Behold, gentle investors, a tale most curious! It concerns Rigetti Computing (RGTI +2.53%), a company which, in these modern times, dares to chase the very substance of dreams – quantum computation. As the clamor for Artificial Intelligence reached a fever pitch, and every speculative venture was deemed a golden opportunity, so too did Rigetti find itself swept along by the tide of fortune. Last year alone, its shares ascended a respectable 45%, a performance which, one might observe, is more a reflection of prevailing sentiment than demonstrable achievement.

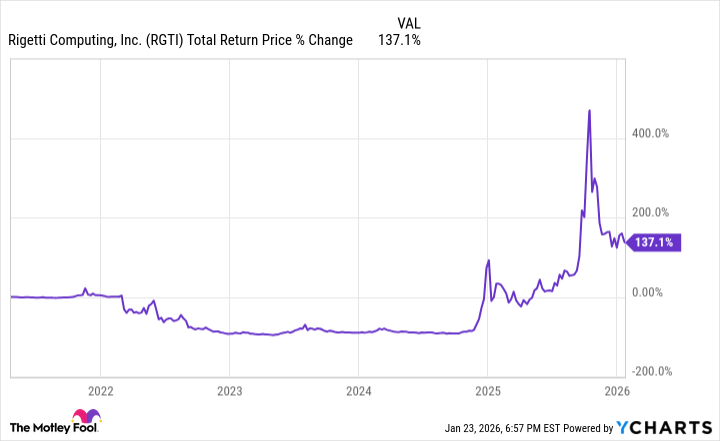

But let us not be hasty in declaring this a triumph. For the true measure of an investment lies not in fleeting gains, but in the enduring stability of its foundations. To examine Rigetti’s performance over the past five years is to witness a spectacle of remarkable volatility, a financial seesaw upon which fortunes are made and lost with alarming ease.

Indeed, a thousand dollars entrusted to Rigetti five years prior would now yield approximately $2,370. A pleasing return, to be sure, representing an average annual gain of 18.8%. Yet, to focus solely upon this figure is to ignore the dramatic contortions that preceded it – a comedy of errors, if you will.

From the heights of late 2021, the stock plunged into an abyss, losing a staggering 96% of its value. Ah, the fickle nature of the market! The year 2022, with its inflationary woes and bearish disposition, proved merciless to companies built upon promise rather than profit. Investors, suddenly afflicted with prudence, abandoned such ventures with commendable haste.

But fear not, for the plot thickens! As stability returned, and the AI frenzy regained its momentum, Rigetti experienced a most astonishing revival. From its nadir, the stock soared by an improbable 5,000%, briefly elevating its market capitalization to over $5.5 billion. It became, for a fleeting moment, the darling of the speculative crowd, a testament to the power of hype over substance.

Alas, such triumphs are rarely enduring. Rigetti has since relinquished more than half of its peak value, confirming its position as a stock closely watched, yet perpetually prone to dramatic swings. It remains, therefore, a cautionary tale – a reminder that in the realm of finance, as in life, the pursuit of novelty often leads to a most amusing, if not entirely profitable, predicament. One might even suggest that Rigetti is less a pioneer of quantum computing, and more a master of the art of speculative distraction.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

2026-01-28 16:12