For three years now, the markets have been animated by the promise of artificial intelligence – a fever dream of automated decision-making, a technological leap forward that, like so many before it, has captured the collective imagination. A multitrillion-dollar opportunity, they proclaim. A cascade of long-term winners. Yet, one is compelled to observe that such pronouncements, uttered with such certainty, often obscure the inherent fragility of these nascent fortunes.

While Nvidia rightly occupies the public face of this revolution, the ascent of Palantir Technologies warrants closer scrutiny. A remarkable rally, indeed. Since the beginning of 2023, shares have ascended with a velocity that borders on the unsustainable, adding some $400 billion to its market capitalization. For a fleeting moment, it stood among the twenty most valuable companies traded on these exchanges. A spectacle, to be sure, but one that invites a necessary question: at what cost, and for how long?

The danger with such ascents is not merely that they are unsustainable, but that they foster a delusion of invincibility. Palantir possesses clear advantages – advantages I shall address presently – yet historical precedent whispers a cautionary tale. The markets, like nature, abhor a vacuum, and the excesses of any boom are inevitably followed by a reckoning.

The Illusion of Irreplaceability

Investors have focused, understandably, on the infrastructure supporting this AI surge. But Palantir has positioned itself not as a builder of the foundations, but as a surveyor and interpreter of the terrain. Its two core platforms, Gotham and Foundry, are often lauded as irreplaceable. And, to a degree, this is true. But the term ‘irreplaceable’ carries a weight, a promise of perpetual dominion, that few, if any, enterprises can truly deliver.

Gotham, the elder sibling, currently sustains the enterprise. It serves the U.S. military and allied intelligence agencies, providing the tools for planning and overseeing operations. Contracts of four to five years duration offer a degree of predictability, a respite from the turbulent currents of the market. Yet, to rely solely on the patronage of state power is to accept a fundamental constraint, a dependence that can, in time, become a vulnerability.

Foundry, the younger platform, holds the promise of broader application, assisting businesses in streamlining operations and optimizing data analysis. The growth in commercial customers – a 49% increase year-over-year – is encouraging. But it is crucial to remember that subscription-based models, while offering recurring revenue, are not immune to the vicissitudes of economic circumstance. A downturn, a shift in priorities, can swiftly erode even the most loyal customer base.

Palantir’s balance sheet, replete with over $6.4 billion in cash and marketable securities, is undoubtedly a source of strength. The absence of debt provides a degree of maneuverability, allowing for stock buybacks and continued innovation. But such financial reserves, while comforting, should not be mistaken for an impenetrable shield. Capital, like any resource, can be dissipated, misallocated, or simply rendered inadequate in the face of unforeseen challenges.

The Echoes of Past Delusions

History, of course, offers no guarantees. To predict the future based on past events is a perilous undertaking. Yet, to ignore the lessons of the past is to condemn oneself to repeat them. Two historical parallels, in particular, warrant consideration.

The first concerns the nature of ‘next big thing’ investment trends. The internet, the dot-com boom, biotechnology – each has been heralded as a transformative force, a catalyst for unprecedented wealth creation. Yet, each has also been accompanied by a period of irrational exuberance, a speculative frenzy that ultimately gave way to disillusionment. The adoption of innovation is rarely linear. There is always a learning curve, a period of experimentation and refinement. Investors, time and again, overestimate the rate at which these processes unfold.

AI hardware sales are robust, yes. But the ability to generate positive returns on investment requires more than simply acquiring the tools. It demands a fundamental shift in business processes, a willingness to embrace new paradigms. We are, at present, years away from realizing the full potential of this technology. And a prolonged period of underperformance will inevitably erode investor confidence.

The second historical issue is the matter of valuation. Even acknowledging the inherent subjectivity of assessing a public company, history offers a stark warning. During the dot-com bubble, companies at the forefront of the internet revolution routinely traded at price-to-sales ratios of 30 to 45. Such valuations, while unsustainable, were tolerated for a time. But the bubble eventually burst, and those who had indulged in speculative excess paid a heavy price.

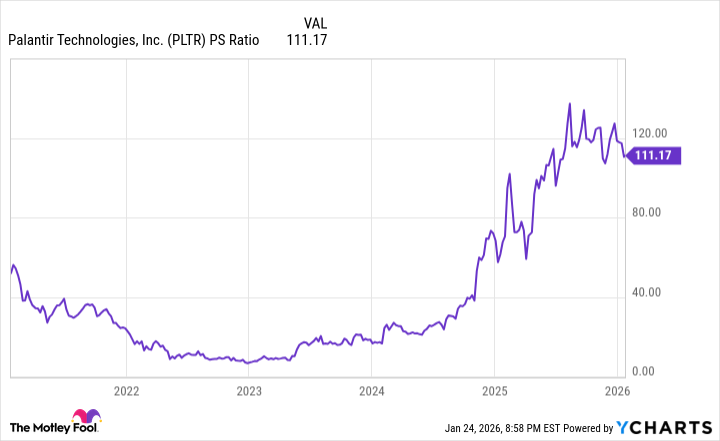

As of January 23rd, Palantir traded at a price-to-sales ratio of 111. Nearly four times the level that historically signals a forthcoming correction. Even with consistent sales growth, there is no justification for such a premium. It is a testament to the power of narrative, the allure of the ‘next big thing.’ But it is also a dangerous delusion.

Based on the evidence, Palantir stock appears poised for a reckoning. A correction, a recalibration, a return to a more sustainable valuation. The markets, like justice, may be slow, but they are ultimately inexorable. The time for prudent assessment is now.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Gold Rate Forecast

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Gold Bugs & Shiny Rocks: A Feller’s Guide

- A Spot of Trouble in the Markets?

2026-01-28 12:13