Author: Denis Avetisyan

This research introduces a novel deep learning model that incorporates volatility trends and investor sentiment to achieve more accurate and interpretable option pricing for the CSI 300 Index.

A deep FBSDE framework leverages volatility trajectories and market sentiment to improve option pricing accuracy and explainability.

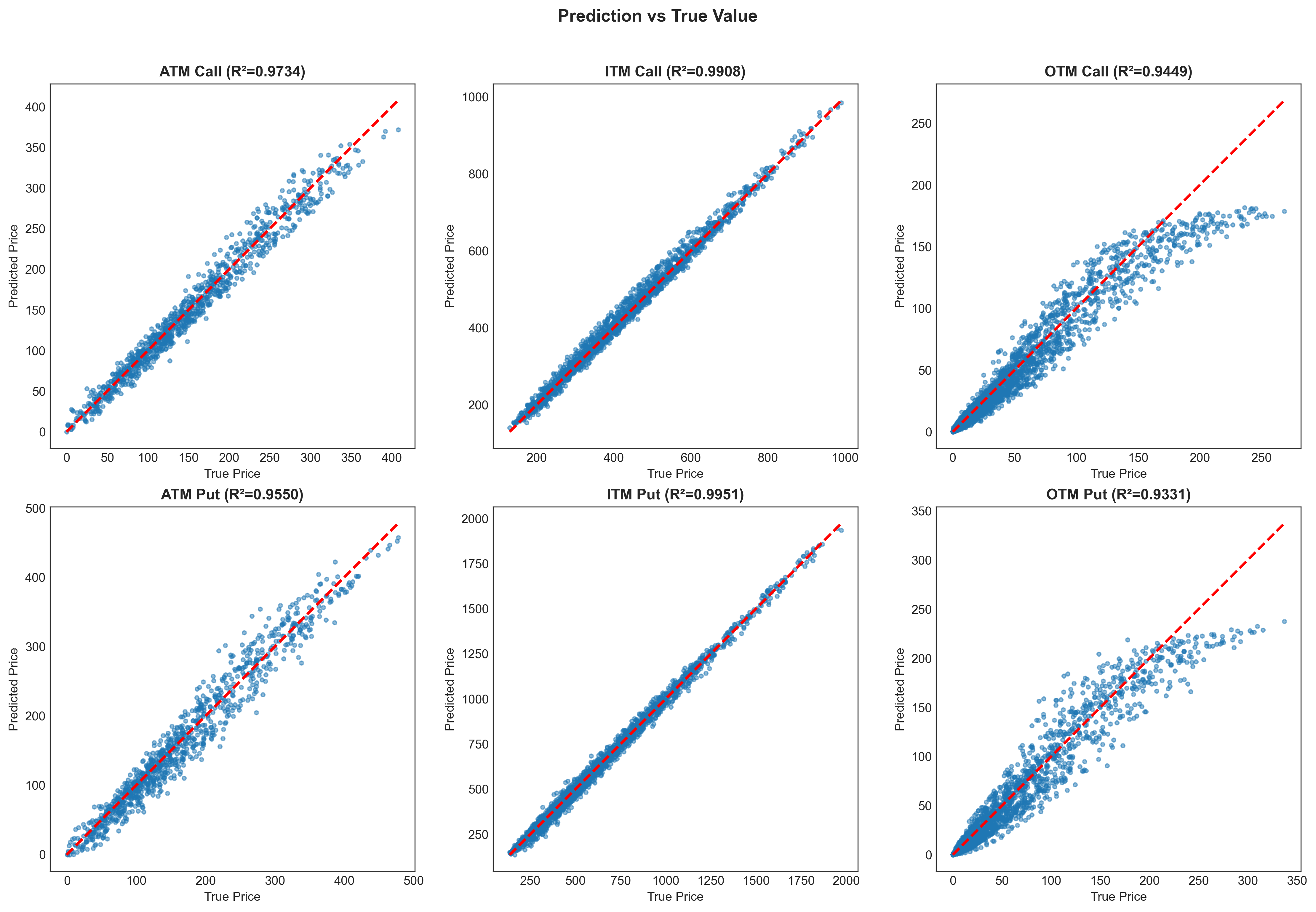

Traditional option pricing models struggle to capture the complexities of real-world market dynamics, often relying on simplifying assumptions like constant volatility. This paper, ‘Deep g-Pricing for CSI 300 Index Options with Volatility Trajectories and Market Sentiment’, addresses this limitation by introducing a deep learning framework that learns a nonlinear generator within a deep Forward-Backward Stochastic Differential Equation (FBSDE), incorporating both volatility trajectories and market sentiment. Empirical results demonstrate substantial improvements in pricing accuracy for CSI 300 index options, reducing Mean Absolute Error by 32.2% compared to the Black-Scholes-Merton model. By offering improved accuracy and interpretability-revealing asymmetric information advantages between call and put options-can this approach unlock more robust and nuanced financial engineering strategies?

The Illusion of Constant Volatility

The widespread adoption of the Black-Scholes-Merton (BSM) model in financial markets belies a fundamental simplification: the assumption of constant volatility. This core tenet, while mathematically convenient, clashes with the observed reality of fluctuating asset prices, where volatility itself is demonstrably dynamic. In practical terms, this means the BSM model struggles to accurately price options, particularly those extending further into the future or featuring complex structures. Market participants routinely witness periods of heightened and subdued volatility, conditions the BSM model cannot inherently reflect, leading to potential mispricing and, consequently, flawed risk assessments. While serving as a foundational tool, the model’s reliance on a static volatility measure ultimately restricts its effectiveness in capturing the nuanced behavior of real-world financial instruments.

The inherent simplification of constant volatility within traditional option pricing models disproportionately impacts options further out in time and those with more intricate structures. As the time to expiration increases, the potential for volatility to shift significantly grows, rendering the constant volatility assumption increasingly inaccurate. Similarly, options linked to multiple underlying assets, or those with non-standard payoff profiles-such as barrier or Asian options-are particularly sensitive to volatility mispricing because their value is intricately tied to the dynamic interaction of these factors. Consequently, the resulting price may deviate substantially from its theoretical value, exposing traders and institutions to unforeseen risks and hindering effective portfolio hedging strategies.

The accurate depiction of volatility’s dynamic behavior is paramount to both effective risk management and the establishment of fair pricing mechanisms within financial markets. Traditional models, while foundational, often struggle to reflect the real-world fluctuations inherent in asset prices, leading to potential miscalculations and increased exposure. Recognizing these limitations, a novel methodology has been developed to more precisely model volatility evolution. Initial results demonstrate a significant improvement in predictive accuracy, evidenced by a 32.2% reduction in Mean Absolute Error (MAE) when benchmarked against the widely used Black-Scholes-Merton model, suggesting a valuable advancement in option pricing and risk assessment capabilities.

Beyond Black-Scholes: A More Flexible Framework

The Forward-Backward Stochastic Differential Equation (FBSDE) framework represents an advancement in option pricing by relaxing the limitations of traditional models. Unlike the Black-Scholes model, which relies on assumptions of constant volatility and normally distributed returns, the FBSDE approach allows for pricing under more general conditions, including stochastic volatility and jumps in the underlying asset price. This is achieved by formulating the option price as the solution to a stochastic differential equation driven by both forward and backward components, enabling the incorporation of richer market dynamics and reducing reliance on restrictive theoretical assumptions. Consequently, the FBSDE framework provides a more robust and adaptable methodology for valuing options in complex and realistic financial environments.

Traditional option pricing models, such as Black-Scholes-Merton (BSM), rely on strong assumptions regarding asset price dynamics, including constant volatility and normally distributed returns. The FBSDE framework overcomes these limitations by decoupling option valuation from these restrictive assumptions. This decoupling is achieved through the formulation of a stochastic differential equation that allows for the direct incorporation of observed market information, such as implied volatility surfaces, and the implementation of more realistic stochastic volatility models – for example, the Heston model or SABR – without requiring analytical solutions or complex calibrations. Consequently, valuation can be performed under a wider range of market conditions and with greater accuracy, as the model adapts to the observed data rather than being constrained by pre-defined parametric forms.

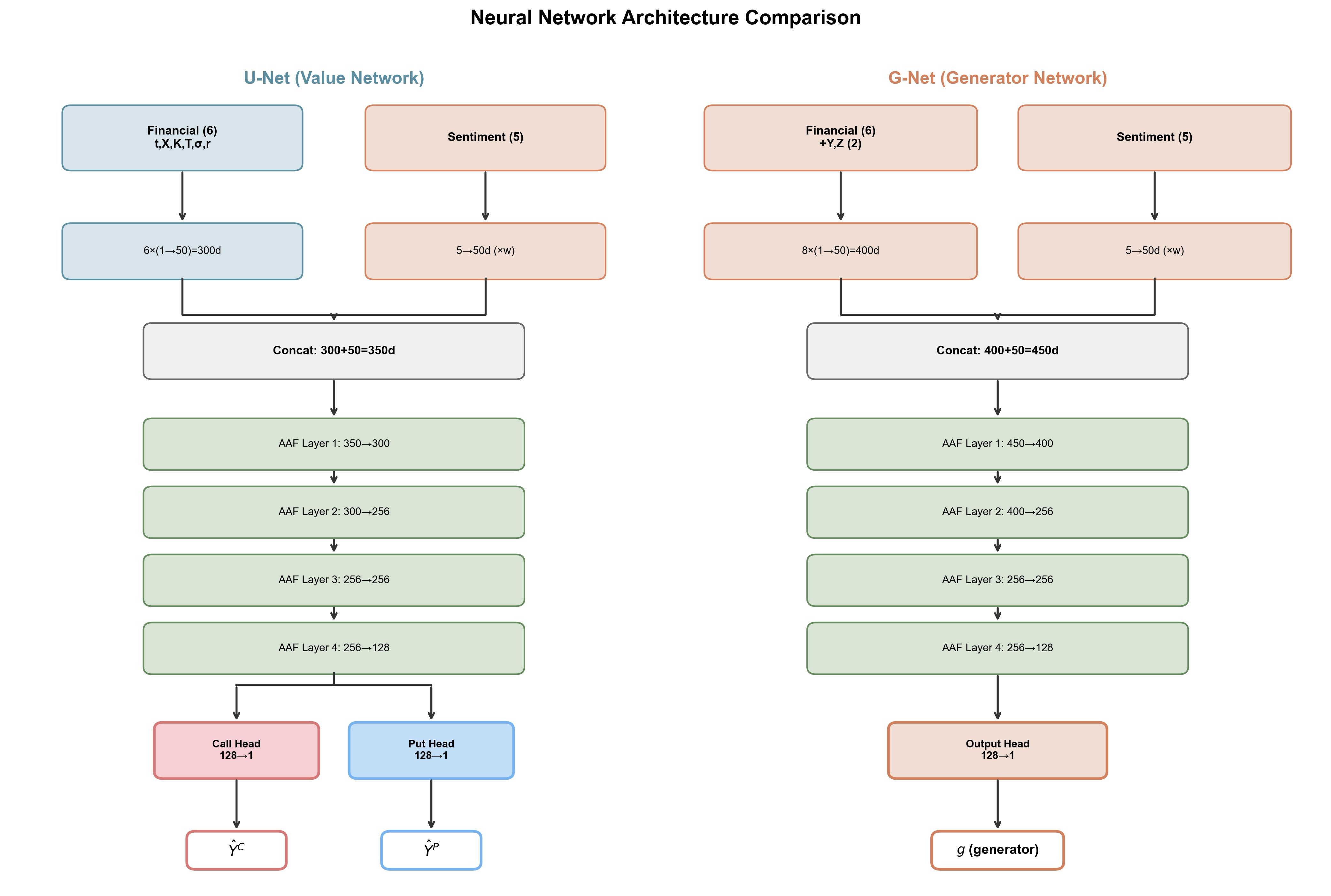

The Dual-Network Architecture is a core element of the FBSDE framework, functioning by simultaneously learning both the value of an option and the mechanisms driving its underlying asset price. This joint learning process improves valuation accuracy, demonstrated by a 35.3% reduction in Mean Absolute Percentage Error (MAPE) when benchmarked against the Black-Scholes-Merton (BSM) model. This performance gain indicates the Dual-Network Architecture’s capacity to more effectively capture complex pricing dynamics and reduce estimation errors inherent in traditional option pricing methods.

The Signal and the Noise: Harnessing Real-World Data

Incorporating realized volatility and market sentiment as input features enhances volatility forecasting by moving beyond historical price data. Realized volatility, calculated from high-frequency trading data, provides a measure of actual price fluctuations, while market sentiment, derived from sources like news articles and social media, captures investor psychology. These features are valuable because historical price data alone may not fully reflect the complex factors driving volatility. Specifically, realized volatility offers a contemporaneous measure of risk, and sentiment analysis can indicate potential shifts in market behavior before they are reflected in price changes. Combining these inputs allows the model to better capture both the magnitude and the direction of future volatility, resulting in a more robust and realistic assessment compared to models relying solely on historical prices.

The Sentiment Gating mechanism functions as an adaptive weighting system for realized volatility and market sentiment input features. This process dynamically adjusts the contribution of each signal based on its demonstrated predictive capability, determined through continuous evaluation of model performance. Specifically, the mechanism utilizes learned weights to prioritize signals exhibiting stronger correlations with future volatility, effectively downplaying the influence of less reliable indicators. This adaptive fusion allows the model to react to changing market conditions and improve the accuracy of volatility predictions by focusing on the most relevant data at any given time.

Incorporating a volatility trajectory as an input feature enables the model to forecast future volatility patterns, resulting in improved option pricing accuracy. Specifically, this approach demonstrably reduced the rate of extreme errors – defined as a Mean Absolute Percentage Error (MAPE) exceeding 100% – from 11.51% to 0.77% when applied to Out-of-the-Money (OTM) options. This significant reduction in extreme error rates indicates a substantial improvement in the model’s ability to accurately price OTM options by leveraging historical volatility trends to predict future movements.

Beyond Prediction: Understanding the ‘Why’

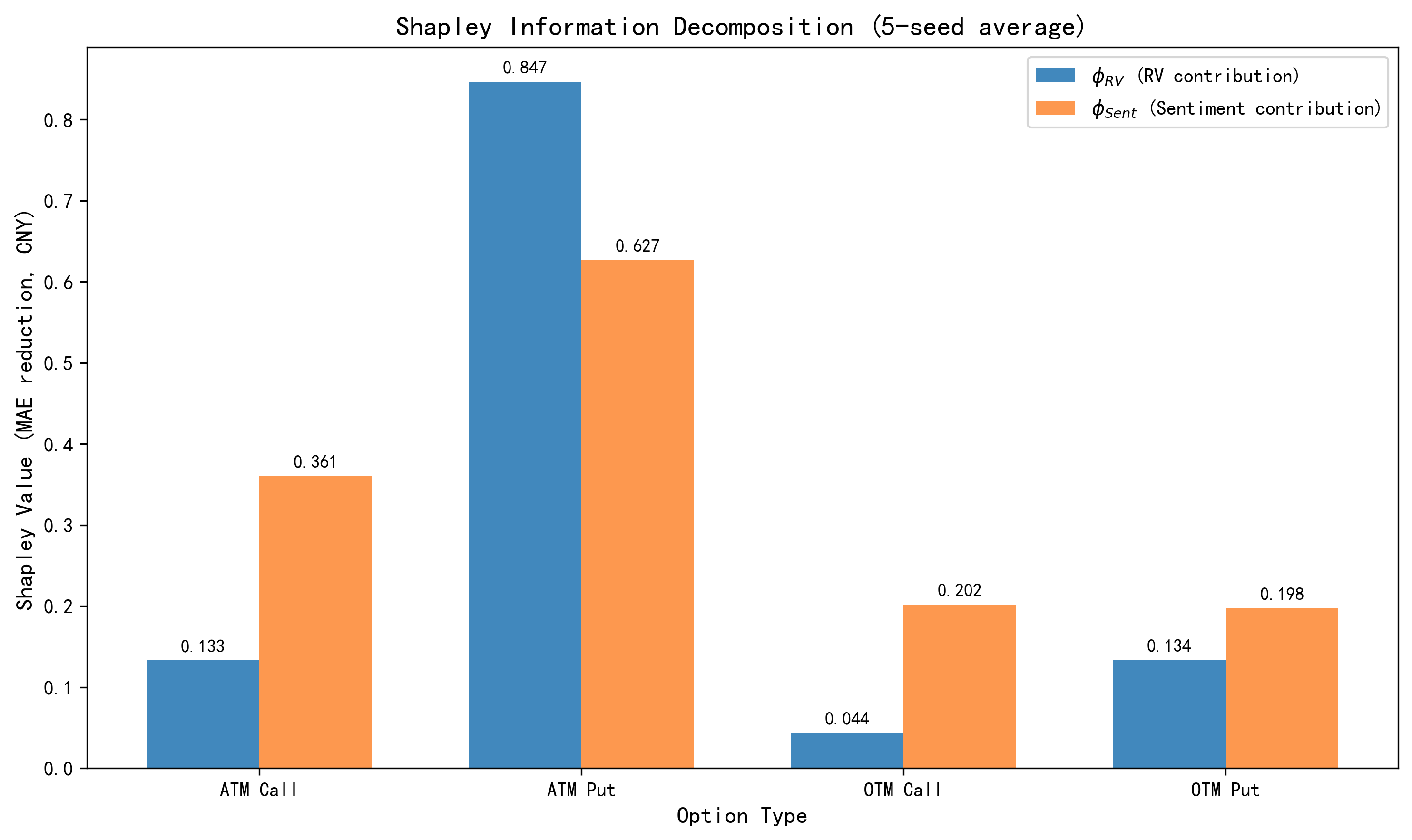

The predictive power of option pricing models is increasingly complemented by techniques that illuminate why a particular price is generated. Employing interpretability methods, such as Shapley Value and Integrated Gradients, allows for the decomposition of a model’s output – the option price – into the marginal contribution of each input feature. These methods don’t simply predict; they quantify the influence of variables like underlying asset price, time to expiration, and implied volatility on the final price. Shapley Value, rooted in game theory, calculates the average marginal contribution of a feature across all possible feature combinations, providing a fair assessment of its importance. Integrated Gradients, conversely, measures the cumulative effect of a feature by integrating the gradients of the prediction with respect to that feature along a path from a baseline input. This detailed attribution enables stakeholders to understand the model’s reasoning, verify its consistency with financial theory, and ultimately build confidence in its predictions.

The ability to dissect and understand the reasoning behind a predictive model’s output is paramount, particularly within the complex financial landscape of option pricing. Without this transparency, models remain ‘black boxes’, hindering acceptance and potentially masking critical flaws. A lack of interpretability can obscure unintended biases learned from historical data, leading to systematically inaccurate or unfair pricing. Furthermore, identifying the specific features driving price predictions allows for rigorous validation; if a model relies heavily on spurious correlations rather than fundamental market dynamics, it signals a need for refinement. This level of scrutiny not only builds confidence in the model’s reliability, but also enables proactive error detection and mitigation, ultimately fostering responsible and trustworthy applications of artificial intelligence in financial markets.

A deeper comprehension of the factors influencing option pricing empowers market participants to refine their strategies and bolster risk management protocols. Recent analysis demonstrates a pronounced sensitivity to distinct inputs depending on the option type; specifically, market sentiment emerges as the dominant driver – contributing 90.7% – in predicting the price of at-the-money (ATM) call options. Conversely, the trajectory of volatility exerts a comparatively stronger influence on ATM put option pricing, accounting for 60.9% of the predicted value. This nuanced understanding, facilitated by explainable AI, allows traders to move beyond purely quantitative models and incorporate qualitative factors, leading to more informed investment decisions and a more accurate assessment of potential losses.

The pursuit of elegant pricing models, as demonstrated in this deep learning framework for CSI 300 options, invariably invites future complications. The model’s reliance on volatility trajectories and market sentiment, while achieving demonstrable accuracy, merely shifts the source of potential error-from theoretical assumptions to the quality of the input data. As Mary Wollstonecraft observed, “It is time to try the weight of masculine argument, and see if it can stand the test of reason.” This rings true; the model appears rational, yet its predictive power is fundamentally reliant on the messy, irrational behavior of the market – a debt accruing with every tick of the exchange. The promise of explainable AI, while laudable, will inevitably face the burden of explaining why the system failed when production inevitably breaks it.

What’s Next?

The pursuit of option pricing perfection, now augmented by deep learning and sentiment analysis, predictably reveals not an end, but a more elaborate set of edge cases. This work, while demonstrating improved accuracy within the CSI 300, merely refines the illusion of control. Production systems, inevitably, will encounter exotic derivatives, unexpected market shocks, and data quality issues that expose the limitations of even the most elegantly constructed neural networks. The ‘explainable AI’ component feels particularly optimistic – as if understanding why a model misprices an option will somehow prevent it from doing so.

Future iterations will likely focus on incorporating alternative data sources – social media trends, news articles, satellite imagery of parking lot sizes, who knows? – in a desperate attempt to anticipate the unpredictable. The framework itself will become more complex, layering reinforcement learning on top of deep FBSDEs, until it resembles a Rube Goldberg machine designed to calculate a single price. One suspects the original Black-Scholes, with a few hand-tuned parameters, will remain stubbornly relevant for its simplicity.

Ultimately, this research, like so much financial engineering, is a sophisticated exercise in managing uncertainty, not eliminating it. It’s the old thing, really – statistical arbitrage with worse documentation and a higher electricity bill.

Original article: https://arxiv.org/pdf/2601.18804.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

2026-01-28 13:24