Oh, Bitcoin, you fickle minx! The darling of the crypto world,

BTC

($83,897, 24h volatility: 6.3%, Market cap: $1.68T, Vol. 24h: $64.87B),

has just pulled a Bridget Jones and accidentally deleted $85 billion of its market cap in less than four hours. Oopsie! And let’s not forget the $200 million in liquidations-because nothing says “Monday funday” like watching your portfolio go poof faster than a bad date.

As of this writing (and my coffee is still hot, so it’s recent), BTC was sulking at $84,437, down 5.83% in the last 24 hours. According to CoinMarketCap on Jan. 29, Bitcoin’s nearly $1.70 trillion market cap took an $85 billion nosedive. That’s like losing your favorite pair of jeans and your dignity in one go. The entire crypto market is now sitting in a corner, sobbing into its blockchain.

Bitcoin (BTC) market data and price as of January 29, 2026 | Source: CoinMarketCap. Spoiler: It’s not pretty.

Bitcoin’s 24-hour exchange volume spiked 20% to $51 billion, which is like 3% of its market cap. The crash kicked off right after the U.S. stock market opened in the red on Jan. 29. The S&P 500, the U.S. dollar index, gold, silver, and basically everything else decided to join the pity party. It’s like the entire financial world got dumped by the same guy.

But hey, CrypNuevo saw this coming. (Aren’t analysts always the ones who “saw it coming”? Eye roll.) For over a month, they’ve been warning that BTC needed to revisit the $80,000 to $84,000 range before dreaming of $100,000. Because, you know, nothing says “I’m ready for a new high” like a quick trip to the emotional gutter.

$BTC update:

The projection is still playing out perfectly. Bitcoin has just retested the range lows.

As we mentioned on Sunday, the bearish acceptance below the mid-range was signaling another drop to the range lows.

This projection from 1 month ago is 90% completed here 🔨😮

– CrypNuevo 🔨 (@CrypNuevo) January 29, 2026

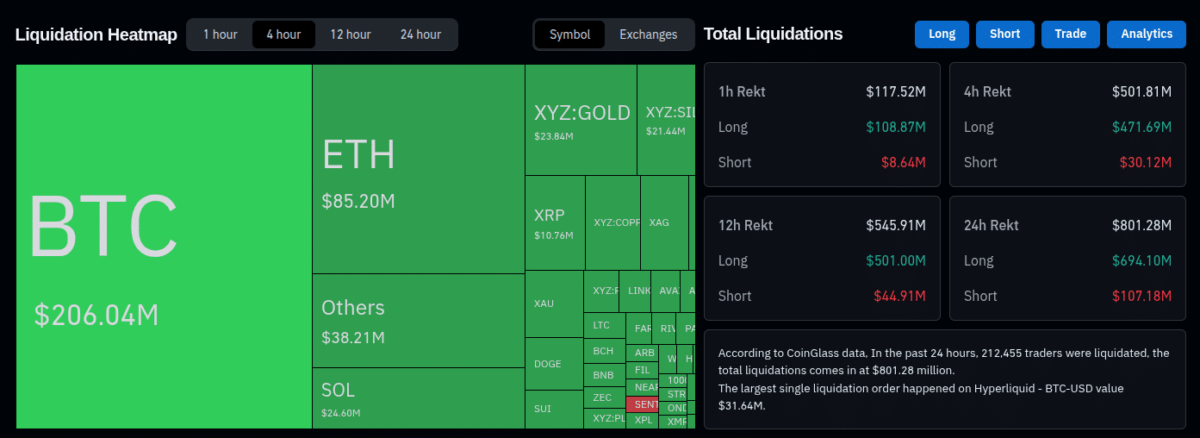

Crypto Traders Lose $500M in 4 Hours: Liquidation Nation, Population: Everyone

In other news, crypto traders are now officially members of the “I Should’ve Sold Earlier” club. A cool $500 million in leveraged positions got liquidated in just four hours, with $471 million coming from longs. Ouch. Bitcoin alone saw $206 million in liquidations, $202 million of which were longs. That’s a lot of tears and therapy sessions.

In the bigger picture, over 200,000 crypto traders lost $800 million in the last 24 hours. The biggest ouch? A $31 million long position on Hyperliquid. Someone’s Monday just got a whole lot worse. But hey, at least it’s not $19.35 billion like that time in October 2023. Silver linings, people!

Liquidation heatmap and total liquidations (4-hour), as of January 29, 2026 | Source: CoinGlass. It’s like a bonfire of dreams.

So, will Bitcoin bounce back? Maybe, if the macroeconomic gods and geopolitical fairies decide to sprinkle some risk-on liquidity dust. But don’t hold your breath-JPMorgan says BTC isn’t exactly a hedge against the falling U.S. dollar. Unlike gold, silver, and copper, which are having a field day. Go figure.

In the meantime, grab your popcorn (or your tissues) and watch the drama unfold. Because in the world of crypto, every day is a soap opera, and we’re all just waiting for the next plot twist.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Black Actors Who Called Out Political Hypocrisy in Hollywood

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- Actresses Who Don’t Support Drinking Alcohol

- Meta: A Seed for Enduring Returns

- Micron: A Memory Worth Holding

2026-01-29 22:24