The year 2025 offered a quiet rebuke to the prevailing wisdom regarding domestic equities. International stocks, for a time dismissed as lagging, demonstrably outperformed their American counterparts. This is not a matter of national pride, but of simple arithmetic. The continuation of this trend into 2026, with the iShares Core MSCI Total International Stock ETF (IXUS 1.63%) showing a gain of 7.5% against the S&P 500’s 1.9%, suggests a re-evaluation of portfolio strategy is warranted. The pursuit of yield, after all, demands a willingness to look beyond familiar shores.

The resurgence is not limited to established, large-capitalization stocks. Smaller companies, often overlooked in the rush to embrace the seemingly ‘safe’ bets, contributed significantly to this outcome in 2025, and early indicators suggest this pattern will persist. This is why the Avantis International Small Cap Value ETF (AVDV 2.72%) currently occupies a prominent position on my list of potential investments.

The appeal of this fund is straightforward. If both small-cap and international equities are anticipated to lead the market, combining them under a single umbrella appears, at the very least, logical. It is a simple principle, often obscured by the complexities of modern finance.

A More Refined Approach to Value

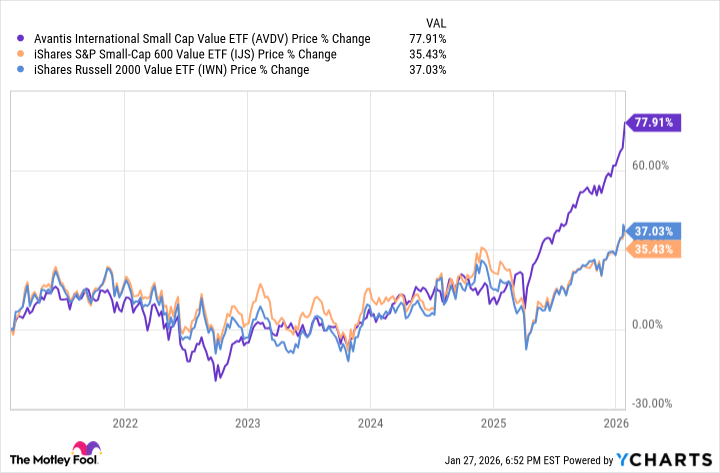

Historically, small-cap value investing has proven its worth over the long term – nearly a century, in fact. However, recent performance of domestic small-cap value funds has been…disappointing. This Avantis ETF, thankfully, has avoided that fate, consistently outperforming its U.S. counterparts over the past five years. It is a reminder that past performance is not a guarantee, but a useful data point nonetheless.

The fund’s active management is a key consideration. The small-cap sector, by its very nature, is less efficient than the realm of large-capitalization stocks. This inefficiency creates opportunities for skilled managers to identify undervalued assets, particularly in international markets where scrutiny from American investors is often limited.

Furthermore, the fund’s geographic allocation is thoughtfully constructed. A substantial 32% of its portfolio is dedicated to Japanese small caps. Some observers believe these companies are currently undervalued and stand to benefit from the economic policies of Prime Minister Sanae Takaichi. This is not speculation, but a reasoned assessment based on available data.

With approximately $17 billion in assets, the Avantis ETF offers a compelling value proposition. Its annual expense ratio of 0.36%, or $36 for every $10,000 invested, is reasonable, though one must always remain vigilant against unnecessary fees. It is a small price to pay for access to a potentially lucrative segment of the market, provided one approaches it with due diligence and a clear understanding of the risks involved.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-31 18:22