Author: Denis Avetisyan

New research reveals that even generally reliable prediction markets are vulnerable to price manipulation by large, well-funded participants, especially when combined with investor herd mentality.

Agent-based modeling demonstrates that sufficiently capitalized actors can temporarily distort prices in prediction markets, raising concerns about their accuracy as unbiased forecasts.

Despite their promise as aggregators of informed opinion, prediction markets are vulnerable to strategic behavior that can skew reported forecasts. This research, ‘Manipulation in Prediction Markets: An Agent-based Modeling Experiment’, uses agent-based modeling to investigate how well-capitalized actors can introduce and sustain price distortions in these markets. We find that while generally self-regulating, prediction markets can experience temporary price shifts proportional to the manipulator’s stake, particularly when other participants exhibit herding or slow learning. This raises a critical question: can prediction markets maintain their objectivity as forecasting tools in the face of increasingly sophisticated and resourced manipulation attempts?

The Illusion of Prediction: Why Markets Often Fail

The ability to anticipate future events is paramount across diverse fields, from economic policy and public health to technological innovation and strategic planning. However, conventional forecasting techniques-reliant on statistical modeling, expert opinions, or trend extrapolation-often falter when confronted with the inherent complexities of real-world systems. These systems are frequently characterized by non-linear interactions, emergent behaviors, and a multitude of influencing factors that defy simple prediction. Traditional methods struggle to account for unforeseen circumstances, subtle shifts in underlying conditions, and the sheer volume of relevant data, leading to inaccuracies and potentially costly miscalculations. Consequently, there is a growing need for innovative approaches capable of navigating uncertainty and providing more reliable probabilistic assessments of future outcomes.

Prediction markets represent a distinctive forecasting method that taps into the collective intelligence of a diverse group. Rather than relying on expert analysis or statistical modeling alone, these markets function much like real-world exchanges, where individuals buy and sell contracts contingent on future events. The resulting prices reflect the aggregated beliefs of all participants, effectively generating probabilistic forecasts; a higher price suggests a greater perceived likelihood of the event occurring. This ‘wisdom of the crowd’ approach often outperforms traditional forecasting techniques, particularly in situations characterized by uncertainty and incomplete information, because it efficiently incorporates a wide range of perspectives and quickly adapts to new data as it becomes available. The power lies not in identifying a single ‘correct’ answer, but in harnessing the diverse knowledge and insights held by many, distilling them into a surprisingly accurate prediction.

Prediction markets operate on a surprisingly simple, yet powerful, principle: incentivized forecasting. Participants buy and sell ‘contracts’ representing the potential outcomes of future events, with contract prices reflecting the collective probability assigned to each outcome. This isn’t mere gambling; it’s a dynamic information marketplace. As new data emerges, traders adjust their positions, driving prices to efficiently incorporate dispersed knowledge – insights held by individuals with varying expertise and perspectives. The resulting price signals can, therefore, provide remarkably accurate probabilistic forecasts, often surpassing the performance of traditional forecasting methods, because the market continually aggregates and refines predictions through the collective actions of its participants.

Modeling the Herd: Agent-Based Simulations

Agent-Based Models (ABMs) are computational frameworks used to simulate the actions and interactions of autonomous agents within a defined system to assess its behavior over time. Unlike equation-based models that rely on aggregate data and assume system-wide averages, ABMs model individual decision-making processes and allow for heterogeneous agent characteristics. In the context of prediction markets, each agent represents a trader who makes buy and sell decisions based on their private information, beliefs about the outcome of an event, and pre-defined trading strategies. The collective actions of these agents, operating under specified rules, generate emergent market-level phenomena such as price discovery, information aggregation, and market efficiency, which can then be analyzed to understand the underlying dynamics of the system.

Agent-based modeling (ABM) simulates market dynamics by constructing a population of autonomous agents, each representing a trader with defined characteristics and behavioral rules. These agents operate independently, making decisions based on their individual strategies, private information, and perceptions of the market. Rather than relying on aggregate data or assumptions of rational behavior, ABM focuses on the interactions of these individual agents. This bottom-up approach allows for the observation of emergent behavior – patterns and outcomes at the market level that are not explicitly programmed into the agents themselves, but arise from their collective interactions. The resulting simulation provides insights into how micro-level trader characteristics influence macro-level market phenomena, such as price discovery, information diffusion, and overall market efficiency.

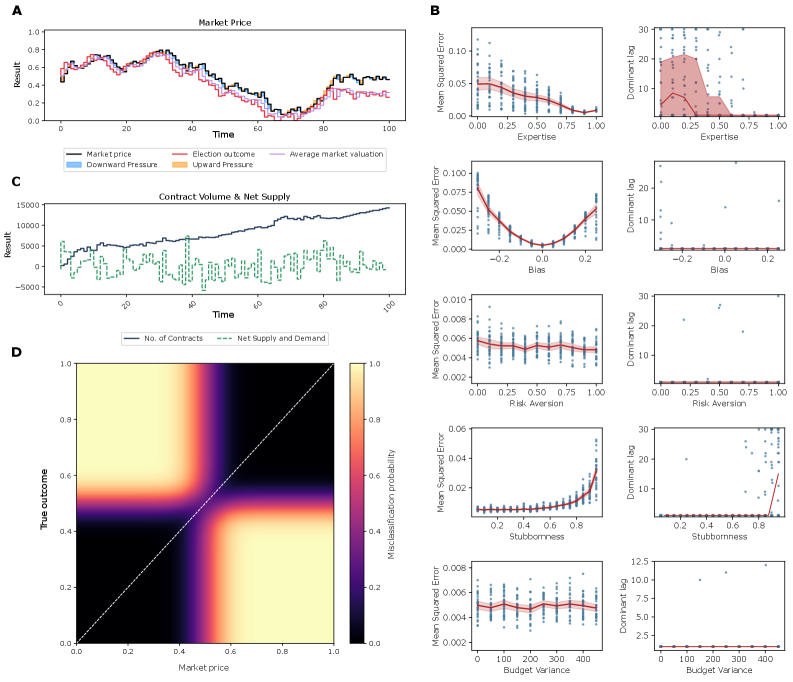

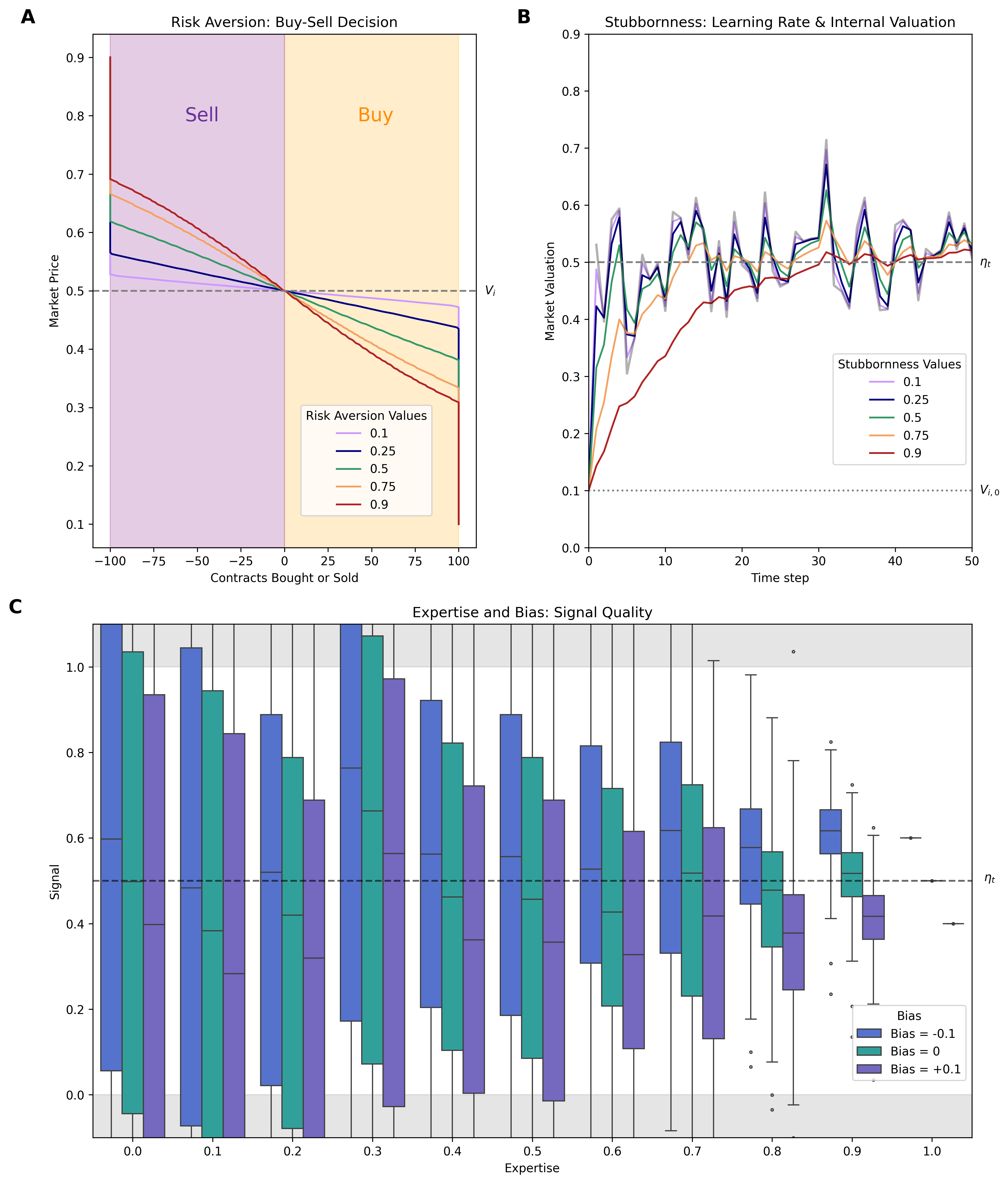

Agent-based modeling allows for the systematic variation of key parameters influencing prediction market accuracy. Simulations can be run with populations of agents exhibiting differing levels of expertise – ranging from naive random guessing to informed analysis of underlying data – to quantify the contribution of informed traders to overall market price discovery. Similarly, the degree of risk aversion programmed into each agent – represented by parameters governing willingness to trade on uncertain outcomes – directly affects market volatility and the speed of convergence to accurate predictions. Furthermore, the distribution of budgets among agents – whether evenly distributed or concentrated in the hands of a few – impacts the influence of individual traders and the potential for manipulation, ultimately affecting the reliability of the market’s aggregated forecast.

The fidelity of an Agent-Based Model (ABM) is directly correlated with the thoroughness of agent characteristic definition. These characteristics typically encompass trading strategies-ranging from simple heuristics to complex algorithms-as well as parameters representing individual trader attributes such as risk tolerance, initial capital allocation, information access, and cognitive biases. Defining these parameters involves specifying distributions-uniform, normal, or otherwise-from which each agent’s attributes are randomly drawn, ensuring population diversity. Crucially, the selection of these distributions and their associated parameters must be informed by empirical data or reasonable assumptions about the target market population to achieve a simulation that accurately reflects real-world behavior. Furthermore, agent characteristics can be dynamic, evolving over time based on simulated trading performance and interactions within the market environment.

Measuring the Illusion: Quantifying Market Error

Market Price Deviation (MPD) serves as a quantifiable metric for evaluating the efficiency of prediction markets. It is calculated as the absolute difference between the market price of an outcome and its actual, empirically-determined probability. A lower MPD indicates a more accurate market assessment, while a higher deviation suggests systematic mispricing. This metric allows for objective comparison of market performance across different events and time periods, and is crucial for identifying instances where market prices diverge significantly from underlying realities. Analyzing MPD trends helps to understand the degree to which market signals reflect genuine information or are influenced by behavioral biases and external factors.

The analysis of market price deviations utilizes an Autoregressive model of order 2, denoted as AR(2), which is predicated on the Linear Order Update (LOU) method. The LOU method provides a mechanism for iteratively updating beliefs based on observed market orders, while the AR(2) specification allows for the modeling of temporal dependencies in these deviations – specifically, that current deviations are influenced by both the immediately preceding deviation and the deviation two time steps prior. This approach enables the quantification of deviation stability over time, revealing whether errors tend to persist, oscillate, or regress towards zero. The AR(2) model is parameterized and estimated using maximum likelihood estimation, allowing for statistically rigorous inference regarding the magnitude and persistence of price errors.

Analysis indicates that price deviations are amplified by both herding behavior and the actions of large-budget participants, often referred to as ‘whale’ bettors. Specifically, the magnitude of price error is directly proportional to the product of a whale’s budget fraction – the proportion of the total market budget they control – and their individual valuation error, which represents the difference between their private assessment of an event’s probability and its true value. Herding behavior further exacerbates this effect, as the collective, potentially misinformed, actions of numerous traders can reinforce the impact of a whale’s erroneous valuation, leading to substantial and systematic distortions in market prices.

Empirical analysis demonstrates systematic distortions in market signals attributable to specific agent behaviors. Comparative data between Polymarket forecasts and those of professional economists reveal a Root Mean Squared Error (RMSE) ranging from 5 to 30 percentage points. This variance indicates a consistent, measurable deviation from rational pricing, suggesting that factors beyond purely probabilistic assessment influence market outcomes. The magnitude of this error provides a quantitative basis for assessing the impact of behavioral biases and concentrated capital on market efficiency, confirming that observed price deviations are not solely attributable to random noise.

Visualizing the System: A Tool for Manipulation and Insight

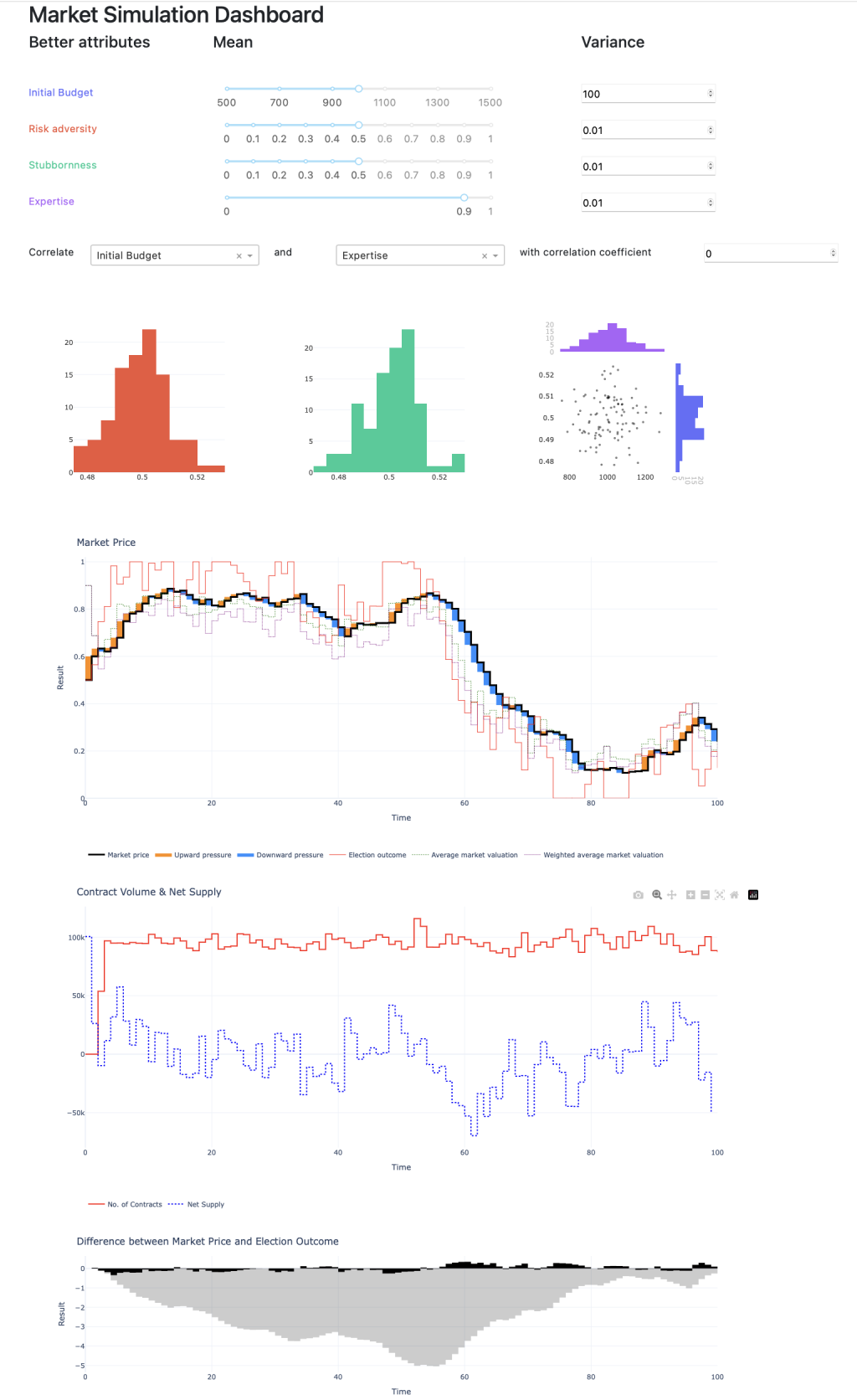

A novel Dash Application was engineered to provide an accessible platform for investigating agent-based modeling (ABM) scenarios. This graphical interface prioritizes usability, enabling researchers to intuitively navigate and manipulate complex simulations without requiring extensive programming knowledge. The application translates abstract parameters – such as agent budget constraints, individual risk tolerances, and varying levels of expertise – into visually interpretable data. This allows for dynamic experimentation; users can readily adjust these key variables and observe the immediate impact on resulting market behaviors, fostering a deeper understanding of the forces driving prediction market outcomes and offering a powerful tool for iterative design optimization.

The application provides a uniquely interactive environment, empowering users to directly manipulate the foundational elements governing agent-based model (ABM) behavior. Researchers can precisely calibrate parameters defining each agent’s financial resources – their budget – as well as their propensity to take chances – risk tolerance – and the depth of their knowledge pertaining to the prediction task – expertise levels. This dynamic adjustment capability moves beyond static simulations, allowing for focused experimentation on how alterations to these core characteristics influence collective market dynamics and, crucially, the overall accuracy of predictions generated within the model. The resulting flexibility enables a granular understanding of parameter sensitivity and facilitates the identification of optimal agent configurations for enhanced forecasting performance.

The application doesn’t simply present data; it transforms abstract computational results into readily interpretable visual representations of market dynamics. Researchers are afforded the opportunity to observe how shifts in parameters – like agent budget or risk aversion – ripple through the simulated market, directly impacting the overall accuracy of predictions. This visual approach bypasses the need for exhaustive statistical analysis to discern complex relationships; patterns and sensitivities emerge intuitively from the displayed behaviors. Consequently, investigators can quickly identify critical factors driving forecast performance and, crucially, understand how those factors interact – revealing synergistic or antagonistic effects that might otherwise remain hidden within raw data. This capacity for intuitive understanding dramatically accelerates the process of refining prediction market designs and optimizing strategies for improved forecasting.

The development of this interactive prediction market simulation tool extends beyond mere visualization; it offers a powerful platform for systematically optimizing market design itself. Researchers can now experimentally manipulate critical parameters – from agent incentives and information access to market structure and reward systems – and directly observe the resulting impact on forecasting accuracy and efficiency. This capability allows for the identification of optimal configurations that maximize predictive performance, potentially leading to more reliable forecasts across a wide range of applications, including economic forecasting, political analysis, and even corporate strategy. Ultimately, the tool promises a data-driven approach to prediction market design, moving beyond intuition and toward empirically validated best practices for improved forecasting outcomes.

The study reveals a vulnerability inherent in collective belief systems, mirroring the tendency for individuals to prioritize perceived social consensus over independent judgment. This echoes Henry David Thoreau’s observation: “It is not enough to be busy; so are the ants. The question is: What are we busy with?” The agent-based model demonstrates how a concentrated force – the ‘whale’ participant – can manipulate the ‘busyness’ of the market, distorting price signals not through rational economic force, but by exploiting the herding instincts of other agents. The market, then, becomes a collective meditation on fear, a simulation of conviction rather than a true reflection of underlying probabilities. It isn’t the pursuit of accurate forecasting that dominates, but the illusion of shared understanding.

What’s Next?

The simulations presented here don’t invalidate prediction markets, but they do suggest a persistent vulnerability – not to rational disagreement, but to the amplification of emotional responses. The ‘whale’ isn’t a sophisticated analyst, but a concentrated locus of fear or optimism, capable of nudging the herd not toward truth, but toward self-fulfilling prophecies. The question isn’t whether markets can predict, but whether they predict what people believe will happen, a subtly different, and far more malleable, reality.

Future work should focus less on refining forecasting algorithms and more on modeling the psychological biases of the participants. How do different forms of information asymmetry exacerbate herding? What network structures make a market most susceptible to manipulation, not through intentional deceit, but through the simple, predictable dynamics of social influence? The models need to incorporate more realistic representations of cognitive shortcuts and emotional contagion.

Ultimately, the pursuit of a perfectly predictive market feels increasingly like a category error. People don’t make decisions; they tell themselves stories about decisions. And those stories, encoded in price fluctuations, are rarely about objective probability. The real challenge isn’t to eliminate error, but to understand the narrative structures that give those errors their peculiar, and often profitable, shape.

Original article: https://arxiv.org/pdf/2601.20452.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 10 Hulu Originals You’re Missing Out On

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Sandisk: A Most Peculiar Bloom

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- Actresses Who Don’t Support Drinking Alcohol

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

2026-01-29 07:52