Right. So, Joby Aviation. It’s one of those things that feels…important. Like, potentially world-altering, or just another tech bubble waiting to burst. Honestly, I’m never quite sure. My portfolio is currently a thrilling mix of cautious optimism and outright panic, and Joby feels very much in the latter camp, but with a glimmer of…something.

The basic premise is electric vertical take-off and landing aircraft – eVTOLs, if you’re keeping up with the acronyms. Apparently, the future is flying taxis. Who knew? It’s either that or a dystopian nightmare of congested airspace, but let’s focus on the upside for now, shall we?

Joby isn’t just building the aircraft, though. That’s the crucial bit. They want to

own

the whole shebang – make, operate, the works. A vertically integrated model. It sounds…ambitious. And also, terrifyingly expensive. It’s like deciding to not just open a bakery, but grow the wheat, mill the flour,

and

build the oven yourself.

Units of Sleep Lost Analyzing FAA Certification: 7. Number of Times I’ve Repeated “Vertically Integrated” to My Cat: 4.

Archer Aviation, their competitor, is taking a different tack – just building the planes and selling them. Less risk, perhaps, but also less control. And let’s be honest, control is what everyone wants, isn’t it? Even if it’s an illusion. Joby is further along in the FAA certification process, which is good, but it’s a bit like being slightly less likely to trip and fall off a cliff. Still a cliff.

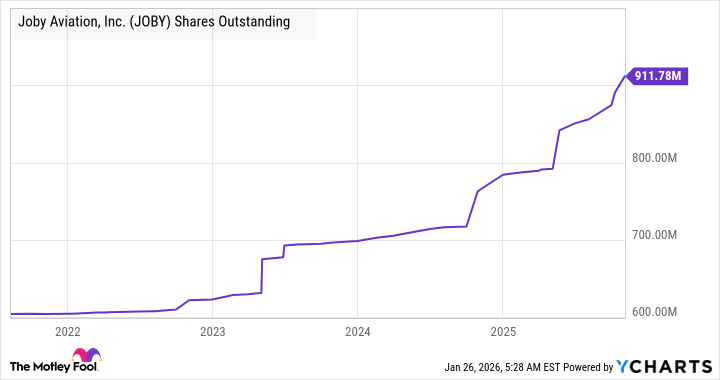

The risks, naturally, are substantial. FAA approval is never a given. And then there’s the small matter of funding. They’re going to need a

lot

of cash to build out manufacturing, vertiports (apparently, that’s where the flying taxis land), and an actual fleet of aircraft. My calculations suggest they’ll need to raise more capital in 2026. Possibly through another equity raise, which, let’s face it, dilutes existing shareholders. It’s like realizing you’ve accidentally signed up for another subscription service.

Here’s a handy table of projected cash burn, just to keep things cheerful:

| Wall Street Consensus for Joby Aviation | 2023 | 2024 | 2025Est | 2026Est | 2027Est |

|---|---|---|---|---|---|

| Cash Burn | $344 million | $477 million | $538 million | $646 million | $574 million |

| Net Cash | $1032 million | $933 million | $710 million | $1034 million | $925 million |

And then there’s Wisk, Boeing’s subsidiary. They’re planning

autonomous

eVTOLs. Which is either incredibly clever or incredibly reckless. The idea of a pilotless air taxi is… unsettling. And potentially cheaper, which is always a problem. It’s like realizing your artisanal coffee is suddenly competing with instant granules.

However. There’s a glimmer of hope. Joby has partnerships with Delta Air Lines (who want to fly passengers to airports – a sensible plan, actually), Uber (because everyone needs an app for everything), and Toyota (who apparently know a thing or two about manufacturing). That’s a pretty formidable alliance. And they’re even dabbling with Nvidia on potential autonomous capabilities.

Hours Spent Trying to Understand the Regulatory Landscape of Autonomous Air Travel: 18. Number of Times I’ve Considered a Career Change to Become a Shepherd: 3.

Joby might just get a first-mover advantage. Autonomous aircraft are still years away, and even then, they’ll face significant technical, regulatory, and cost hurdles.

So, is Joby a good investment? Honestly, I have no idea. It’s risky, yes. But it also has potential. A lot of potential. It’s the kind of stock that could either make you rich or leave you wondering what you did with all your money. It’s a gamble, really. And sometimes, a girl just has to take a gamble. Just maybe not with all her savings.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 📅 BrownDust2 | August Birthday Calendar

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

2026-01-31 09:13