Okay, so Apple. Down almost nine percent year-to-date. Nine! And everyone’s acting like this is some massive, unforeseen catastrophe. It’s a phone. A very expensive phone, admittedly, but still. It’s not like the global economy just spontaneously combusted. Though, honestly, sometimes it feels like it. And then they expect me to get excited about their AI integration? Please.

They’re touting this partnership with Google, Gemini models, the whole shebang. Like that’s going to magically fix everything. It’s just… more stuff. More features nobody asked for. I remember when a phone made calls. Now it’s a battle to find the basic functions under layers of… what is all this stuff? And don’t even get me started on Siri. That thing is actively unhelpful. It’s like talking to a brick that occasionally misinterprets your commands. And now they want to make it more… approachable? By having it talk at you even more? It’s infuriating.

They had that iPhone 17 last year, supposedly a big deal with the camera and design. “Strong demand,” they said. Strong demand for what? Another incremental upgrade? It’s the same story every year. A slightly shinier rectangle. And then the stock goes up, and everyone loses their minds. I swear, the market has no sense of proportion. It’s like people are rewarding them for… existing.

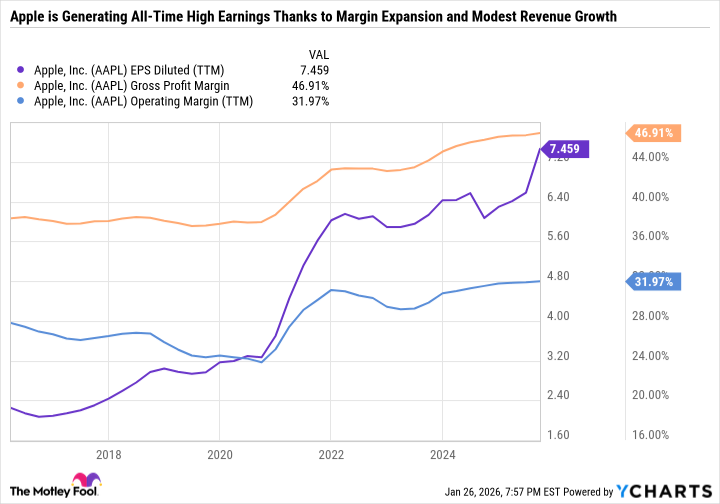

Their earnings are…fine. I guess. They went up, then they stagnated, now they’re inching back up. It’s all so…predictable. And the margins? Okay, the services margin is decent. But 75.4%? What are they, selling pure air? And services making up 26.2% of sales? That’s just… unsettling. It’s like they’re realizing they can’t actually make anything anymore, so they have to charge you for subscriptions to use the things you already bought. It’s a racket, I tell you, a racket.

And now they’re talking about a 2-nanometer chip in the iPhone 18. The most expensive iPhone ever. Of course. Because that’s what we need. A phone that costs more than a used car. And for what? Slightly better battery life? It’s just… excessive. It’s a statement. “Look how much money we can get you to spend on something completely unnecessary.”

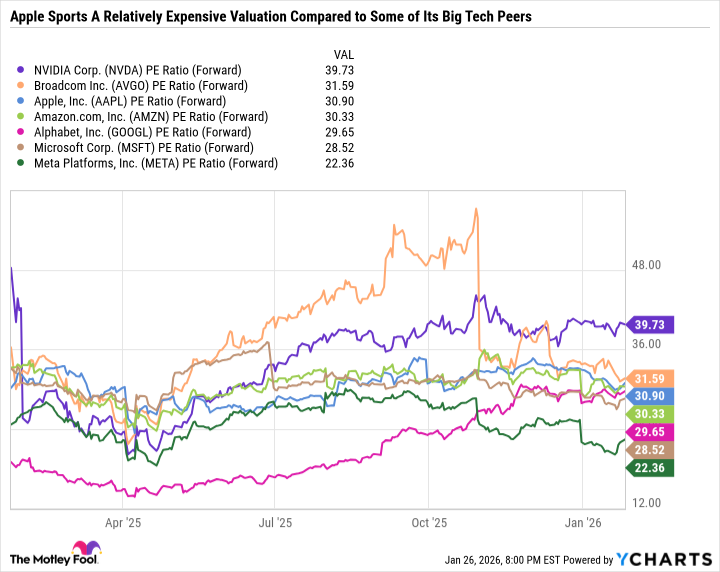

The valuation is… optimistic. Let’s just say that. A 30.9 forward P/E ratio? Compared to Amazon, Alphabet, Microsoft, Meta? They’re all trading at more reasonable levels. Even Broadcom, which is actually growing, has a lower ratio. It’s just… illogical. People are paying a premium for… what exactly? Brand recognition? The promise of future innovation? It’s all smoke and mirrors, I tell you.

They’re so reliant on consumer spending. And what happens when consumers decide they’ve had enough? When they realize they don’t need the latest gadget? What then? They’ll be scrambling, I guarantee it. They’ll be offering discounts, running promotions, begging people to buy their overpriced phones. It’s a house of cards, I tell you, a house of cards.

Look, I’m not saying Apple is a bad company. It’s just… not compelling. There are better opportunities out there. Stocks that are actually growing, companies that are actually innovating, businesses that aren’t so dependent on the whims of consumer spending. I’d rather buy Coca-Cola or Procter & Gamble. At least they sell things people actually need. Soap. Soda. It’s simple. It’s honest. It’s not… this.

They’ll probably hold up okay if there’s a sell-off in AI stocks. They have a good balance sheet, they generate a lot of cash flow. But it’s not a “screaming buying opportunity.” It’s just… a stock. A slightly overpriced stock. And frankly, I have better things to worry about. Like finding a decent bagel. That’s a real crisis.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-29 13:23