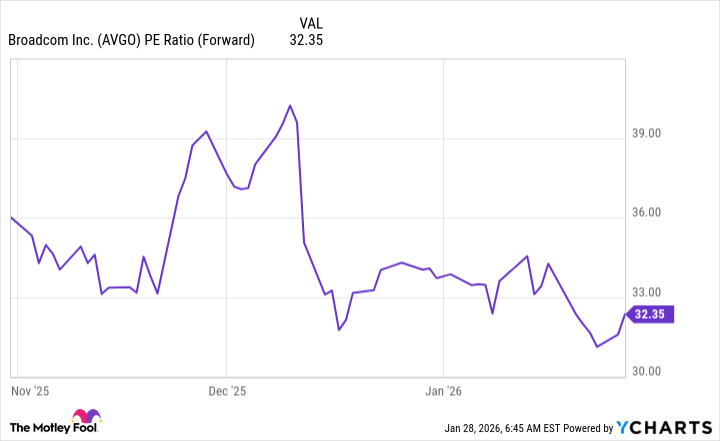

However, such brilliance doth come at a price. Broadcom’s stock currently trades at 32.4 times forward earnings, while Nvidia commands a multiple of only 24.6. To invest in Broadcom, therefore, is to pay a premium for potential, a gamble that may or may not yield a satisfactory return.

Thus, whilst Broadcom presents a compelling alternative, I must concede that Nvidia remains the superior investment at this juncture. Yet, to place all one’s eggs in a single basket is rarely a prudent course. I recommend, therefore, that investors consider a diversified portfolio, embracing both Nvidia and Broadcom. For in the ever-changing landscape of Artificial Intelligence, it is the adaptable player, not the sole star, who is most likely to enjoy a lasting triumph.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2026-02-01 01:42