Now, listen closely, because this isn’t about those flashy, fizzgigging growth stocks that vanish quicker than a chocolate éclair at a picnic. No, sir. We’re talking about the real treasure – the ultra-high-yield dividend stocks. The sort that build wealth slowly, steadily, and with a satisfying thunk like a good, solid bank vault closing. If you’re aiming for a comfortable income stream in 2026 and beyond, pay attention. These five aren’t just stocks; they’re little income-producing machines, and I’ve had a good, long look under their bonnets.

1. Enterprise Products Partners: A Pipeline of Plenty (6.4%)

Enterprise Products Partners (EPD 1.10%) – a name that sounds suspiciously like a villain from a spy novel – owns a network of pipelines stretching 50,000 miles. That’s enough to wrap around the Earth more than twice, which is frankly a bit alarming when you think about it. But fear not! 2026 is a pivotal year. They’ve been splashing out on new projects – a whopping $4.5 billion in 2025 – but now the spending is easing off to a more sensible $2.5 billion.

This means more cash, naturally, and what do sensible companies do with extra cash? They return it to shareholders! They’ve already decided to buy back shares – a clever trick to make the remaining ones more valuable – and a juicy dividend increase could be just around the corner. They’ve been raising that dividend for 27 years – a truly remarkable feat, and a sign of a company run by people who aren’t entirely foolish.

2. Realty Income: The Monthly Miracle (5.3% yield)

Realty Income (O +1.07%) is a rather peculiar beast. It pays a dividend every month. Every single month! Like clockwork. And not just any dividend, but one they’ve been increasing for 113 straight quarters. That’s a lot of quarters, let me tell you. As a REIT, they’re required to hand out most of their profits – a rule I wholeheartedly approve of.

They own over 15,500 properties – everything from pharmacies to bowling alleys – spread across 92 industries. A bit of everything, you see. They lease these properties under what they call ‘triple-net’ agreements, which means the tenants pay for everything – even the leaky roofs. Smart thinking. This diversification makes them remarkably stable, even when the world is going topsy-turvy.

3. Brookfield Infrastructure Partners: The Asset Accumulator (5% yield)

Brookfield Infrastructure Partners (BIP 0.55%) is a collector of things. Utilities, transport networks, pipelines, data centers… they gobble them up. And these aren’t just any old assets; they’re the sort that earn predictable income under long-term contracts. They also have a habit of selling off older assets to fund new adventures – a bit like a magpie with a business plan.

In 2025, they raised a tidy $3 billion by selling some of their old treasures and are now investing in high-growth areas like artificial intelligence (AI) data centers. They’re predicting strong growth in 2026, aiming for a 5% to 9% annual increase in funds from operations and dividends. A sensible target, I think.

4. Oneok: The Turnaround Tale (5.3% yield)

Oneok (OKE +0.80%) had a bit of a wobble in 2025. Their debt piled up after acquiring several companies – Magellan Midstream, Medallion Midstream, and EnLink Midstream. A bit greedy, perhaps? But these acquisitions have significantly expanded their pipeline capacity, and they expect to save nearly $500 million in the near term.

They even managed a 4% dividend raise in January 2026, despite the debt concerns. A bold move! Management is confident they can increase the dividend by 3% to 4% annually. A compelling turnaround story, and a stock worth a closer look.

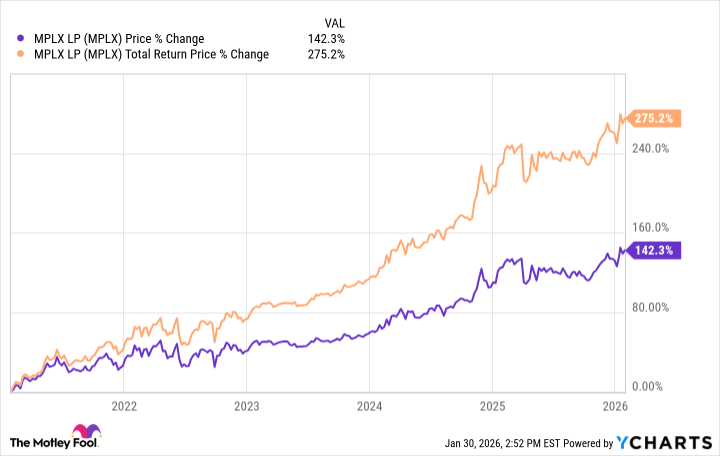

5. MPLX: The Monster Yield (7.7% yield)

MPLX (MPLX 0.60%) is a bit of a beast – one of the highest-yielding large-cap stocks in the energy sector. And it has a powerful backer: Marathon Petroleum (MPC +0.26%). This provides MPLX with predictable revenues and plenty of growth opportunities.

Their recent acquisitions and expansions in key oil and gas regions set the stage for a strong 2026. In the first nine months of 2025, their net earnings grew by 15%, and they raised their dividend by 12.5%. Another dividend increase is expected soon, making this a monster high-yield stock that deserves a place in your portfolio.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-31 17:12