So, the S&P 500 is up. Fine. Records. Whatever. But you read the surveys, right? A third of investors are pessimistic? Pessimistic! Like they’re expecting something to actually happen. It’s infuriating. Everyone’s suddenly an expert, predicting doom. And now it’s AI’s fault. Of course. It always has to be something. They’re terrified of an AI bubble. A bubble! As if bubbles are new. It’s just… predictable. And frankly, a little insulting to those of us who remember the dot-com era. The sheer lack of historical perspective…

Look, I’m not saying AI isn’t overhyped. It absolutely is. But the market will correct itself eventually, regardless. It’s just…physics. Things go up, things go down. It’s not rocket science. And people act like they’re surprised? It’s the same story every time. The only guarantee in the market is that someone, somewhere, is about to make a spectacularly bad decision. It’s a certainty. A statistical inevitability. And the rest of us have to suffer for it.

The Problem With “Smart” Investing

Everyone’s always talking about “limiting risk.” Limiting risk! Like that’s some kind of achievement. As if the goal of investing is to avoid losing a few bucks. It’s absurd. The point is to make money. But no, they want “diversification,” ETFs, all this…complexity. It’s just a way to feel busy without actually accomplishing anything. You end up owning a tiny sliver of everything, so when the inevitable crash comes, you’re just… mildly disappointed instead of genuinely outraged. It’s pathetic.

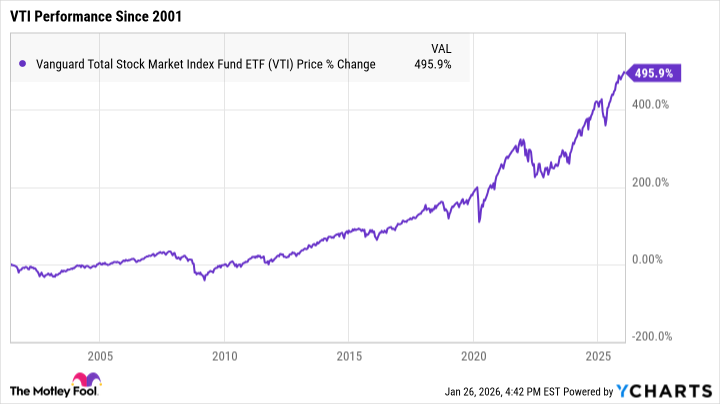

Which brings me to the Vanguard Total Stock Market ETF (VTI +0.36%). It’s…fine. It holds everything. Literally everything. Over 3,500 stocks. It’s the investing equivalent of beige paint. Safe, boring, and utterly devoid of personality. And yes, it has a chunk of AI companies. Of course it does. Because everything does these days. It’s inescapable. You can’t even buy a toaster without some algorithm trying to upsell you a smart refrigerator. It’s a nightmare.

They tout its historical performance – 500% returns since 2001. Great. It survived the dot-com bust, the financial crisis, COVID, and whatever other calamities the market could throw at it. But that’s not exactly a ringing endorsement. It just means it’s… resiliently mediocre. It didn’t thrive during those periods, it just… existed. And now they want you to be grateful for that? It’s insulting.

The Real Risk: Doing Nothing

Here’s the thing: if you’re going to invest, you have to be in it for the long haul. Five years, ten years, decades. Otherwise, what’s the point? You’re just gambling. But people can’t commit. They panic sell at the first sign of trouble. It’s a reflex. And then they wonder why they’re broke. It’s baffling. You need a long-term strategy, and a thick skin. The market will test you. It will try to break you. And it will succeed if you let it.

Safer investments mean lower returns. That’s just… basic math. You can’t have it both ways. But people always want the impossible. They want guaranteed profits with zero risk. It’s delusional. The Vanguard ETF isn’t going to make you rich overnight. It’s not going to fund your yacht. But it might… prevent you from losing everything. And in this market, that’s… something.

Look, it’s not a perfect solution. Nothing is. But it’s a reasonably sensible way to avoid the worst of the volatility. It’s… pragmatism. And frankly, in a world filled with irrational exuberance and reckless speculation, pragmatism is… a victory. A small, insignificant victory, but a victory nonetheless. And in the current market, I’ll take what I can get.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

2026-01-28 14:32