Last year witnessed a peculiar efflorescence in the valuation of certain enterprises engaged in the pursuit of ‘artificial intelligence’. Those of us who refrained from participation in this speculative surge found ourselves, predictably, trailing the indices. Nvidia, Alphabet, and Palantir – names now uttered with a reverence previously reserved for cathedrals – ascended on currents of enthusiasm and, let us be frank, a collective suspension of disbelief. It was a demonstration, not of insight, but of the market’s capacity for self-delusion.

Now, a new instrument is offered – the Roundhill Generative AI and Technology ETF (CHAT). A convenient vessel, ostensibly designed to deliver exposure to this ‘high-growth industry’. It is a mechanism for channeling capital, a modern-day indulgence, for those who believe the digital oracle will bestow fortune. The price of admission is a mere $70, a sum easily parted with in these times of profligacy.

The fund’s holdings – forty-nine in number – represent a concentrated bet on the infrastructure, software, and platforms that underpin this technological mirage. Five names – Alphabet, Nvidia, Microsoft, Amazon, and Meta – account for nearly a third of the total portfolio. These are the leviathans, the established powers, who stand to profit most from the automation of human endeavor. They are the beneficiaries, not the innovators.

| Stock | Roundhill ETF Portfolio Weighting |

|---|---|

| Alphabet | 6.75% |

| Nvidia | 6.66% |

| Microsoft | 5.29% |

| Amazon | 4.38% |

| Meta Platforms | 3.80% |

Nvidia, of course, provides the silicon heart of this operation – the chips that process the endless streams of data. Alphabet, Microsoft, and Amazon lease access to this computational power, effectively becoming the landlords of the digital age. Without their infrastructure, the average enterprise would be unable to afford participation in this ‘revolution’. It is a system designed to exacerbate existing inequalities, to concentrate wealth in the hands of a few.

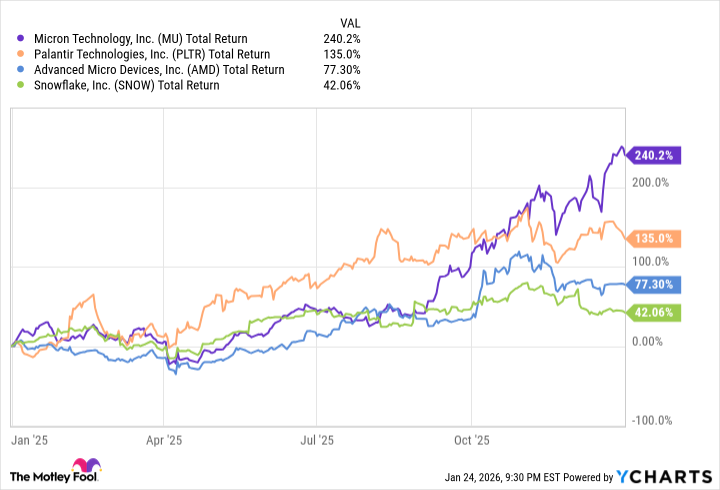

But let us not overlook the smaller players, the ‘disruptors’ who promise even greater returns. Advanced Micro Devices, challenging Nvidia’s dominance. Palantir Technologies, extracting value from data – a practice fraught with ethical implications. Micron Technology, supplying the memory that feeds the insatiable appetite of these machines. And Snowflake, a platform for collecting, processing, and analyzing data – a modern-day panopticon. Last year, these four delivered an average return of 123%. A fleeting triumph, perhaps, built on unsustainable hype.

- Advanced Micro Devices has entered the arena, seeking to challenge Nvidia’s supremacy in the provision of data center chips. OpenAI, predictably, is among the first to receive their wares.

- Palantir Technologies offers software platforms designed to extract value from internal data, enabling organizations to make ‘faster and better-informed decisions’. A euphemism for surveillance and control.

- Micron Technology supplies the high-bandwidth memory required to feed the insatiable appetite of these data centers. A critical component, enabling ever-faster processing speeds.

- Snowflake provides a platform for collecting, processing, and analyzing data, enabling organizations to train their artificial intelligence software. A digital fortress, guarding the secrets of the powerful.

Last year, the Roundhill ETF outperformed the S&P 500 by a considerable margin – 45.7% versus 16.4%. A testament to the power of speculation, not to the underlying value of these enterprises. Any significant disruption in the AI industry could trigger a sharp correction, a reckoning for those who have placed their faith in this digital deity. The trillions of dollars in infrastructure spending currently in the pipeline may offer temporary respite, but risk management remains a forgotten art.

The Roundhill ETF is best suited for a diversified portfolio that currently lacks exposure to the AI space. It offers a convenient way to own a slice of this burgeoning industry, without the burden of individual stock selection. But investors should be mindful of position sizing, lest they become casualties of the inevitable downturn.

Finally, let us consider the cost. This is an actively managed fund, meaning a team of Roundhill’s investment experts will regularly adjust the portfolio. This expertise comes at a price – an expense ratio of 0.75%. An investment of $10,000 will incur an annual fee of $75. A seemingly insignificant sum, perhaps, but twenty-five times greater than the fee charged by a passively managed Vanguard S&P 500 ETF. A stark reminder that even in the realm of finance, efficiency is often sacrificed at the altar of profit.

In conclusion, the Roundhill ETF may offer a temporary boost to a diversified portfolio, as long as the AI boom continues. But investors should remain vigilant, mindful of the risks, and prepared for the inevitable reckoning. For in the end, the algorithm is merely a tool, and the pursuit of profit, a timeless and often ruthless endeavor.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

2026-01-28 18:32