The universe, as anyone who’s accidentally glanced at a physics textbook knows, is fundamentally irrational. Investing, therefore, is less about predicting the future and more about identifying the least improbable outcomes. Most investors chase ‘growth’ – a concept roughly equivalent to trying to herd smoke. I prefer to look for companies that, while not necessarily thriving, are at least managing to avoid immediate and catastrophic implosion. And, ideally, are currently experiencing a temporary, market-induced bout of being undervalued. Because, let’s face it, everything is relative, even financial ruin.

Two companies currently tickle my contrarian fancy, largely because everyone else seems to be briefly distracted by something shinier. They aren’t glamorous. They won’t launch you into orbit. But they might not lose all your money. Which, in the grand scheme of things, is a victory. (It’s a low bar, admittedly. But standards are overrated.)

1. Costco Wholesale: The Membership Paradox

Costco. The name suggests a wholesale accumulation of… well, things. And it delivers. But the real brilliance lies in the membership fee. Think of it as a pre-emptive bribe to ensure you’ll continue buying things you didn’t realize you needed. It’s a remarkably effective system, and one that economists are still trying to fully understand. (They suspect it involves quantum entanglement and the subtle manipulation of consumer desires. Or possibly just really good hot dogs.)

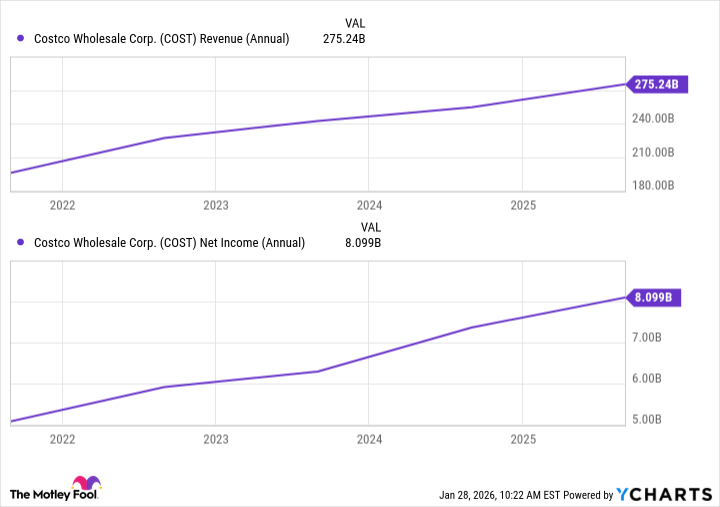

The company essentially gets paid before you spend, which is a remarkably sensible business model. Most companies operate on the principle of hoping you’ll pay them eventually. Costco is just… proactive. And during times of economic uncertainty, people flock to places offering the illusion of saving money while simultaneously buying more things. It’s a beautiful, self-perpetuating cycle. Costco’s revenue has been steadily increasing, a feat akin to a particularly stubborn pebble defying gravity.

Crucially, Costco’s membership retention rate is exceptionally high. Over 90% in the US and Canada. This suggests that people either genuinely enjoy shopping there or have simply lost the ability to calculate the true cost of their bulk purchases. (It’s probably a bit of both.) The stock hasn’t exactly been cheap, because, you know, common sense. But a recent dip has brought the valuation down to a relatively reasonable 47x forward earnings. Which, in the current climate, is practically a giveaway. (Don’t tell anyone I said that.)

2. Chewy: The Autoship Singularity

Chewy. A company dedicated to the proposition that pets deserve all the things. All of them. And their owners, apparently, have unlimited disposable income. It’s a surprisingly effective strategy. They’ve managed to become profitable, which is always a good sign. (Companies that consistently lose money tend to, eventually, stop existing.)

But the real magic lies in Autoship. The concept is simple: you sign up for automatic delivery of pet supplies, and Chewy happily obliges. It’s a stroke of genius. It guarantees recurring revenue, reduces inventory risk, and fosters a deep, unsettling dependence on a corporate entity. (Think of it as a long-term relationship with a very efficient supplier of kibble.) Over 80% of Chewy’s sales come from Autoship, which means they’ve essentially created a subscription to pet ownership. It’s terrifyingly effective.

And now, they’re launching veterinary clinics. Because apparently, selling pet supplies wasn’t enough. They want to control the entire pet care ecosystem. It’s a bold move. And slightly unsettling. (But also, surprisingly logical.) The stock is currently trading at 24x forward earnings, down from over 36x a year ago. Which, in the grand scheme of things, is a steal. (Unless, of course, the entire pet care industry collapses. But let’s not dwell on that.)

So, there you have it. Two companies that aren’t going to make you rich overnight. But might just prevent you from losing everything. In a world of increasing uncertainty, that’s a victory in itself. (Or at least, a temporary reprieve.)

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2026-01-31 11:22