Now, Meta Platforms (META 2.96%). A curious beast, isn’t it? A few years back, it looked as if it might be joining the ranks of once-great companies now relegated to the footnotes of business history. But here we are, and it’s been quite the turnaround. Up eightfold since the depths of 2022, which, when you think about it, is rather a lot. The latest earnings report? Let’s just say it caused a bit of a stir amongst those who watch these things – and I, naturally, am one of them.

Revenue for the fourth quarter jumped a respectable 24% to $59.9 billion. Spending, as these things often do, went up too, which is always a bit of a balancing act. But investors, being the shrewd bunch they are, had anticipated that. Net income still rose a healthy 9% to $22.8 billion, or $8.88 per share. Not bad. Not bad at all.

Looking ahead, Meta is predicting revenue of $53.5 to $56.5 billion for the first quarter. That’s a 30% increase year-over-year, with a little help from currency exchange rates (about 4%). That would be its fastest quarterly growth in five years, which, statistically speaking, is quite fast indeed. It’s enough to make one reconsider one’s portfolio, wouldn’t you say?

But here’s the truly interesting bit. Meta is on the verge of something rather remarkable. It’s getting to the point where its advertising revenue could actually surpass that of Alphabet’s (GOOG 0.02)(GOOGL 0.07) Google Search. As soon as this year, some are saying. It’s a bit like watching a tortoise overtake a hare, isn’t it? Except the tortoise has a very clever algorithm.

Meta Stakes Its Claim

Almost all of Meta’s revenue comes from advertising. In 2025, they brought in $201 billion, of which a whopping $196.2 billion was from ads. It’s a remarkably concentrated business, really. All this despite the considerable resources poured into ‘Reality Labs’ and the metaverse. One wonders if they’ll ever quite figure that one out, but that’s a discussion for another day. The core engine, the bit that actually makes money, remains stubbornly, and profitably, Facebook and Instagram.

Ad revenue rose 22% last year, and the guidance for the first quarter suggests that growth is likely to accelerate. Susan Li, Meta’s CFO, mentioned that improvements driven by AI are boosting conversion rates. “Driving strong conversion growth,” she said. A wonderfully understated way of saying they’re getting better at selling things, isn’t it?

Based on Meta’s 30% top-line growth forecast for Q1 (including that 4% currency boost), a 28% growth rate for the ads business seems a reasonable estimate for the full year. That would bring their advertising revenue to $251.1 billion for 2026. A substantial number. A very substantial number.

Alphabet hasn’t released its full-year results for 2025 yet, but through the first three quarters, Google Search & other brought in $161.4 billion, up 12%. If the fourth quarter grows at the same rate, they’ll finish 2025 with around $222 billion. And if that grows another 12% in 2026, they’ll reach $248.7 billion. Just shy of Meta’s forecast. A close race, to be sure. A very close race.

The Advantage?

Now, Alphabet investors are perfectly right to point out that this isn’t a straight comparison. Google Search isn’t Alphabet’s only advertising business. They also have YouTube and the Google Network, which runs ads on countless third-party websites. Combined, those segments bring in over $300 billion in ad revenue, giving them a comfortable cushion. But the trend is clear. Meta is gaining ground. And if that continues, it’s only a matter of time – likely a few years – before Meta surpasses Alphabet’s entire advertising business.

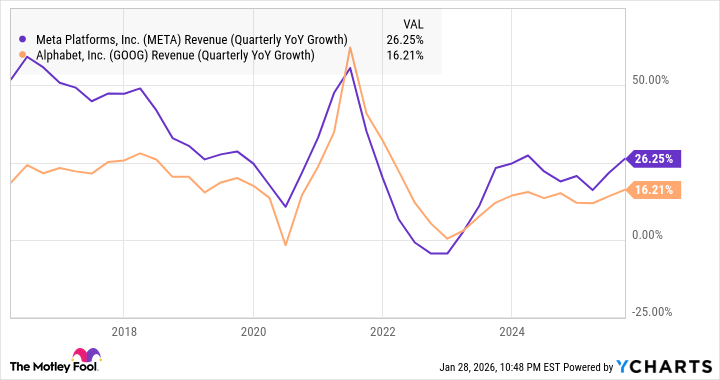

The chart below illustrates the overall revenue growth of both companies. And you can see that Meta has consistently outgrown Alphabet in nearly every quarter of the last decade, barring a brief post-pandemic wobble. That suggests Meta is well-positioned to continue its impressive growth trajectory.

What Does it Mean?

Alphabet has overcome earlier worries that AI chatbots would cannibalize its advertising business, and the stock has soared over the last six months, in part thanks to Google Gemini. But when it comes to advertising, Meta’s social media-based business model appears to have a significant edge in the AI era. They’ve used AI to improve ad targeting and introduced tools that help advertisers create ads.

Alphabet, meanwhile, seems to have been playing a bit of defense. They’ve introduced AI overviews in search, but that seems more about defending market share from ChatGPT and other challengers than about growing their ad business. It’s a subtle difference, but an important one.

In the AI era, Meta looks likely to become the world’s biggest advertising business. That’s not to diminish Alphabet, which is driving growth in a number of areas, but Meta’s rapid growth in advertising is making it a winner. And AI has become a significant tailwind for the company in its core business. Regardless of when it overtakes Alphabet, that’s a good reason to bet on Meta to be a market-beater this year and beyond. It’s a curious turn of events, isn’t it? A most curious turn indeed.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

2026-01-31 03:32