The land is changing. Not with dust and drought, but with currents of electricity and the whisper of algorithms. Artificial intelligence, they call it. A force that promises much, and demands a reckoning. It’s not a gold rush, not precisely. More like a slow turning of the soil, a hope for a better yield, but one that requires careful tending, lest the weeds choke the life from it.

They say this intelligence could add twenty-two trillion to the world’s wealth by the end of the decade. A sum so large it feels…unreal. For every dollar spent, nearly five are promised in return. Promises are cheap things, though. It’s the work, the honest toil, that counts. And the question isn’t just what this wealth will be, but who will gather it. The current drifts toward those with the means to build the dams, leaving the smaller currents to swirl and dissipate.

There’s been talk of fortunes made. Names whispered like blessings – Nvidia, Palantir. But to believe a quick bet will blossom into a million-dollar harvest is a fool’s errand. The market is a fickle god, and demands more than just hope. It demands diligence, a diversified field, and a long view. To put all your eggs in one basket, even a shiny, new AI basket, is to invite ruin.

Still, there are companies worth watching, worth investing in, not for the quick gain, but for the steady growth. Palo Alto Networks and Broadcom. These aren’t the glamorous names, the ones splashed across every screen. They are the builders, the craftsmen, the ones laying the foundations for this new world. And in a world built on shifting sands, a solid foundation is worth more than gold.

The Watchmen at the Gate: Palo Alto Networks

The more we build in this digital realm, the more we need to protect it. It’s a simple truth, older than any technology. And the demand for security, for watchmen at the gate, is only going to grow. They say the market for AI cybersecurity could swell fivefold in the next ten years, reaching a hundred and sixty-eight billion. That’s a lot of vigilance. A lot of sleepless nights spent guarding the harvest.

Palo Alto Networks understands this. Their Prisma AIRS platform isn’t just about stopping attacks; it’s about securing the entire life cycle of this new intelligence, from the seed of an idea to the full bloom of its potential. Customers are recognizing this, and the demand for their services has more than doubled in a single quarter. That’s a sign, not just of a good product, but of a growing need, a quiet desperation for protection.

They’re consolidating their offerings, bringing everything under one roof. It’s a smart move. Too often, security is fragmented, a patchwork of defenses. This is about building a fortress, a unified system that can withstand any assault. Customers are responding, moving away from the scattered defenses, and embracing this holistic approach. It’s a testament to the power of simplicity, of a single, strong shield.

They’ve seen a thirty-two percent increase in customers adopting this unified platform. And their future contracts are growing at a faster rate than their current revenue. That’s a sign of a healthy business, a company that’s building for the long term. They’re predicting twenty billion in annual recurring revenue by 2030. A bold claim, but one backed by a growing market and a solid foundation.

The potential is vast, a three-hundred-billion-dollar market waiting to be tapped. And Palo Alto Networks is well-positioned to claim its share. For those looking to build a lasting portfolio, to plant seeds that will bear fruit for years to come, this is a company worth considering. Not for the quick profit, but for the steady growth, the reliable yield.

The Silent Engine: Broadcom

Nvidia gets the headlines, the fanfare. But every machine needs an engine, a silent power that drives it forward. And Broadcom is building those engines, the custom processors that power this new intelligence. They aren’t the face of the revolution, but the hands that build the machines.

These processors are gaining traction with the giants – the hyperscalers, the AI companies. They’re cost-effective, efficient, and powerful. And the market for custom processors is growing at a rapid pace, projected to reach one hundred and eighteen billion by 2033. That’s a lot of engines. A lot of power.

Broadcom is the dominant player in this market, expected to control sixty to eighty percent of it by 2033. They’re the trusted partner of the giants – Alphabet, Meta, OpenAI. They’re the ones building the infrastructure that will power this new world. They’re a bedrock in a world of shifting sand.

Their AI revenue could hit eighty-three billion by 2033. A fourfold increase from their current level. That’s a testament to the power of innovation, the strength of their partnerships, and the growing demand for custom processors. Analysts predict they will become much bigger going forward. And that’s not just good for their shareholders, it’s good for the future of this technology.

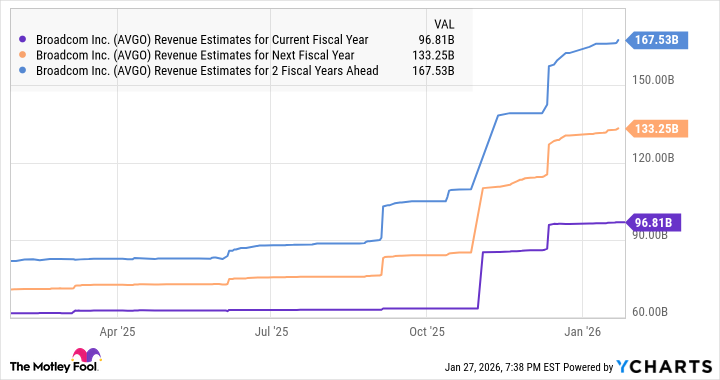

Broadcom reported sixty-four billion in revenue last year. They’re on track to more than double that in just three years. That’s a remarkable feat, a testament to their vision and their execution. And they’re well-positioned to sustain that growth for years to come. For those looking to build a lasting portfolio, to invest in a company that’s building the future, Broadcom is a worthy contender. Not for the quick profit, but for the steady growth, the reliable yield, the silent power that drives it all.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

2026-01-31 23:54