Now, one observes, with a slightly raised eyebrow, that the stock market, particularly those rather grand, blue-chip specimens, is exhibiting a touch of the exuberance. It’s not quite a giddy whirl, mind you, but a decided spring in its step, fostered, no doubt, by a bull market that’s been galloping along for a good three years. A return of 23%, 24%, and 16% in the last three calendar years, you see, does tend to inflate things, much like a particularly enthusiastic aunt at a garden party.

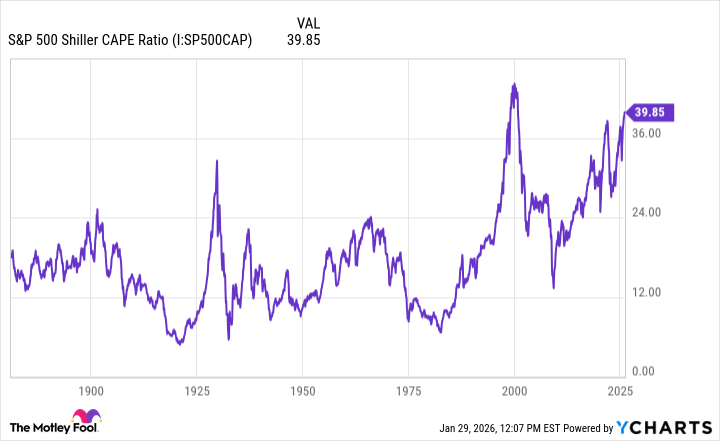

This has resulted, rather predictably, in valuations reaching levels that are, shall we say, historically noteworthy. We’re talking about the Shiller P/E ratio, or, as the more learned chaps call it, the Cyclically Adjusted P/E. A mouthful, what? But a useful measure nonetheless.

This ratio, conceived by the bright spark that is Nobel laureate Robert Shiller, takes the market price of, say, the S&P 500, and compares it to earnings adjusted for inflation over a decade. It’s a bit like assessing a chap’s character over a long acquaintance, rather than judging him on a single, possibly misleading, handshake. Smoothes things out, you see, and gives a broader view of the market’s general state of affairs.

Currently, this Shiller P/E ratio stands at a rather alarming 39.85. Why is this significant? Because it hasn’t been this high since July of 2000 – a quarter of a century ago, at the height of that dot-com brouhaha. Even higher, in fact, than in October 2021, when the post-COVID technology boom had everyone in a bit of a flutter.

A Spot of Trouble Brewing?

One doesn’t need to be a seasoned market observer to recall what followed those previous peaks. The dot-com bubble, you see, had a rather ungraceful burst in 2000, leading to a three-year bear market. The S&P 500 took a tumble, sinking by 9%, 12%, and 22% in successive years. By January 2003, the Shiller P/E ratio had retreated to a more sensible 21. A bit of a recovery, you might say.

Then, after the 2021 peak, the market experienced a bit of a wobble in 2022, falling 18%, before regaining its composure in 2023. The Shiller P/E ratio, rather obligingly, retreated to 28 in April of that year.

Does this portend another correction in 2026 or 2027? It’s impossible to say with any certainty, of course. But history does have a habit of rhyming, as the poets are so fond of saying. When valuations reach these lofty heights, earnings must continue to rise to justify them. If they don’t, for whatever reason – macroeconomic forces, a sudden aversion to bowler hats, anything really – investors will seek safer pastures, such as bonds, commodities, or even those rather dependable small-cap companies.

This, in turn, could spark a sell-off of those overvalued large caps, which, let’s be honest, make up a disproportionately large slice of the market pie. The result? A bit of a drop in stock prices. Not necessarily a catastrophe, mind you, but a correction nonetheless.

Now, some analysts argue that this artificial intelligence boom is boosting earnings and productivity, justifying these high prices. That may well be true. But a prudent investor, much like a well-prepared picnic, should always be prepared for the worst. That means keeping a watchful eye on the P/E ratios of the stocks you invest in. If they’re significantly higher than historical averages, it might be a signal to proceed with a degree of caution. One always appreciates a generous dividend yield, after all, a bit of income to cushion the blow, you see.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2026-01-31 14:43