Paul Tudor Jones, a gentleman who has successfully navigated the currents of Wall Street for nearly half a century – a feat requiring a certain…flexibility of principle – has been adjusting his portfolio. He’s diminished holdings in the celebrated Apples and Alphabets, those digital orchards promising perpetual growth, and has instead been accumulating gold. Gold, that most ancient of anxieties. One might ask, is this wisdom, or merely a particularly refined form of panic? The question, naturally, is rhetorical. The market, as always, will provide its own, less elegant answer.

The fund, managed by Mr. Jones, has seen a rather vulgar surge in its gold allocation – nearly half again. The SPDR Gold ETF, a convenient vessel for those seeking refuge from…well, from everything, has blossomed. It ascended by a preposterous 64% last year, and already shows a disturbing eagerness to climb further in 2026. The metal itself has breached the $5,000 mark – a psychological barrier, no doubt, but one built on foundations of…what exactly? Hope? Fear? The dwindling faith in paper promises? It is a question best left to the theologians.

The Allure of Uselessness

Gold, let us remember, is fundamentally useless. It does not nourish, it does not shelter, it does not, in and of itself, contribute to the advancement of civilization. Its value derives solely from collective delusion – a shared agreement that it is, somehow, important. A curious phenomenon, and one that speaks volumes about the human condition. It is a testament to our capacity for both profound faith and breathtaking folly. Only 216,265 tons of it exist, compared to the mountains of coal and iron ore. A scarcity artificially maintained, of course, by the very act of valuing it.

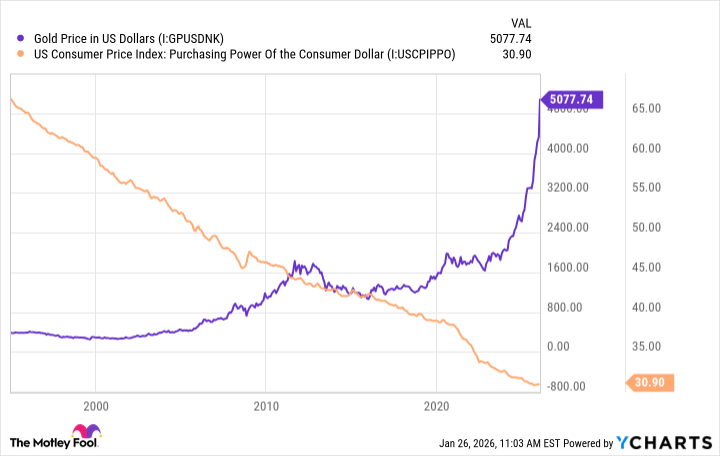

Until 1971, governments, in a fit of responsible behavior, tethered their currencies to this glittering bauble. A constraint, naturally, on their appetite for unrestrained spending. But the siren song of unlimited credit proved irresistible. The gold standard was abandoned, and the floodgates opened. The dollar, predictably, has lost a substantial portion of its purchasing power – roughly 90%, if one is inclined to count such things. Gold, therefore, has not gained value so much as the dollar has lost it. A subtle distinction, but one that separates the astute observer from the merely excitable.

Mr. Jones, in a moment of candor, suggested that investors consider gold in light of the United States’ unsustainable fiscal trajectory. A polite way of saying that the government is spending money it does not have. The budget deficit, indeed, ballooned to $1.8 trillion, and the national debt now stands at a figure so large it defies comprehension. Civilizations, throughout history, have consistently chosen to inflate away their debts – a remarkably consistent pattern of self-deception. Gold, naturally, benefits from this madness.

A Fleeting Shine

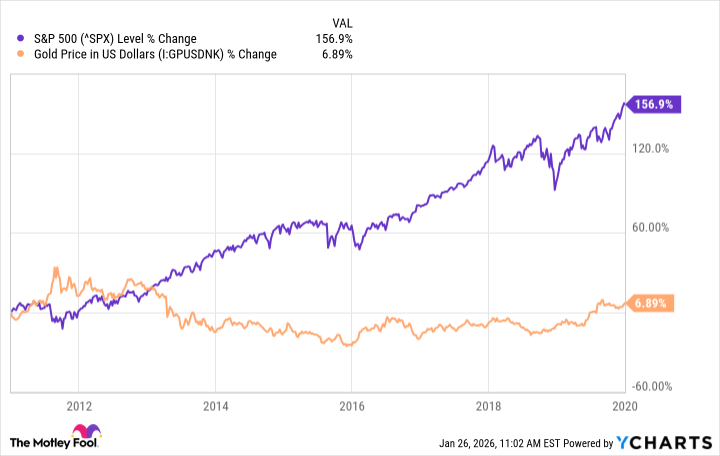

The conditions that propelled gold higher in 2025 are, alas, likely to persist. More debt, more deficits, more promises that will inevitably be broken. However, one must resist the urge to extrapolate recent gains into the indefinite future. Gold, like all assets, is subject to the whims of the market. It has a habit of rewarding exuberance with disappointment. Over the past 30 years, it has averaged a mere 8% annual return, lagging far behind the stock market’s 10.7%. A humbling reminder that even the shiniest of metals cannot defy the laws of gravity.

Sharp spikes in gold prices are often followed by prolonged periods of stagnation. Between 2011 and 2020, it delivered virtually no return, while the stock market doubled. A cautionary tale for those who chase fleeting trends. One should not mistake a temporary surge for a fundamental shift. The market, as always, is a cruel teacher.

That is not to say one should avoid gold entirely. Billionaires, after all, are still buying. But history suggests that returns may be more modest going forward. A small allocation, perhaps, but one should prioritize income-producing assets like stocks. The SPDR Gold ETF offers a convenient way to gain exposure without the hassle of storage or insurance. It is fully backed by physical reserves, and its expense ratio is a mere 0.4%. A small price to pay for a little peace of mind – or, at least, the illusion of it.

The world, as always, is a stage for absurdity. And gold, that glittering symbol of both hope and despair, remains one of its most compelling props. One might even say, a rather expensive one.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Actresses Who Don’t Support Drinking Alcohol

- Meta: A Seed for Enduring Returns

- Micron: A Memory Worth Holding

2026-01-30 02:32