A stock yielding over ten percent. It always makes you wonder, doesn’t it? Usually, something’s broken. Some fundamental sadness at the heart of the business. So it goes.

AGNC Investment. They’ve been handing out that ten-percent-plus dividend for a long time, which is… unusual. Doesn’t make it a good buy for folks chasing income, though. Not really. It might, however, appeal to a different sort of creature. A speculator, perhaps. Let’s look at the gears turning inside this thing.

What Does AGNC Do, Exactly?

They buy mortgages. Bundled up, sliced and diced into securities. Not like owning a rental property, not really. More like being a middleman in a very large, very complicated game of debt. They use leverage, of course. Everyone does. It’s how you amplify both the good and the bad. Makes things interesting.

It’s a bit like a mutual fund, if mutual funds dealt in mortgages and had a fondness for borrowing money. They report a ‘tangible net book value’ which is, essentially, a way of saying ‘here’s what we’d get if we sold everything tomorrow.’ You have to dig a little, see what you’re actually owning. It’s always a good idea to know what you own, isn’t it?

That big twelve-point-something percent yield? Tempting, sure. But don’t mistake a high yield for a safe harbor. It’s more like a flashing red light. The dividend hasn’t exactly been climbing steadily. It’s been… wobbly. The stock price follows along, mostly. Keeps the yield looking impressive, even when things aren’t.

Who is AGNC For?

Most folks want income. A steady stream of money to keep the lights on. AGNC doesn’t really offer that. Not reliably, anyway. If you’re trying to live off your portfolio, you might want to look elsewhere. It’s a simple equation, really.

That doesn’t mean it’s a bad investment. Just a bad investment for some investors. It’s possible it could work for someone else. Someone who isn’t so attached to the idea of a predictable income stream.

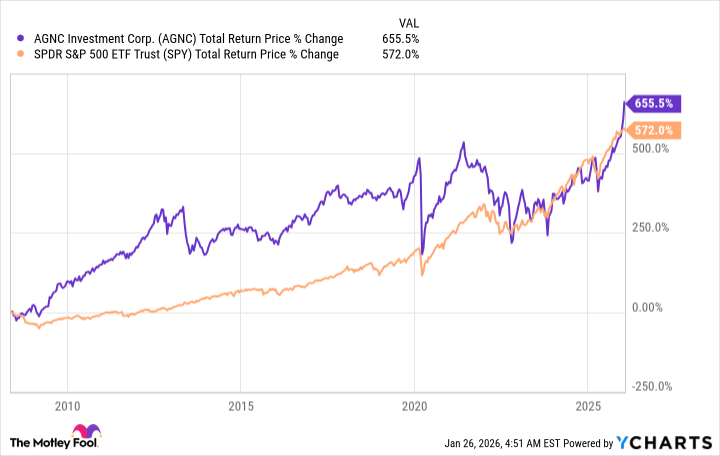

The total return, since they started, is actually pretty good. Better than the S&P 500, if you look at it that way. But here’s the catch. You have to reinvest those dividends. That’s how you get that total return. If you spend the dividends, you get… less. Less income, less capital. It’s a cruel world. So it goes.

Know What You’re Buying

AGNC can have a place in a portfolio, if you’re willing to look beyond the headline yield. If you’re focused on total return, and you understand the risks, it might be worth a look. It doesn’t move in lockstep with the broader market, which means it could smooth out your returns over time. A little diversification never hurt anyone.

It’s not a simple story. It requires a little more attention than most investments. Don’t just look at the yield. Look at the whole machine. It’s a reminder that things are rarely what they seem. For dividend seekers, caution is advised. For those chasing total return, it might be worth a gamble. But remember, in the grand scheme of things, we’re all just spinning our wheels. So it goes.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-29 16:53