The early weeks of 1926 – or what passes for it in this age of swift calculations and flickering screens – reveal a certain hesitancy amongst those who traffic in fortunes. There is a lingering skepticism regarding the true substance of this ‘artificial intelligence’ which so occupies the public imagination. Yet, a discerning eye, observing the reports emanating from Taiwan Semiconductor Manufacturing, perceives a reality that belies the prevailing doubt. It is a tide rising, whether acknowledged or not.

The market, ever prone to fits of delayed recognition, has yet to fully account for this shift. Consequently, certain equities present themselves as opportunities – not for reckless speculation, but for the patient investor, one who understands that true value often resides in the overlooked or momentarily unfashionable. There are, too, those that bear the marks of a recent, perhaps overdone, correction, offering a chance to acquire sound businesses at a reasonable price.

It is with a measure of quiet confidence that I present a few considerations, not as guarantees of future prosperity, but as points of reflection for those who seek to build lasting wealth.

Nvidia: The Current of Innovation

It is scarcely necessary to introduce Nvidia. The company stands as a clear beneficiary of this technological current, its processing units continuing to push the boundaries of what is computationally possible. Demand persists, and projections suggest a substantial increase in data center expenditure – a sum reaching trillions, if the forecasts prove accurate. Such figures are, of course, subject to the whims of fate, but the underlying trend is undeniable.

To dismiss Nvidia at this juncture would be akin to ignoring the gathering storm. The winds of change are strong, and the company appears well-positioned to harness their power.

Taiwan Semiconductor: The Foundation of Progress

As anticipated, Taiwan Semiconductor has reported robust results, a testament to the relentless demand for its specialized chips. Revenue has increased by a considerable margin, and management foresees continued growth in the coming year. The company is investing heavily in expanding its production capabilities, a clear indication of its confidence in the future.

This is not merely a story of technological advancement; it is a reflection of a fundamental shift in the economic landscape. The demand for these chips is not a fleeting fad; it is a structural imperative.

Nebius Group: A Rising Star

Nebius Group, a lesser-known entity, merits attention. It operates in a niche market, providing access to powerful computing resources for those engaged in the demanding task of training artificial intelligence models. This is a business model reminiscent of the early days of cloud computing, but focused on a specific, rapidly growing segment.

The company anticipates a substantial increase in its revenue run rate, a figure that, if realized, would represent a remarkable achievement. Such rapid growth carries inherent risks, of course, but the potential rewards are equally significant.

The Trade Desk: A Moment of Reprieve

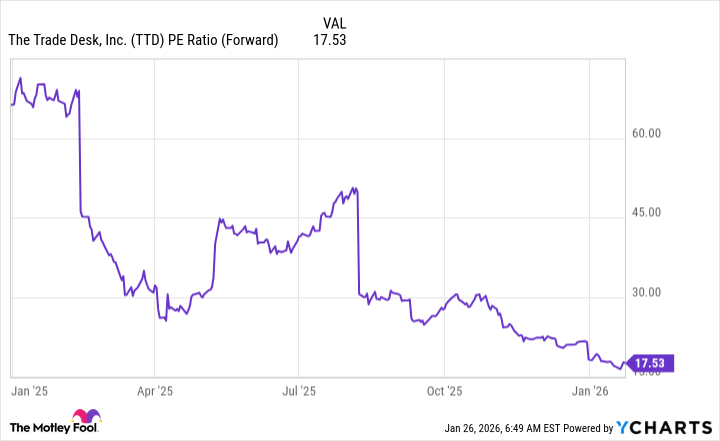

Turning to those equities less directly involved in the artificial intelligence narrative, The Trade Desk presents an intriguing opportunity. The past year has been unkind to the company, its share price having suffered a substantial decline. However, this downturn appears overdone, given the company’s continued growth prospects.

The demand for advertising technology remains robust, and The Trade Desk is well-positioned to capture a significant share of this market. The current valuation, at a mere seventeen and a half times forward earnings, represents a compelling entry point for the patient investor.

MercadoLibre: A Diversifying Influence

Finally, MercadoLibre offers a degree of diversification, its operations centered in Latin America. While I am not one to advocate for diversification for its own sake, MercadoLibre is a business worthy of consideration. It has established itself as a leading e-commerce and fintech platform in the region.

The company’s share price has experienced a recent correction, a consequence of the market’s occasional forgetfulness regarding its geographic focus. This presents an opportunity to acquire a well-managed business with a strong track record of growth. There remains considerable room for expansion, as a significant portion of the Latin American population has yet to fully embrace the platform.

These are but a few reflections, offered in the hope that they may prove useful to those who navigate the complexities of the modern marketplace. The pursuit of value is a timeless endeavor, and one that requires both diligence and a measure of quiet contemplation.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- The QQQ & The Illusion of Wealth

- Sandisk: A Most Peculiar Bloom

- Altria: A Comedy of Errors

2026-01-30 19:03