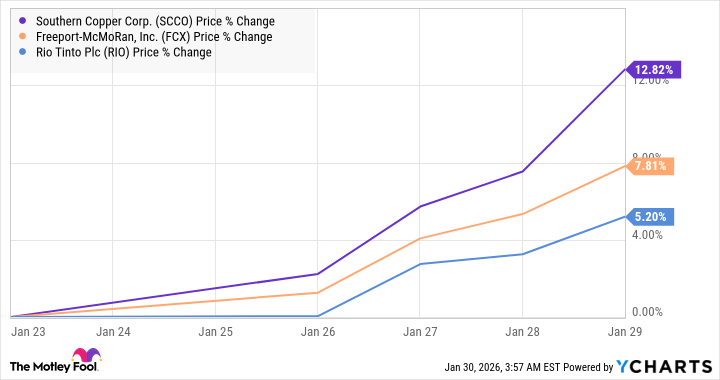

Southern Copper, a name that sounds so…substantial. The shares, they’ve had a week. A lift of nearly thirteen percent, a fleeting brightness in the perpetual grey of the market. Copper itself, briefly touching heights unseen, a shimmer of six dollars and fifty cents a pound. One almost feels a…pity for those who missed it. A small fortune, vanished as quickly as it appeared.

One observes, of course, that a rising tide, however temporary, benefits all boats. Freeport-McMoRan and Rio Tinto also enjoyed the current. A pleasant enough sight for shareholders, though one wonders if they truly appreciate the fragility of it all. It’s a game of numbers, after all, and numbers are rarely kind.

The explanations are always so…orderly. Tightening supply, solid demand, data centers hungrily consuming cable. And now, a projected deficit of 320,000 tonnes by 2026. Southern Copper’s own management anticipates a decline in production – nearly five percent. Lower ore grades, they say, in Peru. As if the earth itself is wearying of the effort. Freeport-McMoRan expects a similar contraction, a few pounds less here, a few tonnes less there. It adds up, naturally. It always does.

Inventories are low, covering only a fortnight of consumption. A precarious situation, one might think. But Freeport promises recovery, Rio Tinto whispers of muon technology – innovations for the future, perhaps. But the future, as always, is a long way off. And in the meantime, the present offers only the illusion of control.

A low-cost producer, they call Southern Copper. A reassuring label, isn’t it? As if cost alone can shield one from the inevitable currents. The market, it seems, is predisposed to higher prices. A fleeting opportunity, a momentary respite. One can only hope, of course. But hope, as any seasoned trader knows, is a rather unreliable investment.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- The QQQ & The Illusion of Wealth

- Sandisk: A Most Peculiar Bloom

- Altria: A Comedy of Errors

2026-01-30 15:33