Last year, the tech sector, bless its heart, outperformed pretty much everything else, delivering a return of 24.7%. This was, predictably, driven by the usual suspects – semiconductor companies like Nvidia, Broadcom, and a whole host of others with names that sound suspiciously like they should be building spaceships. It was, you might say, a good time to be in the business of making tiny things that make other things work. Which brings us, inevitably, to software.

Software, once the darling of the tech world, is currently experiencing what one might politely call a ‘correction’. A downturn. A bit of a wobble. Investors, you see, are suddenly seized by the rather novel idea that artificial intelligence might, just might, disrupt things. The SaaS model – Software as a Service, for those not fluent in acronyms – is looking a little less assured. And when investors get spooked, they do what they always do: they sell. So, naturally, someone has created an ETF to capitalize on this entirely predictable state of affairs.

This, then, is the story of BlackRock’s iShares Expanded Tech Software Sector ETF (IGV). A fund designed, in essence, to let you buy the dip in software stocks without having to actually choose which software stocks to dip into. A perfectly sensible, if slightly defeatist, approach.

Beyond the Biggest Names (and Their Marketing Budgets)

The iShares U.S. Technology ETF (IYW) is, let’s be honest, heavily weighted towards the giants. A staggering 44.5% of its holdings are in Nvidia, Apple, and Microsoft. It’s a bit like building a house with only three types of brick. The iShares Expanded Tech Software Sector ETF, on the other hand, attempts a little more diversification. It’s less top-heavy, providing a bit more exposure to the smaller, less-hyped software companies that might actually be doing interesting things. Or, at least, not actively losing money.

| Company | Weight |

| Microsoft | 9% |

| Palantir Technologies | 8.9% |

| Oracle | 8% |

| Salesforce | 7.6% |

| AppLovin | 5.6% |

| Intuit | 5.3% |

| Palo Alto Networks | 4.4% |

| Adobe | 4.4% |

| CrowdStrike Holdings | 4% |

| ServiceNow | 3.8% |

iShares U.S. Technology ETF

| Company | Weight |

| Nvidia | 16.9% |

| Apple | 14.5% |

| Microsoft | 13.1% |

| Alphabet | 4.8% |

| Meta Platforms | 3.2% |

| Broadcom | 3.1% |

| Palantir Technologies | 2.6% |

| Micron Technology | 2.5% |

| Advanced Micro Devices | 2.5% |

| Oracle | 2.2% |

The Software Slowdown (or, Why Panic is Often Justified)

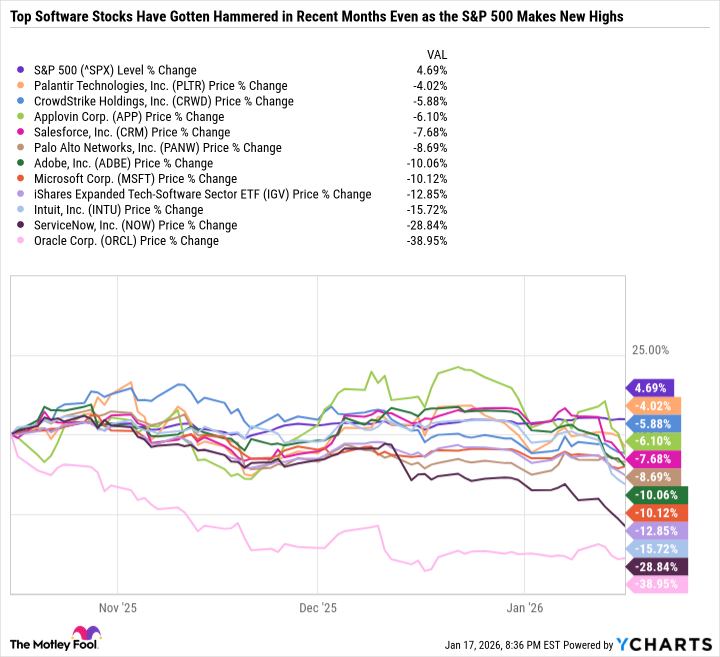

While the broader market merrily continues to hit new highs, software stocks have been… less enthusiastic. The iShares Software ETF is down 12.9% in the last three months. Even Palantir, the darling of certain investment forums, has lost value. It’s a sobering reminder that even the most promising technologies aren’t immune to a good old-fashioned market correction.

Microsoft, of course, is under pressure, largely due to its entanglement with OpenAI. OpenAI, a company that seems to exist in a perpetual state of hype and near-collapse, is being challenged by Alphabet’s Gemini. The problem, as always, is converting high capital expenditures into actual earnings. Oracle, similarly, is heavily invested in OpenAI and its cloud infrastructure. A perfectly sensible strategy, perhaps, but one that’s currently draining the balance sheet.

Palantir, meanwhile, has seen its growth rate moderate. The stock, previously soaring, is now subject to the cold realities of valuation. A price-to-sales ratio of 112 and a forward P/E ratio of 169 suggest that a lot of optimism is already baked into the price. Investors, it turns out, do eventually care about things like, you know, profits.

The truth is, investors care more about where a company is going than where it has been. A few years ago, Salesforce and Adobe were the rock stars of the software world. Now? They’re trading at significantly lower valuations. It’s a reminder that even the most successful companies can fall from grace. The market, it seems, is anticipating slower growth. Or, possibly, a complete collapse. One never knows.

Salesforce and Adobe are down 29% and 30% respectively over the last year. Other enterprise software giants like ServiceNow, Monday.com, and Atlassian are doing even worse. It’s a bloodbath, really. Though, to be fair, bloodbaths are often followed by rebounds. Or, occasionally, more bloodbaths.

Cybersecurity stocks have held up relatively well, but even they are feeling the pressure. SentinelOne, Fortinet, and Datadog have all lost value. Okta, Palo Alto Networks, and Zscaler are underperforming the S&P 500. CrowdStrike is the exception, having outperformed. A small victory in a sea of red.

Wall Street despises uncertainty. And right now, the software industry is brimming with it. Subscription models depend on a growing number of subscribers. But what happens if AI tools allow a single user to do the work of several? The implications are… unsettling. There’s also the possibility that free or inexpensive AI tools will replace entire workflows. It’s a disruptive force, to say the least.

The ETF Wrapper: A Perfectly Rational Response

There are plenty of ways to buy the dip in software stocks. You can invest in former highfliers, software/cloud hybrids, or cybersecurity companies. But when an entire industry is under pressure, one of the simplest options is to buy an ETF. It’s a way to bet on an industrywide recovery without having to pick winners and losers. A perfectly sensible, if slightly cowardly, approach.

The sell-off in software stocks may be overblown, but a major reshuffling is likely. Former leaders may falter, some may recover, and new companies may emerge. Given the speed and scale of the disruption, the iShares Expanded Tech Software Sector ETF seems like one of the best ways to invest in software stocks. Or, at least, a perfectly adequate way. It’s unlikely to make you rich, but it’s also unlikely to ruin your life.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-29 15:53