Oh, sweet Ethereum, you’re entering the wildest rollercoaster of your life as traders grip their popcorn and brace for today’s FOMC decision! With prices all squished up in a key structural zone like sardines in a can, and on-chain leverage soaring to jaw-dropping heights, it’s like watching a reality show where no one knows who’s getting voted off next. While the market seems to think the Federal Reserve will keep things steady-because why not stick to the same script?-the real drama is in Jerome Powell’s mysterious forward guidance that has ETH all jittery and itching for a thrilling move.

On-Chain Data Flags Elevated Volatility Risk

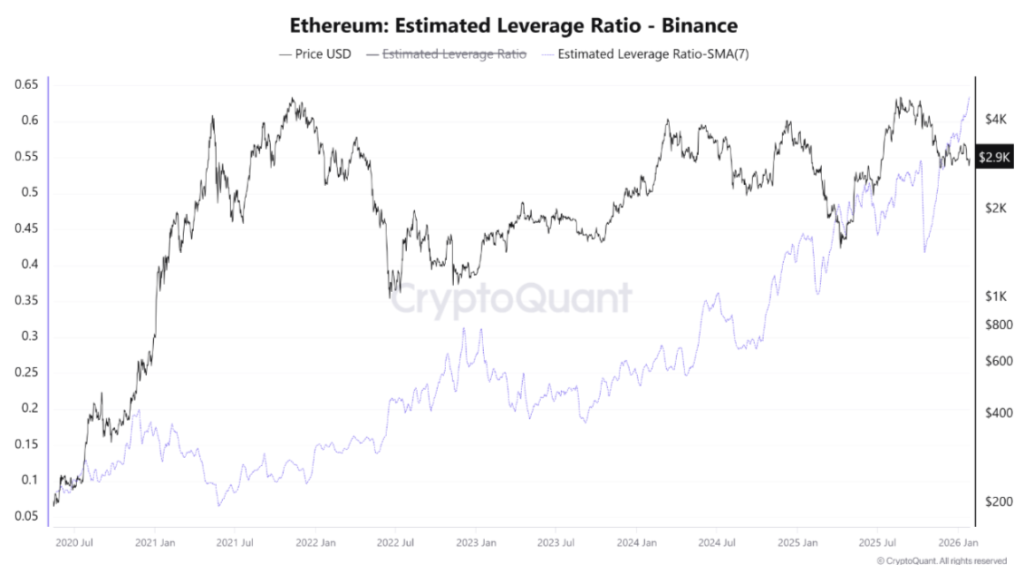

So, here’s the tea: Ethereum’s Estimated Leverage Ratio on Binance is climbing higher than your neighbor’s Christmas lights in July-an all-time high of 0.632! This means that more folks are playing with derivatives instead of good old-fashioned spot buying, which, spoiler alert, usually equals more chaos than calm in the market.

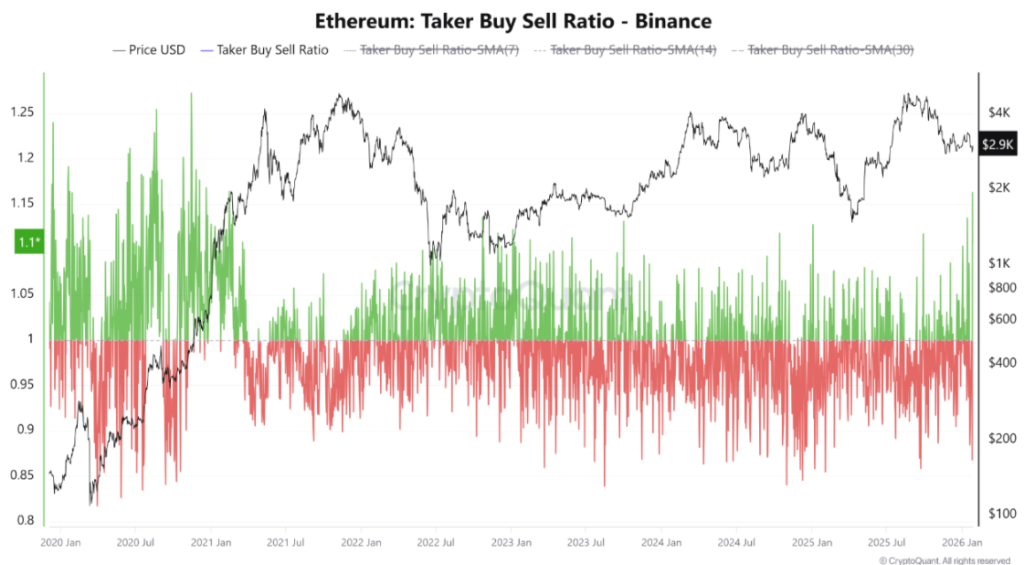

And just when you thought it couldn’t get juicier, the Taker Buy/Sell Ratio is throwing a fit! On January 25, it dropped to 0.86-the lowest since September! Talk about dramatic! But wait, within days, it bounced back to 1.16, the highest daily reading since February 2021, like that friend who always shows up at the party uninvited but somehow becomes the center of attention.

This kind of sudden flip in taker behavior screams emotional trading-because who needs clarity in a market when you can have spontaneous panic? When leverage is sky-high and order-flow changes faster than a Tinder date going south, prices tend to swing wildly, which could lead us into a liquidation nightmare while Ethereum awkwardly hovers around the $2,800 support zone, desperately trying to forget its past glory near $4,800.

Until we see a clear direction, Ethereum is like a cat on a hot tin roof-sensitive and ready to pounce at any external trigger, with liquidation cascades lurking around, ready to crash the party.

Whale Accumulation Counters Leverage Risk

But hold your horses! Despite all this leverage drama, the whales are quietly stacking their ETH like it’s Black Friday and they’ve just found the last TV on sale. Bitmine Immersion Technologies just ramped up its Ethereum stash to about 4.2 million ETH, alongside a hefty crypto and cash reserve of around $12.8 billion. That’s some serious institutional confidence, not just a “buy the dip” moment!

News: Bitmine (NYSE American: $BMNR) has bought another 40,302 $ETH, increasing its total Ethereum holdings to about 4.2 million $ETH, with total crypto and cash holdings of roughly $12.8 billion.

– Crypto Coin Show (@CryptoCoinShow) January 27, 2026

Historically, moments like these often signal long-term positioning rather than fleeting trades, providing a much-needed stabilizing force against all that speculative leverage chaos. It’s like watching a zen master amid a group of hyperactive toddlers-calm amidst the storm!

Ethereum Price Structure Signals a Pivotal Moment

Now, let’s talk about Ethereum’s price chart-it’s looking all kinds of promising, yet oh-so-fragile. For months, ETH has been respecting its rising trend structure like a well-behaved child in church, with strong demand each time it dips to the 200-week moving averages. Each major pullback has been met with enthusiastic buyers, forming higher highs and higher lows. What a well-mannered asset!

Right now, ETH is squished against a resistance band that’s been a real party pooper for its upside attempts. A clean break above the $3300 mark would be the golden ticket towards $3500, followed by a potential jaunt to $4000! But if it dips below $2700, we might find ourselves reminiscing about $2500 pretty quickly.

Final Thoughts

With the markets betting on a rate pause, how Ethereum reacts will depend more on Powell’s mood than the actual decision itself. Any hint of continued tightness might send leveraged longs into a panic spiral, causing all sorts of downside chaos. But if Powell tosses out some dovish vibes, we could see a frenzy of short covering, sending the price skyrocketing! Buckle up, because it’s going to be a bumpy ride!

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

2026-01-28 13:46