The smart money in dividends knows the consumer staples racket. It’s a place where yields hang heavy, a sort of institutional comfort food. Growth? That’s for the dreamers. This is about keeping the lights on, a slow drip instead of a gusher.

Conagra Brands (CAG +0.85%) is throwing off a yield of 8%. That’s a number that’ll catch your eye, especially in a world where the Fed keeps nudging rates lower. Bonds are looking anemic, cash is barely breathing. But a high yield is often just a distress signal, a last gasp before the undertow.

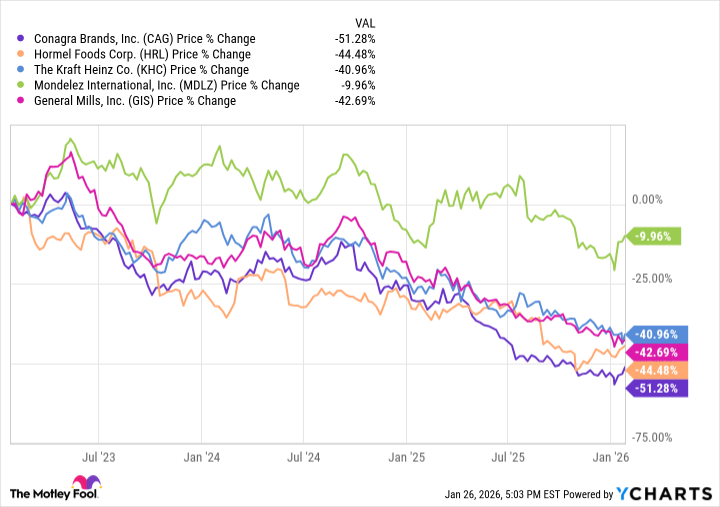

Conagra, you see, isn’t exactly a hidden gem. It’s more like a tarnished one. The yield isn’t a reward for good performance; it’s the price of a falling stock. The company’s been lagging its peers, a slow leak in a crowded market. The consumer’s tastes are shifting, demanding fresher, healthier options. Conagra’s brands? They feel… dated.

Calling it ‘underrated’ feels… generous. It’s a stock that’s been passed over, yes, but not because it’s secretly brilliant. It’s a stock that’s been quietly forgotten. The payout is attractive, sure, but a gambler doesn’t bet on a nag just because the odds are long.

It’s not a Dividend King, not even a Dividend Aristocrat®. Those are stocks with decades of payout increases. Conagra’s history is…patchier. A couple of cuts in the early 2000s. They’ve been inching upwards lately, but a few good quarters don’t erase a troubled past. It’s like putting lipstick on a slow decline.

A Turnaround Story? Maybe. But the Odds Are Long.

“Underrated” implies potential, a spark waiting to ignite. Think of a football team that’s quietly winning games, overlooked by the pundits. Conagra isn’t that team. It’s the one struggling to stay above water.

It doesn’t have a strong “moat,” that protective advantage that keeps competitors at bay. Analysts say it’s just… exposed. In the frozen food aisle, brands like Healthy Choice and Marie Callender’s aren’t exactly dominating. They’re getting squeezed.

The problem? A tight-fisted approach to advertising and research. They’ve been skimping on the things that build brand loyalty. It’s like trying to build a fortress with toothpicks. It hasn’t benefited shareholders, and it’s hard to see how it will.

Now, if Conagra suddenly decides to invest in its brands, to actually fight for market share, then maybe, just maybe, it could become an underrated dividend stock. But that’s a big ‘if.’ It’s a long shot, and I’ve seen too many long shots go bust to get excited. The market has a way of rewarding those who play the game, and Conagra, for a long time, hasn’t been playing.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- The QQQ & The Illusion of Wealth

- Sandisk: A Most Peculiar Bloom

- Altria: A Comedy of Errors

2026-01-30 14:32