It is reported, with the predictable fanfare of those who profit from such pronouncements, that the great hyperscalers – those digital leviathans who now hold sway over so much of modern existence – will expend upwards of half a trillion dollars upon the infrastructure of artificial intelligence this year. A sum so vast it scarcely registers as anything more than a rearrangement of digits in the accounts of the already wealthy. Microsoft, Alphabet, Amazon, Meta – they accelerate the construction of data centers, not from any altruistic impulse, but because the very logic of their existence demands endless expansion, a perpetual motion machine fueled by the anxieties and desires of humankind. One observes this relentless pursuit of growth, and wonders if it is progress, or merely a more elaborate form of the same old folly.

Let us consider, then, those who stand to benefit most from this new gilded age. Not the populace, of course, but those who provide the tools, the gears and levers of this increasingly complex machine.

1. Nvidia: The Purveyor of Illusions

Nvidia, a name now whispered with reverence in the halls of power, appears as the most obvious beneficiary of this frenzy. Three years ago, it stumbled upon a truth: that its graphics processing units, originally designed for the rendering of fantastical images in games, could be repurposed to serve the insatiable hunger of artificial intelligence. A fortunate accident, perhaps, but one that has transformed the company into a modern-day Midas, turning silicon into gold. The demand for these chips is, naturally, described as ‘unprecedented,’ a word so often employed to mask the simple truth of unchecked greed.

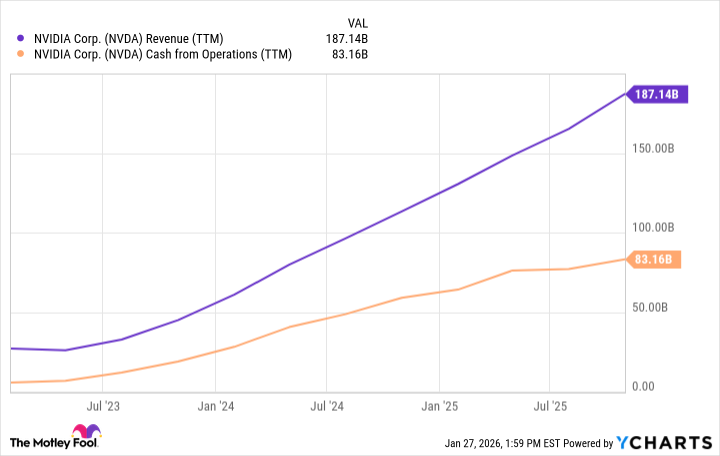

The company’s profitability is, of course, the true object of interest. The operating cash flow swells, and with it, the capacity to innovate, to release new architectures every eighteen months, each one more complex, more expensive, more essential to the continued functioning of the digital empire. The current Blackwell series is hailed as the ‘gold standard,’ but even as the accolades are bestowed, the next generation, dubbed Rubin, is already in development, a backlog of orders stretching into the hundreds of billions. One cannot help but observe the irony: we build machines to automate labor, yet create ever more intricate systems of dependency.

The investment continues to pour in, the demand remains insatiable. It is a self-fulfilling prophecy, a cycle of expectation and expenditure that appears destined to continue until the inevitable reckoning.

2. Broadcom: The Unsung Architect

But to focus solely on the glamour of the chip itself is to miss the larger picture. Building these artificial intelligence data centers is not merely a matter of stacking rows of processing units. It requires a vast, intricate network of supporting infrastructure, a hidden architecture that keeps the whole edifice from collapsing. Broadcom, a name less celebrated than Nvidia’s, provides the ‘nuts and bolts’ – the networking switches, the interconnects – that allow these chips to communicate, to process information at the speeds demanded by the modern world.

Furthermore, Broadcom has positioned itself as a provider of custom silicon, designing application-specific integrated circuits for companies like Apple, ByteDance, Alphabet, and Meta. The hyperscalers, it seems, are not content to rely solely on a single provider, seeking to complement their existing infrastructure with custom architectures, to lower costs, and to assert a degree of control over their own destinies. A sensible precaution, perhaps, but one that merely adds another layer of complexity to the already labyrinthine system.

Broadcom, while lacking the headline-grabbing appeal of its peers, plays a crucial role in this unfolding drama. As the demand for processing power grows, so too will the need for the supporting infrastructure that makes it all possible.

3. Taiwan Semiconductor Manufacturing: The Foundry of Dreams

But the true beneficiary of this relentless demand for chips is, perhaps, the most unassuming of all: Taiwan Semiconductor Manufacturing. If Nvidia and Broadcom design and manufacture the brains of the artificial intelligence revolution, TSMC holds the keys to the factory, the foundry where these dreams are brought to life. Holding an estimated 70% of the market share, TSMC is the largest chip manufacturer in the world, outsourcing production for Nvidia, AMD, Broadcom, Micron Technology, and even some of the hyperscalers themselves.

This makes TSMC a ‘pick-and-shovel provider’ – a company that profits not from the innovation itself, but from the tools that make it possible. It matters little which chip architectures are in demand; so long as enterprises are spending on artificial intelligence, TSMC is likely to be the company manufacturing them. The rising capital expenditure budgets serve as a proxy for TSMC’s trajectory, a testament to its central role in bringing this new era to life.

The company’s management sees artificial intelligence as a ‘generational growth trend,’ one that will produce robust revenue and profit margin expansion throughout the decade. And so, TSMC may well be the biggest beneficiary of all, the safest bet for long-term investors, a silent partner in the grand spectacle of technological progress. One can only hope that this progress, for all its expense and complexity, ultimately serves a purpose beyond the accumulation of wealth.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2026-01-31 16:33