It is a truth universally acknowledged, that a speculative market must be in want of a novelty. And in the past year, none has captured the imaginations – and, alas, the fortunes – of investors quite so thoroughly as the promise of quantum computing. While artificial intelligence, long esteemed for its potential, found itself momentarily eclipsed by this newer, more elusive prospect. The recent, rather extraordinary, ascent of companies such as IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. has been a spectacle to behold, a veritable whirlwind of gain that has left many with expectations, shall we say, exceeding prudence.

Indeed, the returns witnessed – figures reaching heights previously reserved for the most audacious of ventures – have inspired a degree of enthusiasm bordering on the imprudent. The fear of being left behind, that most unsettling of sentiments, has driven many a gentleman – and, increasingly, a lady – to commit their resources to this most uncertain of pursuits. But as with all such excitements, a more sober assessment is required. It is a regrettable truth that the path to genuine prosperity is rarely so swift, and often beset with unforeseen difficulties.

Let us, therefore, examine the situation with a degree of circumspection. Three considerations, it seems to me, ought to give pause to those contemplating a further investment in these quantum enterprises.

The Elusive Promise of Practical Application

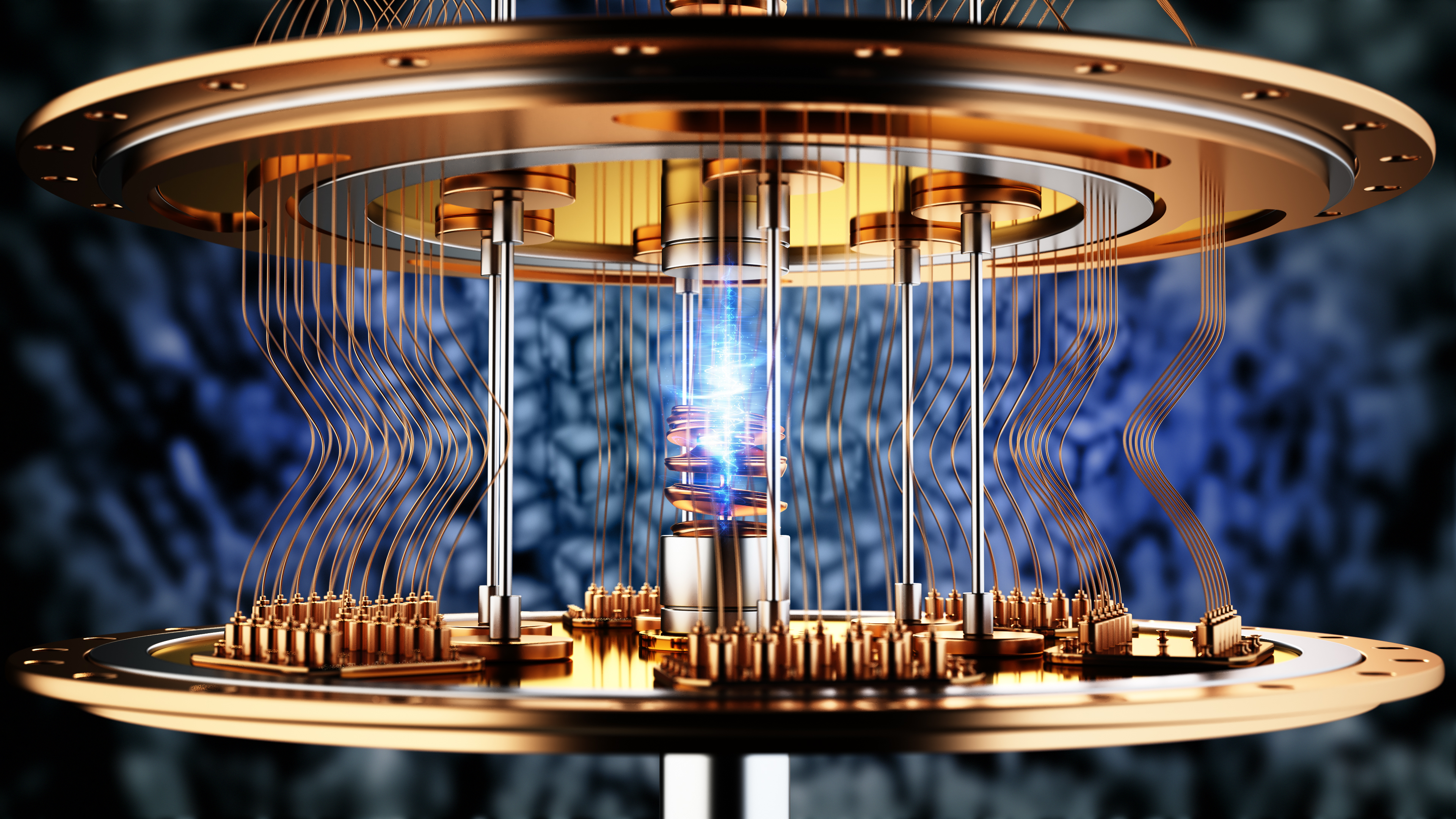

The very notion of a computer capable of solving problems beyond the reach of its classical counterparts is, of course, captivating. These machines, it is said, will unlock new possibilities in fields ranging from artificial intelligence to weather forecasting, even to the refinement of medicinal compounds. The Quantum Insider, a publication dedicated to these matters, estimates a potential economic value exceeding a trillion dollars by 2035. A sum, it must be admitted, that is rather difficult to comprehend.

Quantum Computing 1 Year Returns 🤯$RGTI +6,217% $QBTS +3,912%$QUBT +2,798%$IONQ +670%

Connor Bates (@ConnorJBates_) October 13, 2025

However, it is one thing to envision such grand possibilities, and quite another to realize them. The development of any truly revolutionary technology requires not merely ingenuity, but time, and a considerable expenditure of capital. These companies – IonQ, Rigetti, D-Wave, and Quantum Computing Inc. – are, as yet, in the very early stages of commercializing their innovations. While they have secured some initial contracts – notably with the cloud services of Amazon and Microsoft – these are but modest beginnings. The prospect of a practical, cost-effective quantum computer remains, alas, some years distant. It is a truth that the market, in its eagerness, appears to have overlooked.

The Necessity of Sustenance

A young enterprise, however promising, requires a steady flow of resources to maintain its operations. It is a truth that many a hopeful venture has foundered for want of adequate funding. These quantum companies, lacking the established revenues of more mature businesses, find themselves reliant upon external investment. And, in the current climate, that investment comes at a price.

While one should not censure the management teams for seeking to raise capital – indeed, it would be imprudent to do so – the consequences of such actions must be carefully considered. The recent issuance of shares and warrants, while providing a much-needed influx of funds, has inevitably diluted the holdings of existing shareholders. IonQ, Rigetti, D-Wave, and Quantum Computing Inc. collectively raised a considerable sum – over four billion dollars – in the past year. A sum that, while impressive, comes with a corresponding increase in the number of shares outstanding. The warrants issued, in particular, represent a potential ceiling on future share price appreciation. A delicate matter, indeed.

The Inevitable Competition

The ease with which one may enter the field of quantum computing is, perhaps, its most unsettling characteristic. While IonQ, Rigetti, and D-Wave have enjoyed a first-mover advantage, that advantage is unlikely to endure. The established giants of the technological world – those businesses with the resources and the expertise to dominate any market – are beginning to take notice.

The “Magnificent Seven,” as they are known, are not accustomed to being left behind. These companies – Alphabet, Microsoft, and their peers – have the capital and the ambition to invest in any promising innovation. And they have, in fact, begun to do so. Alphabet’s Willow processing unit and Microsoft’s Majorana 1 QPU are but early indications of their intentions. These established businesses, with their foundational operating segments, are in a far stronger position to compete than the fledgling quantum companies. It is a truth that the first-mover advantage, so prized in the modern marketplace, is often a fleeting one.

Thus, while the promise of quantum computing remains alluring, a degree of caution is warranted. The path to prosperity is rarely so swift, and often beset with unforeseen difficulties. A prudent investor would do well to consider these matters before committing their resources to this most uncertain of ventures.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- TSMC & ASML: A Most Promising Turn of Events

- Ephemeral Engines: A Triptych of Tech

- A Prudent Man’s Treasury

- Altria: A Comedy of Errors

2026-01-28 11:52