It has, of late, become apparent that Fiserv (FISV +0.54%) has suffered a most considerable diminution in its standing. A decline of seventy per cent in the past year, marked by a particularly distressing fall of forty-four per cent upon the announcement of its third-quarter results, suggests a fragility not previously suspected. One might venture to observe that the company’s projections, once held in some esteem, have proven to be built upon foundations less secure than was comfortable to believe.

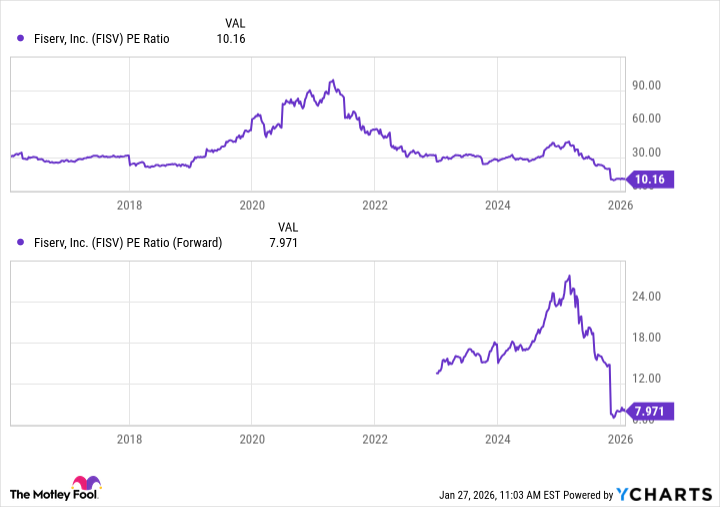

The stock now trades at a valuation scarcely seen in a decade, prompting the question whether this presents an opportunity for judicious investment. A closer examination of the business, therefore, is warranted, lest one be led astray by mere appearances.

A Business of Necessary, if Unromantic, Utility

Fiserv occupies a position of considerable, if somewhat unglamorous, importance. It provides, as it were, the very sinews of monetary exchange, serving upwards of ten thousand financial institutions across the globe. The company manages an astonishing 1.7 billion accounts and authorizes ninety billion transactions annually – a scale of operation that, while impressive, speaks more to necessity than brilliance.

Its Clover system, a point-of-sale solution for smaller enterprises, is a particularly noteworthy aspect. This allows merchants to accept various forms of payment, and provides tools for managing inventories, scheduling employees, and cultivating customer relations. It is a practical, if uninspired, undertaking.

Clover, however, is but one facet of Fiserv’s wider payments business. The company also furnishes the technological infrastructure for banks and other financial entities, handling payment processing, card issuance, and a variety of banking services. In the first nine months of the past year, it generated $15.9 billion in revenue and $2.7 billion in net income – figures that, while respectable, do not necessarily guarantee future prosperity.

A Disquieting Turn of Events

Despite its solid foundations, Fiserv has, of late, encountered difficulties. Its third-quarter results were, to put it mildly, unsettling. Adjusted earnings per share fell by eleven per cent, and management was compelled to revise its projected organic revenue growth downwards, from a hopeful twelve per cent to a far more modest four per cent. Such a reduction in expectation is rarely a sign of underlying strength.

The initial projections, it appears, were somewhat inflated by circumstances particular to Argentina. The company acknowledged that inflationary pricing in that country contributed significantly to its reported growth in recent years. Removing this artificial boost reveals a more sober reality – organic growth in the mid-single digits. The normalization of the Argentine economy, while undoubtedly desirable in the long run, has necessitated a painful, if necessary, adjustment of expectations.

The company has embarked upon a multi-year plan, dubbed “One Fiserv,” to prioritize structural, recurring revenue over short-term gains. This, it is hoped, will provide a more stable foundation for future growth. The undertaking will require a considerable investment – approximately $1.8 billion in capital expenditure – a sum which, while substantial, may prove inadequate if the underlying issues are not addressed.

A Prudent Course of Action

Fiserv’s stock has, undeniably, experienced a significant decline. However, one must be wary of assuming that this presents an immediate opportunity. A low price is often, one observes, indicative of underlying weakness, and the reasons for Fiserv’s current predicament are not easily dismissed. Should the “One Fiserv” initiative fail to deliver tangible results, the stock risks becoming a most unfortunate investment – a value trap, as the moderns term it – amid slow growth and increasing competition.

Given the considerable uncertainty that lies ahead, a cautious approach is warranted. One would, therefore, recommend a sale of existing holdings, and refrain from acquiring new ones until there is clear evidence of improvement. Prudence, after all, is the better part of valor, and a sound investment requires more than merely a favorable price.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- IonQ: A Quantum Flutter, 2026

- Gold Rate Forecast

- 📢【Browndust2 at SDCC 2025】Meet Our Second Cosplayer!

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

2026-01-30 22:32