The matter of Tesla, designated TSLA, presents itself not as a simple accounting of profit and loss, but as a peculiar case study in the mechanics of expectation. The year 2025 concluded, not with the anticipated surge, but with a discernible contraction – a dwindling of vehicular units dispatched and a corresponding sluggishness in the valuation metrics. One is compelled to observe that the customary trajectory of ascent has, for the moment, plateaued, or perhaps begun a slow, almost imperceptible descent.

The presiding figure, Mr. Musk, is a subject of considerable speculation. His history is populated with pronouncements and achievements that defy conventional forecasting. To wager against him, it is often noted, is to invite a peculiar form of financial disappointment, though one suspects the precise nature of this disappointment is rarely fully understood until it manifests itself. The logic of his successes remains opaque, a series of improbable outcomes achieved through means that seem to operate outside the established parameters of industrial efficiency.

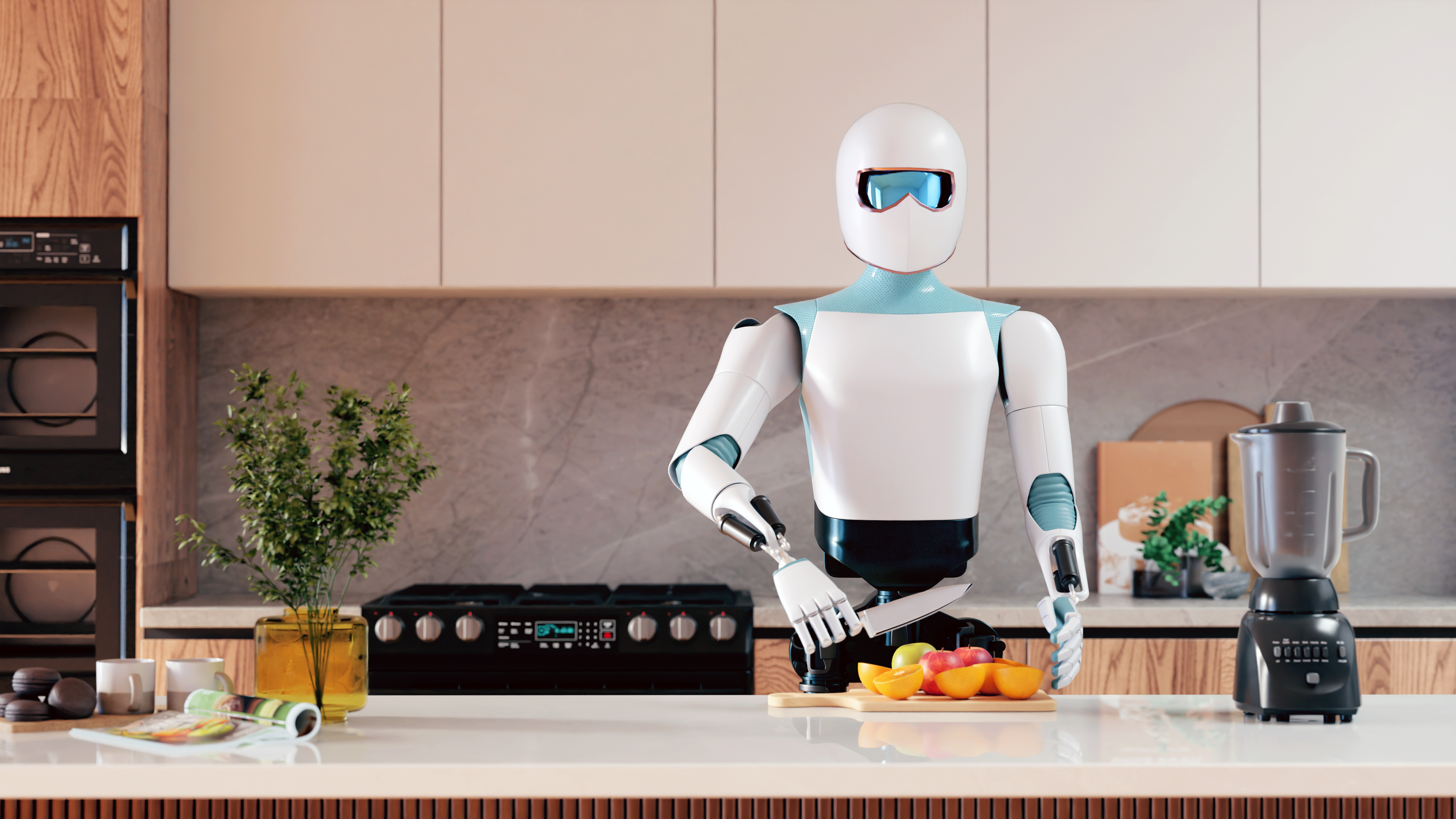

The company itself is no longer definable solely as a purveyor of automobiles. Between the pursuit of fully autonomous conveyance and the development of humanoid automatons – designated ‘Optimus’ – Tesla appears to be evolving into something else entirely, a complex system whose ultimate purpose is only dimly perceived. It is a transformation that inspires a certain unease, as if the very definition of ‘transportation’ is undergoing a subtle, unsettling revision.

The question, therefore, is not merely whether Tesla represents a viable investment, but whether the very act of attempting to quantify its worth is not a fundamentally flawed exercise. After the unremarkable performance of 2025, one is compelled to inquire: is this a moment for acquisition?

The Laws of Automated Motion

Let us begin with the matter of self-propelled vehicles. Mr. Musk, via a digital communiqué dated January 22, 2026, declared the operational status of robotic taxis within the jurisdiction of Austin, Texas. These vehicles, it should be noted, are not entirely devoid of human oversight. Rather, a supplementary vehicle follows in their wake, occupied by personnel tasked with observing and, presumably, intervening should the automated systems encounter unforeseen circumstances. This arrangement feels less like progress and more like a temporary reprieve, a bureaucratic ritual designed to allay public anxiety.

The market for autonomous taxis is, ostensibly, expanding. Tesla now finds itself competing with the entity known as Waymo, an affiliate of Alphabet. However, Waymo operates on a scale that dwarfs Tesla’s current efforts. A recent report, compiled by an analyst named Sarwant Singh, projects a fleet exceeding 900,000 vehicles and a market valuation of approximately $100 billion by the year 2035. The numbers are precise, yet they offer no real clarity. They are merely markers in a landscape that remains largely uncharted.

Waymo currently maintains a fleet of 2,500 vehicles. The market, therefore, is not yet fully occupied, allowing for the potential entry of competitors such as Tesla. However, the ‘Optimus’ robots represent a more substantial, and potentially more disruptive, development. These automatons, Mr. Musk announced, are slated for public availability by the end of 2027, with preliminary deployment within Tesla’s manufacturing facilities anticipated this year. The prospect of acquiring a robotic domestic servant before the year 2030 is, admittedly, uncertain.

However, this is the same individual whose other enterprise, SpaceX, has demonstrated the capacity to recover and reuse rocket-propelled vehicles. Therefore, the seemingly impossible should not be dismissed outright. Mr. Musk postulates that the ‘Optimus’ robots could add $20 trillion to Tesla’s valuation. This figure is, perhaps, overly optimistic. Yet, there is no precedent for a product quite like the ‘Optimus’ robot, and the potential market remains, for all intents and purposes, unknown. It is a void filled with speculation and improbable calculations.

However, it is crucial to remember that even Mr. Musk’s successes are rarely achieved without a degree of friction. The operational robotaxis, while impressive, represent a delayed realization of a vision originally articulated in 2020, with mass production projected for 2024. Furthermore, Mr. Musk himself acknowledged, via a digital communiqué, that the production of both robotaxis and ‘Optimus’ robots will proceed at an “agonizingly slow” pace before accelerating. This admission, while candid, does little to alleviate the underlying sense of unease.

Still, if he manages to overcome these obstacles, both developments could represent significant opportunities for Tesla. But what of its core automotive business? The news there is less encouraging. Tesla’s sales for the first nine months of 2025 were down 9.5% from the peak achieved in 2023. Deliveries for the fourth quarter of 2025 were down 15.6% from the corresponding period in 2024.

The year 2025 proved to be an anomalous one for electric vehicles in general. While global sales increased by 20%, the United States, Tesla’s largest market, experienced a 4% decline in new registrations, with a precipitous 39% drop in December. This downturn was likely attributable to the expiration of the electric vehicle tax credit in November. Regardless, it had a detrimental effect on Tesla’s performance.

Despite this setback, and a decline in revenue for the first nine months of 2025, Tesla’s third-quarter results did show an 11% increase in revenue compared to the same period in 2024. However, net income and cash flows remained down. The company remains profitable, with a net income margin of 5.3% and a positive cash position of $41.56 billion, offset by $13.79 billion in debt. The balance, while positive, feels precarious, as if a slight perturbation could disrupt the equilibrium.

Therefore, the question remains: can Tesla recover, and should one invest? The answer, one suspects, depends on one’s faith in Mr. Musk’s objectives and business acumen. He is, undeniably, the company’s most valuable intangible asset. One is compelled to examine Tesla closely and determine whether one believes in Mr. Musk’s vision before committing capital.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Sandisk: A Most Peculiar Bloom

- Meta: A Seed for Enduring Returns

- Micron: A Memory Worth Holding

- Ephemeral Engines: A Triptych of Tech

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

2026-01-28 20:13