Hark! A curious spectacle unfolds upon the market stage, wherein Palantir Technologies, a purveyor of data sorcery, doth attempt to charm investors with promises of artificial intelligence. Launched into the public eye some years ago, this company hath experienced a most irregular fortune – a dizzying ascent followed by a period of melancholic slumber, before awakening once more to the allure of gain. One might observe, with a touch of irony, that fortune, like a fickle audience, is rarely consistent in its applause.

The current enthusiasm, it appears, is fueled by this ‘AIP’ – an Artificial Intelligence Platform, as they call it – a device purportedly capable of unlocking the secrets hidden within mountains of data. Customers, eager to appear abreast of the latest marvels, flock to this platform, swelling the coffers of Palantir. Indeed, the demand is such that one wonders if they purchase insight, or merely the appearance thereof. A question for the ages, is it not?

Thus, we approach a pivotal moment – the release of Palantir’s latest earnings report. Will this pronouncement be a triumphant fanfare, or a mournful dirge? History, that most unreliable of narrators, offers a suggestion, though, as any seasoned observer knows, the past is seldom a faithful prophet.

Palantir and the Illusion of Progress

Let us, for a moment, consider the company’s journey. Palantir, at its core, offers systems for the aggregation and interpretation of data. A noble endeavor, to be sure, yet one that often masks a simpler truth: that the accumulation of facts does not necessarily lead to wisdom. This ‘AIP,’ however, is presented as a shortcut to enlightenment, a means by which even the most unlearned may fancy themselves masters of strategy.

Companies, ever anxious to demonstrate innovation, eagerly embrace this technology, hoping to avoid the tedious labor of genuine analysis. It is a temptation as old as commerce itself – the pursuit of effortless profit. Through AIP, they believe they may effortlessly tap into the benefits of AI, a belief that, while convenient, may be founded upon a rather flimsy foundation.

The quarterly reports, predictably, reflect this enthusiasm, showcasing double-digit growth in both government and commercial sectors. Most intriguing is the surge in commercial clients. For years, Palantir relied upon the patronage of the state, a comfortable, if somewhat predictable, arrangement. Now, with the allure of AIP, they have broadened their base, attracting hundreds of commercial customers and exceeding a billion dollars in contract value. A most impressive feat of marketing, one might say, though the true value of these contracts remains, as always, a matter of conjecture.

The Upcoming Performance

And so, we arrive at the subject of the forthcoming earnings report, due on February 2nd. It is a moment fraught with anticipation, a scene ripe for dramatic irony. Will the news be favorable, prompting a surge in the stock price? Or will it reveal a less rosy picture, casting a shadow over the company’s prospects? One can only speculate, though history, as we have noted, offers a tantalizing clue.

Examining the past seven earnings reports, we find a curious pattern: the stock advanced five times, and declined twice. A rather respectable record, to be sure, though hardly a guarantee of future success.

| Earnings period | Stock performance in the two weeks following the report |

|---|---|

| Q1 2024 | down 14% |

| Q2 2024 | up 34% |

| Q3 2024 | up 47% |

| Q4 2024 | up 42% |

| Q1 2025 | up 2% |

| Q2 2025 | up 8% |

| Q3 2025 | down 17% |

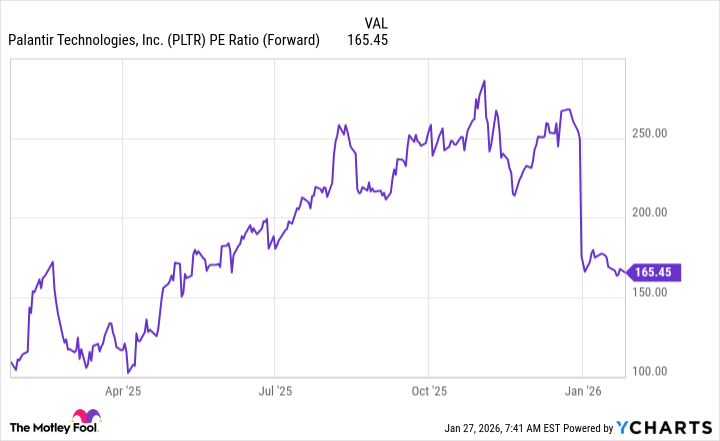

It is worth noting that the declines were not always linked to negative news from the company itself. The last report, for instance, coincided with growing anxieties about a potential ‘AI bubble,’ and Palantir, with its lofty valuation, found itself under scrutiny. Investors, ever wary of inflated expectations, began to question the sustainability of such gains. A prudent concern, one might add.

In any case, history suggests that Palantir has more often than not advanced after its earnings reports, occasionally delivering substantial gains. Of course, it is entirely possible that this time around, the stock will deviate from the trend and stagnate or decline, regardless of the contents of the report. Such is the capriciousness of the market, and the folly of relying solely on past performance.

But if history is to be believed, the answer to our question is strikingly clear: Palantir stock could climb after February 2nd. A fitting finale, perhaps, to this most curious of spectacles.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- 10 Hulu Originals You’re Missing Out On

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-29 13:13