Alright, let’s cut the crap. Taiwan Semiconductor Manufacturing – TSM, if you’re keeping score – is the engine room of the digital apocalypse. They don’t make the chips, they birth them. And right now, the demand is…ravenous. Every AI wet dream, every self-driving car delusion, every TikTok-fueled dopamine hit…it all runs on TSM silicon. It’s a beautiful, terrifying feedback loop, and we’re all just along for the ride. A ride that’s currently blasting past ALL-TIME HIGHS. But is it too late to jump on? That’s the question, isn’t it? The one that keeps the analysts up at night and the small-time investors twitching.

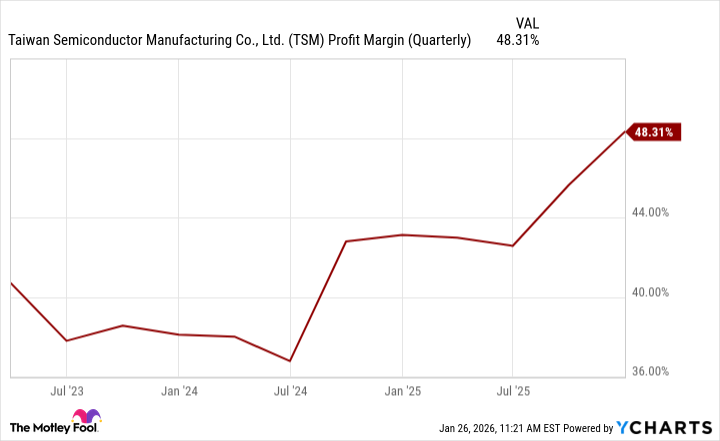

The Bottom Line: They’re Printing Money (For Now)

Forget incremental growth. TSM’s last quarter wasn’t a step forward, it was a GODDAMN LEAP. A 35% jump in net income? In this economy? That’s not sustainable, it’s a SIGNAL. They’re lean, they’re efficient, they’re operating with a cold, calculating precision that would make a Swiss watchmaker blush. Revenue up 21% is respectable, but the PROFIT margin? That’s where the real story is. Eight consecutive quarters of bottom-line increases? That’s not luck, that’s DOMINATION. It means they’re squeezing every last drop of value out of this AI frenzy. And frankly, it’s intoxicating to watch.

Look, we’re talking about a company that’s turning raw materials into the future. That kind of alchemy doesn’t come cheap, but it builds value. And rising earnings? That’s the fuel that powers the long-term rocket ship. It’s simple math, people. And I like simple math. Especially when it involves a potential fortune.

$1.7 Trillion: Is It Worth the Hype?

Okay, let’s address the elephant in the room. $1.7 TRILLION. That’s a number that makes your head spin. It puts TSM in the same league as the tech behemoths, the titans of industry. But valuation isn’t about absolute numbers, it’s about CONTEXT. You gotta look under the hood. And the Price-to-Earnings ratio is a decent starting point. Currently hovering around 26, it’s a bit of a premium compared to the S&P 500’s 22. But for a company that’s positioned at the epicenter of the AI revolution? It’s a premium I’m willing to consider. It’s not a steal, but it’s not a robbery either. It’s…prudent speculation.

So, is it too late to invest? Honestly? Maybe. The easy money has probably been made. But dismissing TSM now would be…foolish. This isn’t about getting rich quick, it’s about participating in a fundamental shift in the global economy. The AI wave is just building, and TSM is the surfboard. It’s a bumpy ride, a chaotic scramble for dominance, but it’s a ride I intend to be on. Just remember, hold on tight. This thing is about to get WILD.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- Actresses Who Don’t Support Drinking Alcohol

- Sandisk: A Most Peculiar Bloom

- New Sci-Fi Movies & TV Shows Set to Release in December 2025

- The QQQ & The Illusion of Wealth

2026-01-30 05:32