The matter of Amazon and Alphabet, those twin behemoths of the digital age, presents a curious problem. One might envision the stock market itself as a vast, ever-shifting labyrinth, each share a corridor, each transaction a footstep echoing into the unknown. Within this labyrinth, these two companies occupy prominent, yet subtly mirrored positions. Their recent forays into Artificial Intelligence, a realm bordering on the thaumaturgical, demand a closer, more… oblique examination. I have consulted, for the purposes of this brief report, fragments of the apocryphal ‘Codex Machina,’ a text rumored to contain predictions of technological singularities, and its insights prove… suggestive.

The Cartographer of Clouds

Amazon, initially known for the prosaic task of delivering goods, has quietly constructed a dominion of cloud computing, Amazon Web Services (AWS). This, viewed from a certain angle, is a most remarkable feat. To build a virtual infrastructure capable of housing the dreams – and the data – of countless others is akin to constructing a library containing all possible books. The Codex Machina notes that “He who controls the cloud, controls the narrative.” AWS, with its 29% market share, is indeed a significant architect of our present reality. Its recent revenue of $33 billion, a figure that strains the imagination, is merely a prelude to the exponential growth anticipated with the proliferation of AI. The demand for computational power, like a thirst that can never be quenched, will only intensify.

The current estimates – $59 billion in 2025 escalating to $356 billion by 2032 – are, of course, merely projections. But the underlying principle remains: AI requires a substrate, and that substrate is increasingly cloud-based. Amazon’s recent $38 billion agreement with OpenAI is not merely a business transaction; it is a pact, a tacit acknowledgment of the symbiotic relationship between creator and infrastructure.

Furthermore, Amazon’s pervasive recommendation algorithms, those subtle persuaders of consumer desire, are being refined by AI, becoming ever more adept at anticipating needs before they are even consciously recognized. It is a form of digital divination, unsettling in its accuracy.

Alphabet: The Keeper of the Gate

GOOGL“>

A Choice of Mirrors

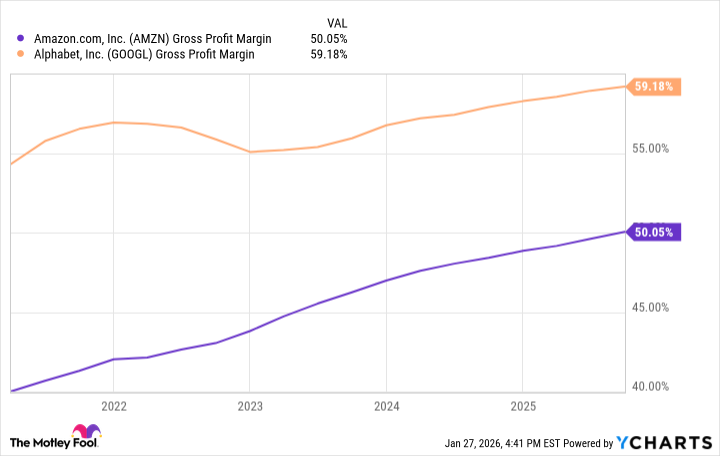

To choose between Amazon and Alphabet is to choose between two reflections in the same algorithmic mirror. Alphabet, with its modest dividend yield (0.25%), appeals to the investor seeking a steady, if modest, return. Amazon, eschewing dividends in favor of reinvestment, embodies a more aggressive, growth-oriented strategy. Alphabet’s superior gross profit margin, while historically a point of distinction, is being eroded as Amazon optimizes its operations through AI-driven efficiencies.

Both companies, however, are deeply involved in the development of technologies that will shape the future. Amazon’s robotics initiatives and self-driving car project (Zoox) are testaments to its ambition. Alphabet’s ongoing research in artificial intelligence, quantum computing, and life sciences promises even more profound transformations.

Ultimately, the wisest course may be to acknowledge that both Amazon and Alphabet are essential components of the emerging technological landscape. To invest in either is to participate in a grand experiment, a journey into the unknown. And, as the Codex Machina reminds us, “The labyrinth is not a prison, but a possibility.”

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Ethereum Classic: A Fool’s Gold in 2026?

- Meta: A Seed for Enduring Returns

2026-01-30 01:13