There’s a peculiar human habit, you see. We chase the shiny new thing, the ‘Next Big Incantation’ as the Guild of Alchemists and Venture Capitalists so charmingly puts it. We dream of overnight fortunes, of turning lead into gold with a single well-placed investment. But sometimes, just sometimes, the most sensible course is to accept a modest, regular payment. A drip, drip, drip of funds that, if you’re lucky and the world doesn’t end in a particularly nasty hailstorm, might just keep the creditors at bay for a few more decades. These are called ‘dividends’, and they’re the financial equivalent of a reliable, if somewhat dull, garden gnome.

The appeal isn’t the thrill of exponential growth, naturally. It’s the sheer, quiet desperation of knowing you’ll receive something, regardless of whether the market decides to throw a tantrum. It’s a small comfort, admittedly, but in a world built on promises and fuelled by hope, a little bit of guaranteed income can be surprisingly… soothing. Don’t mistake this for optimism. It’s merely acknowledging reality.1

So, if you’re looking for companies that might, just might, still be offering these modest payouts twenty years hence, allow me to present a few candidates. Consider it a list of businesses that haven’t yet been swallowed by the swamp of innovation, or haven’t succumbed to the siren song of ‘disruption’.

1. Chevron: The Oil That Keeps On… Oiling

Chevron, or as the ancient texts refer to it, the ‘Keepers of the Black Goo’, is one of the larger entities involved in the extraction, transportation, and refinement of… well, you know. That stuff that makes everything run, and occasionally explode. They do it all, from digging it out of the ground to turning it into fuel, lubricants, and the raw materials for things you didn’t even know needed oil.2

The cleverness, if you can call it that, lies in diversification. If one part of the oil business decides to have a bad day – say, a rogue volcano, or a sudden surge in dragon-powered transport – the others can, theoretically, pick up the slack. It’s not foolproof, of course. No system is. But it’s marginally better than putting all your eggs in one particularly flammable basket.

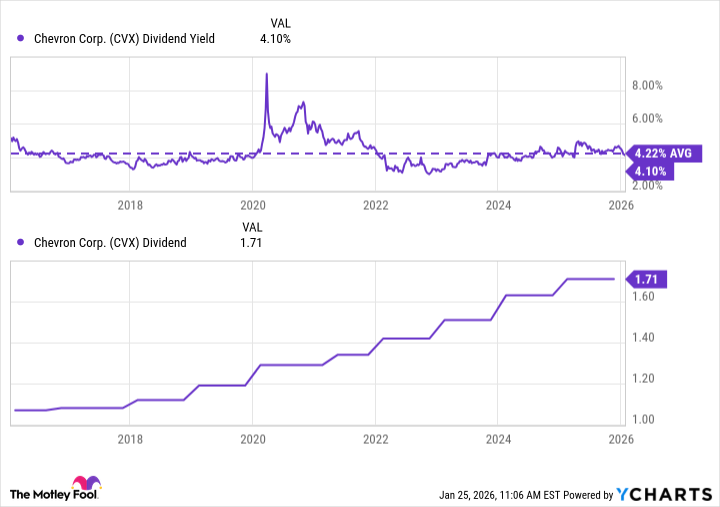

Over the last decade, they’ve been handing out dividends at a rate of around 4.2%, which is more than double what the average company coughs up. And they’ve been doing it for thirty-eight years, which, in the grand scheme of things, is a respectable run. It suggests a certain… resilience. Or perhaps just a stubborn refusal to go bankrupt.

The oil business is, naturally, cyclical. It goes up, it goes down. But Chevron seems determined to keep those dividend payments flowing, even when the black goo isn’t exactly gushing. They claim it’s about efficiency and maximizing shareholder returns. I suspect it’s more about avoiding angry mobs with pitchforks.

2. Procter & Gamble: The Masters of Mundane Necessities

Procter & Gamble. The name doesn’t exactly set the world on fire, does it? But chances are, you use their products every single day. Tide, Pampers, Old Spice, Febreze, Crest… the list goes on. They make the things that keep society from descending into complete chaos. Or, at least, from smelling too bad.

In times of prosperity, people might splurge on fancy soaps and scented candles. But when the economy hits a rough patch, they still need laundry detergent, diapers, and toothpaste. It’s a simple truth. People will always prioritize basic hygiene, even if it means sacrificing their dreams of owning a solid gold bathtub.

Don’t expect explosive growth from P&G. They’re not exactly known for their innovation. But they are known for their dependability. They’ve been paying dividends for sixty-nine consecutive years. Sixty-nine! That’s more than most kingdoms have lasted. There are only five companies in the entire market with a longer streak. It’s a testament to their… shall we say, pragmatic approach to business.

P&G might be a “boring” stock. But sometimes, boring is good. Sometimes, boring is exactly what you need to survive.

3. Johnson & Johnson: The Healers (and Litigators)

Johnson & Johnson. Once a sprawling empire of bandages, baby powder, and pharmaceuticals, they’ve recently undergone a bit of a restructuring. They spun off their consumer division – the stuff you put on cuts and bruises – and are now focusing on pharmaceuticals and medical devices. It’s like a phoenix rising from the ashes… or, perhaps, a slightly less cluttered accounting department.

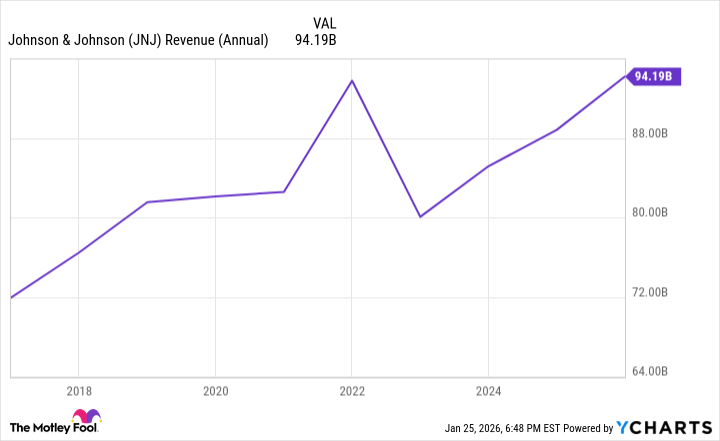

The spinoff caused a temporary dip in revenue, naturally. But they seem to be recovering nicely. Revenue was up 6% in 2025, and 17% since 2023. It’s not exactly rocket science, but it’s a respectable performance for a company of their size and maturity.

Like P&G, Johnson & Johnson benefits from the fact that people will always need healthcare. Chronic diseases, aging populations… these are unfortunate realities. But they also create a steady demand for medical products and services. It’s a grim thought, perhaps, but it’s also good for business.

The healthcare landscape will undoubtedly change over the next twenty years. But you can bet that Johnson & Johnson will still be around, providing bandages, pills, and whatever other medical marvels they come up with. And you can also bet that their dividend will still be going strong. They’ve been increasing their annual payout for sixty-three consecutive years. It’s a record that’s hard to beat. Or, at least, hard to argue with.

1

This is not to say that investing is a sensible activity. Merely that it is a human one. And humans, as a species, are rarely sensible.

2

The ancient texts also mention a shadowy organization known as the ‘Guild of Alchemists and Venture Capitalists’. Their motives remain… unclear. But they are said to wield considerable influence over the flow of capital. And they have a disconcerting fondness for shiny objects.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

2026-01-28 14:13