Now, cybersecurity. It’s not exactly the talk of every tea party these days, is it? Back in the olden days – 2023, if you must know – everyone was terribly excited about it. A proper frenzy, really. Companies were snapping up shares like greedy little goblins hoarding gold.

But then along came Artificial Intelligence, and suddenly cybersecurity became…well, a bit last year’s sweet. A shame, really. It’s left a few rather splendid companies available at prices that aren’t quite so eye-watering. A bit like finding a perfectly good toffee apple that’s been slightly overlooked at the fair.

Last year, I had a little flutter on CrowdStrike (CRWD 1.47%). A rather good call, as it turned out. The share price went zooming upwards by 37%. A delightful result! But can this clever little beast repeat the trick in 2026? Let’s have a proper look, shall we?

CrowdStrike and its Whizzpopping AI

CrowdStrike isn’t entirely immune to the magic of AI, you see. They’ve stuffed some rather ingenious bits and bobs into their software, allowing it to sniff out digital nasties and squash them before they cause any bother. With all these bad actors – now boosted by AI, of course – the need for top-notch cybersecurity has never been greater. It’s been rather good for CrowdStrike’s growth, if I may say so.

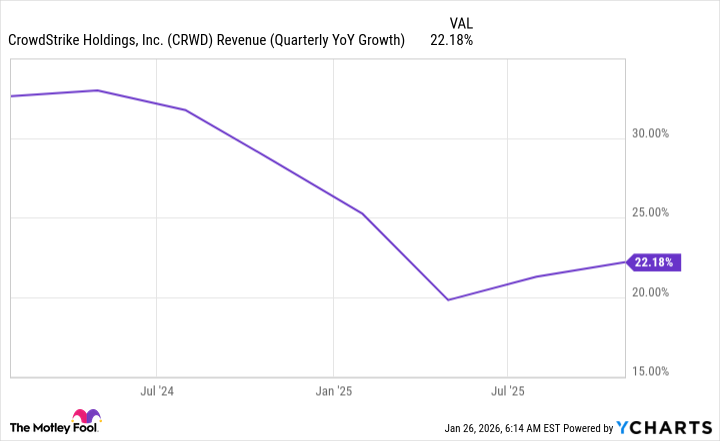

Wall Street chaps are predicting another 22% bump in revenue for the year ending January 2027. Not bad, not bad at all. The management types reckon the total addressable market for cybersecurity is currently around $140 billion, but that’s going to balloon to a whopping $300 billion by 2030. A colossal expansion, wouldn’t you agree? And with CrowdStrike considered one of the leading players, they should be able to grab a sizable chunk of that pie.

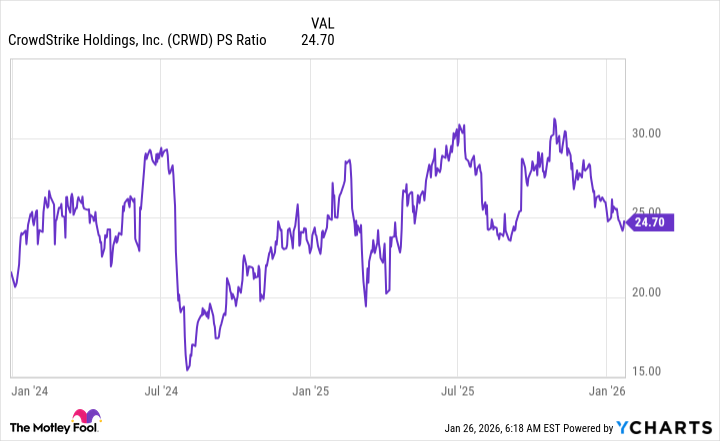

However, and this is where things get a bit sticky, CrowdStrike’s revenue isn’t exactly rocketing upwards at the same pace as its share price did last year. A bit of a red flag, if you ask me. Valuation is always a worry, isn’t it? Is it all a bit…expensive?

A Little Wobble in 2025

Now, back in July 2024, CrowdStrike had a bit of a mishap. A software update caused a rather widespread outage, disrupting businesses all over the globe. The share price took a bit of a tumble, naturally. But it recovered, and has since reached an all-time high. That little wobble was actually part of the reason the stock did so well in 2025. It was still recovering, you see, and investors swooped in.

At 25 times sales, CrowdStrike isn’t exactly cheap as chips, is it? I rather like to see software companies growing their revenue at a faster rate than their price-to-sales ratio. CrowdStrike doesn’t quite meet that test, so I’m a little concerned about its potential.

I still reckon CrowdStrike will outperform the market in 2026, but it won’t have a year quite like 2025. I’m expecting something in the mid-teens appreciation range. Normally good enough to beat the average, you see. So, it might be a solid long-term buy right now. A clever little beast, indeed, but one that requires a watchful eye.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-29 15:36