The allocation of five thousand units of currency is, predictably, a matter of some urgency for those afflicted with the delusion of control over their own futures. Three entities have been identified—Taiwan Semiconductor Manufacturing, Broadcom, and The Trade Desk—each presenting a potential avenue for the dispersal of these funds. It is not a suggestion of optimism, merely an observation that, within the labyrinthine structure of the market, these particular corridors appear, for the moment, less obstructed than others. The implication of ‘gains’ throughout the designated period of 2026 is, of course, a probabilistic assertion, subject to the whims of forces entirely beyond comprehension.

Should one find oneself without ownership of shares in these entities, the acquisition thereof may prove… expedient. Not because of inherent value, but because the prevailing currents of speculation dictate that such actions are, at present, less disadvantageous than others.

1. Taiwan Semiconductor Manufacturing

The current fascination with ‘artificial intelligence’—a term increasingly divorced from any demonstrable intelligence—has generated a demand for specialized silicon. While the architects of these systems receive the accolades, it is Taiwan Semiconductor Manufacturing that performs the actual labor. They are the unseen mechanics of this digital illusion, producing the components that allow others to claim innovation. The sheer scale of their operation—the world’s largest by revenue—is not a testament to success, but rather a reflection of the insatiable appetite of the machine.

This dominance affords them a peculiar insight into the flow of demand, a vantage point from which they can observe the predictable patterns of consumption. It is a position of power, certainly, but one built upon the foundation of endless production and the relentless pursuit of efficiency.

Projections indicate a compounded annual growth rate of nearly 60% related to these ‘AI’ chips between 2024 and 2029. Such figures are not indicative of genuine progress, but rather a temporary surge in demand, driven by the cyclical nature of technological hype. The company’s investment of 52 to 56 billion units is not a sign of confidence, but a desperate attempt to maintain its position within a system that demands constant expansion. The potential for stock appreciation is, therefore, merely a consequence of this relentless pursuit of scale.

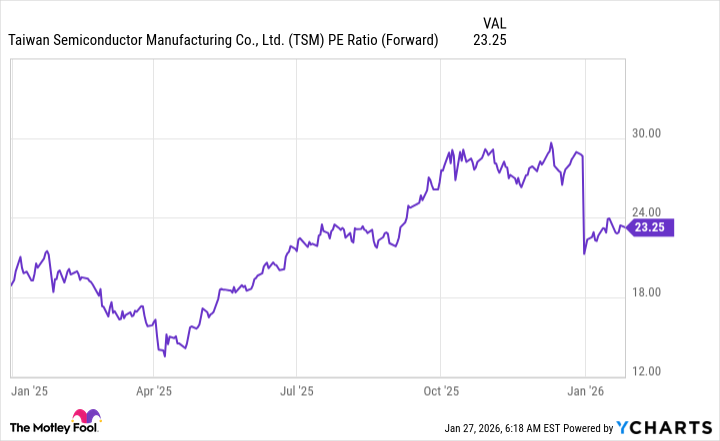

A forward earnings multiple of 23 times is, in the current climate, almost… reasonable. A fleeting moment of equilibrium within a fundamentally irrational system.

2. Broadcom

Broadcom offers a diverse array of products, but its current focus lies in the creation of custom ‘AI’ chips. Rather than providing a generalized computing unit, it collaborates directly with the ‘hyperscalers’—the entities that control the flow of information—to design specialized circuits. These ‘ASICs’—application-specific integrated circuits—are not a novel invention, but Broadcom’s adaptation of them to ‘AI’ applications is… noteworthy. It is a refinement of existing technology, not a breakthrough.

The expectation of doubling ‘AI’ semiconductor revenue in the first quarter is… predictable. Such growth is not indicative of inherent value, but rather a temporary distortion within the market. The potential for this division to comprise half of Broadcom’s revenue by the end of 2026 is… concerning. It suggests an overreliance on a single, volatile sector.

These ‘ASIC’ chips represent a potential alternative to the offerings of Nvidia, which many companies are… actively seeking. The prospect of substantial growth over the next few years is… plausible. It is merely a question of whether this growth can be sustained.

3. The Trade Desk

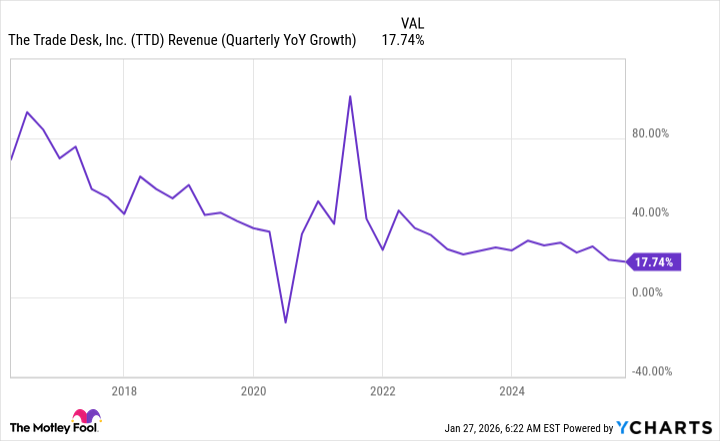

While Broadcom and Taiwan Semiconductor Manufacturing experience a surge in activity, The Trade Desk confronts a different predicament. Its growth is… decelerating. The third quarter represents the slowest revenue growth in the company’s history, excluding a temporary setback in 2020 caused by… unforeseen circumstances.

However, a growth rate of 18% is… not entirely insignificant. Projections of 16% growth for 2026 are… acceptable. The company’s current valuation—16 times forward earnings—is… surprisingly low. It suggests that the market has already factored in the deceleration of growth.

Despite the slowing growth and increasing competition, The Trade Desk is… not on the verge of extinction. It remains a viable entity, capable of delivering… adequate results. Investors should, therefore, consider this pullback as an opportunity to acquire shares at a… discounted price. It is a gamble, certainly, but one that may yield… modest returns.

The Trade Desk is primed for a… temporary rebound in 2026. It is a… relatively safe investment, given the current climate. It is merely a question of whether it can maintain its position within a rapidly changing landscape.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2026-01-31 15:23