In the shadowy ballet of decentralized finance, where numbers pirouette with the grace of a drunken spider, the perpetual exchanges-those perp DEXes, as the initiates whisper-have quietly amassed a nine-figure monthly waltz, their volumes swelling like a financier’s ego at a cocktail party.

These perp DEXes, the bastard children of DeFi, allow traders to speculate on the price of assets like bitcoin and ether without the tedious formality of ownership. Imagine gambling on a racehorse’s speed without ever laying eyes on the beast-a truly modern indulgence.

Instead of the pedestrian act of spot trading, users engage in a leveraged pas de deux, opening long or short positions via perpetual contracts-derivatives with no expiration date, executed entirely through smart contracts. Unlike their centralized cousins, these platforms are noncustodial, a feature as reassuring as a locked door in a house of mirrors.

Traders, with the flair of a magician pulling rabbits from a hat, connect their wallets, post collateral directly into smart contracts, and retain control of their funds-a feat as impressive as it is bewildering. Margin requirements, funding rates, liquidations, and profit-and-loss accounting are all enforced onchain, eliminating the need for a trusted intermediary-a middleman as redundant as a third nipple.

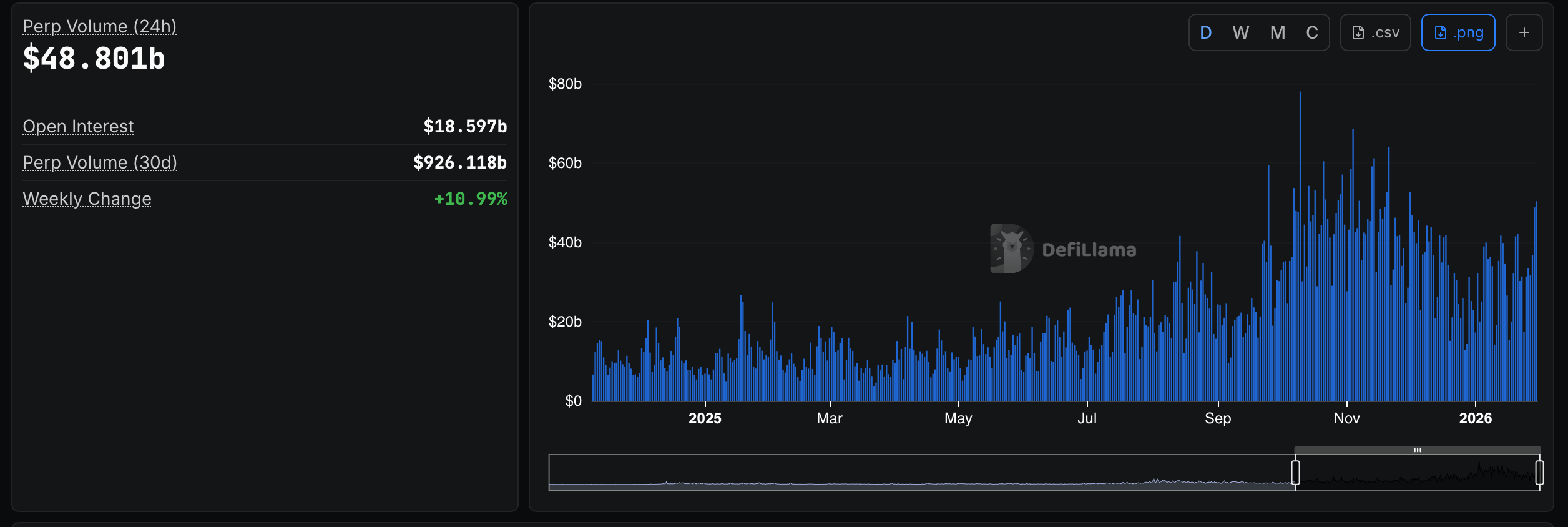

This model, it seems, has seduced the masses. According to the latest defillama.com data, total decentralized perp trading volume reached $48.8 billion in a single day, while the 30-day volume stands at $926.1 billion-a figure as staggering as it is arbitrary. Open interest (OI) across platforms is currently $18.6 billion, a testament to sustained speculative fervor rather than fleeting whims.

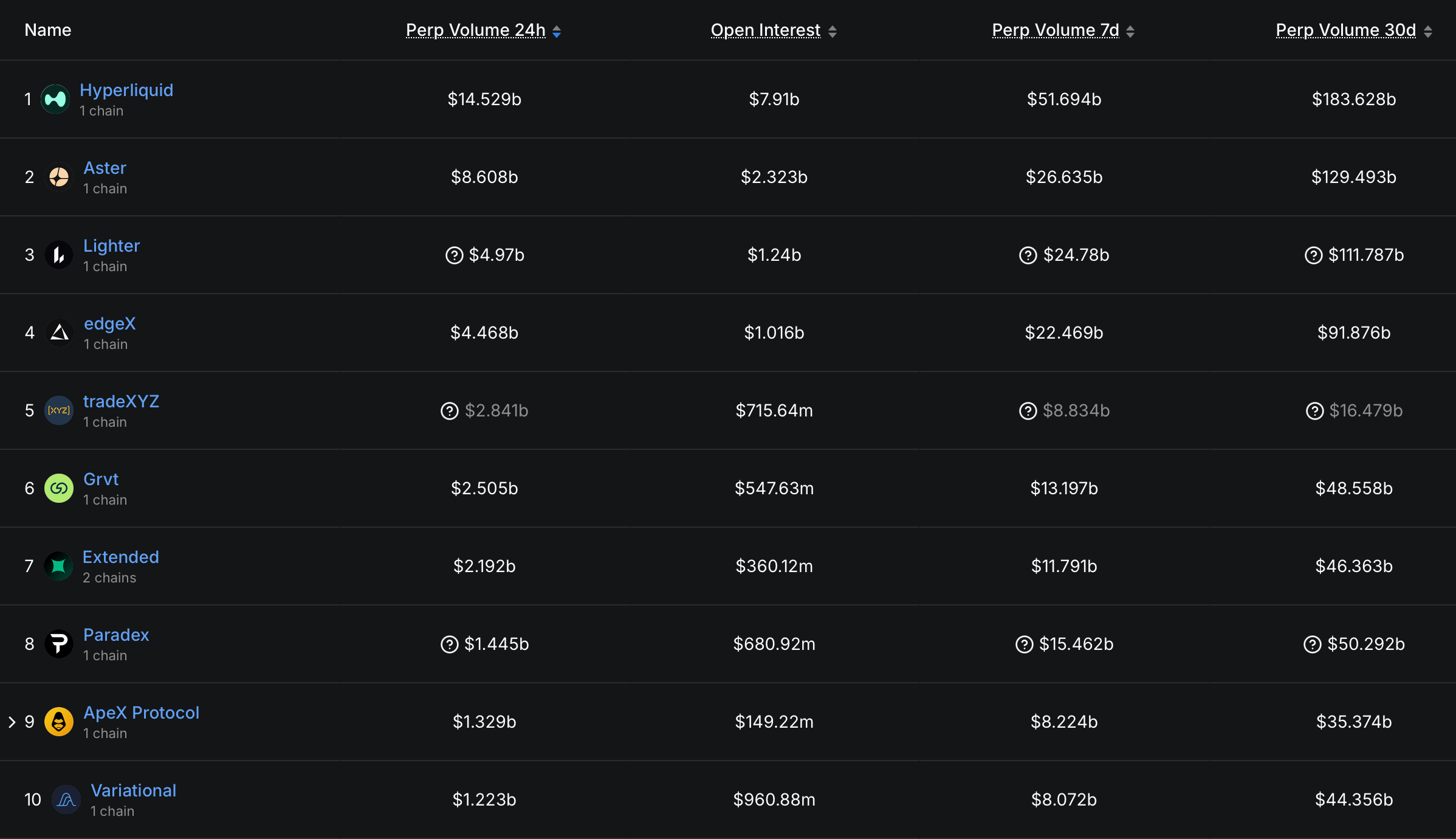

The true spectacle, however, lies in the concentration of power. A handful of platforms, like oligarchs at a banquet, dominate this 30-day feast. Leading the charge is Hyperliquid, a name as sleek as a shark in a tuxedo. With $183.6 billion in 30-day volume, it outpaces its competitors with the ease of a cheetah chasing gazelles. Its $7.9 billion in OI further cements its status as the alpha predator in this leveraged jungle.

Aster, with its $129.5 billion in 30-day volume, trails behind like a loyal but less glamorous sidekick, followed by Lighter at $111.8 billion. EdgeX and TradeXYZ complete the top five, their volumes a mere shadow of Hyperliquid’s grandeur. The bottom half of the top 10, though less dazzling, still command respect: Grvt, Extended, Paradex, ApeX Protocol, and Variational-each a player in this high-stakes game of financial chess.

This upward trend, spanning 2025 and into 2026, reflects a structural shift as inevitable as the changing of the seasons. After years of exchange collapses, regulatory theatrics, and balance sheets as transparent as mud, traders have embraced the onchain paradigm with the fervor of converts. The nearly $1 trillion in 30-day volume is not merely a number-it is a manifesto, a declaration that decentralized derivatives are no longer the playthings of experimenters but the backbone of today’s infrastructure.

If this momentum persists, perp DEXes may soon eclipse mid-tier centralized derivatives venues, not by imitation but by offering a risk and custody model as revolutionary as it is aligned with crypto’s original promise. Centralization, it seems, is not just weeping-it is on the brink of obsolescence.

FAQ ❓

- What is a decentralized perp DEX?

A noncustodial exchange where users trade perpetual futures directly from a wallet using smart contracts-a financial séance, if you will. - Why are perp DEXes popular?

They offer leverage, shorting, and transparency without the indignity of fund custody-a trifecta of allure. - Which platform leads in 30-day volume?

Hyperliquid, with over $183 billion in 30-day volume, reigns supreme-a titan among mere mortals. - How large is the market right now?

Total decentralized perp trading volume reached roughly $926 billion over the past 30 days-a sum as dizzying as it is meaningless.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2026-02-01 01:38