Let’s talk about Tesla. Not the car, precisely, but the idea of Tesla. It’s a fascinating thing, isn’t it? A company that, for a while, seemed to operate on a different plane of reality, defying conventional automotive economics. Now, it appears to be pivoting, shall we say, with the grace of a startled wombat. Two years of declining unit sales will do that to a strategic objective, you see. It’s a bit like trying to navigate a spaceship using only a map of the Isle of Wight – theoretically possible, but unlikely to end well.

The current focus is autonomy. Robotaxis, specifically. And Optimus, the humanoid robot. Investors, bless their optimistic hearts, have bought into the vision. A market cap approaching $1.5 trillion despite… well, let’s just say “challenges” in the growth and profit margin departments. It’s a testament to the power of a compelling narrative. Or perhaps, a collective suspension of disbelief. (It’s often difficult to tell the difference, especially when dealing with numbers of that magnitude.)

But here’s where things get interesting. Because while everyone’s gazing at Elon Musk’s latest pronouncements, a rather less flamboyant contender has been quietly assembling a rather impressive robotic portfolio. I speak, of course, of Boston Dynamics. A name that doesn’t quite roll off the tongue with the same electric charge as ‘Tesla,’ but a company that, arguably, is further ahead in the actual building of robots. And it was valued at a mere $1 billion just five years ago. Which, in the grand scheme of things, is less than the cost of a particularly extravagant cup of coffee if you add up all the zeros. (Or, you know, a small island nation. Depends on your perspective.)

Hyundai Motor Group, in a move that now looks remarkably prescient, acquired an 80% stake in Boston Dynamics from Softbank back in June 2021. A bargain, some might say. A steal, even. (Though ‘steal’ is a rather loaded term when dealing with billions of dollars. It implies a certain level of…impropriety. Let’s just say it was a shrewd investment.)

What You Should Know About Boston Dynamics

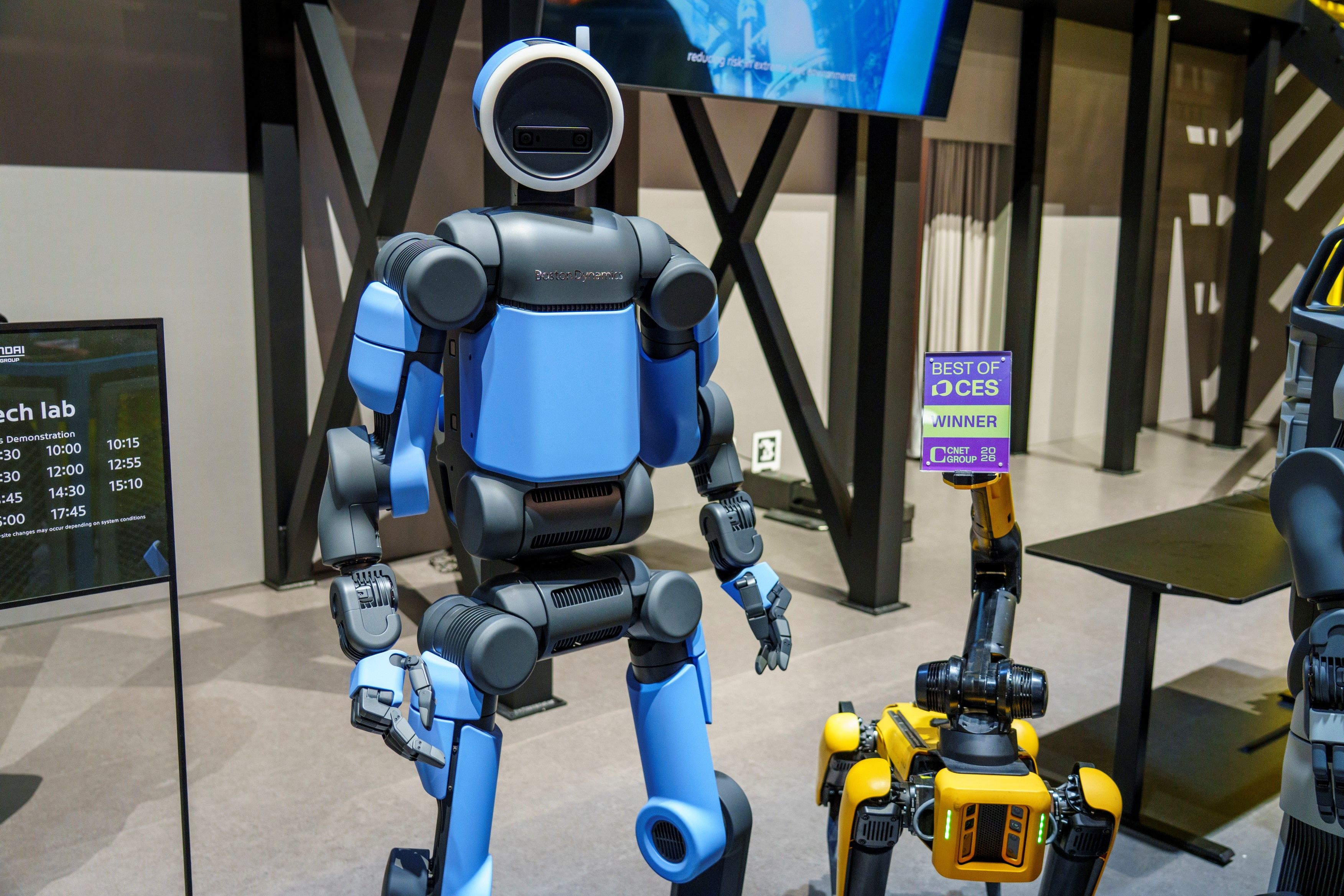

You’ve probably seen the videos. Spot, the quadrupedal robot that looks suspiciously like a robotic dog. Stretch, designed to move boxes in warehouses (a task that, let’s face it, is profoundly depressing for humans). And Atlas, the humanoid robot that can now, apparently, do parkour. (Parkour. For a robot. The sheer improbability of it all.) Atlas recently snagged the “Best Robot” award at CES, impressing the judges with its “naturalistic walking gait.” It’s preparing to be deployed in Hyundai manufacturing facilities, which means your next car might be assembled by a robot named Atlas. Which, when you think about it, is rather poetic.

Is the Boston Dynamics Atlas Better Than the Tesla Optimus?

That’s a question that keeps analysts up at night, fuelled by copious amounts of caffeine and existential dread. Neither robot is currently on the market, making a direct comparison rather difficult. But Boston Dynamics is poised to be first to market, with plans for tens of thousands of Atlas robots to populate Hyundai factories. And they’ve partnered with Google DeepMind to integrate foundation models into Atlas. (Which sounds terrifyingly powerful. Like a robot with a PhD in everything.)

At this point, the consensus is that Atlas has an edge in mobility and agility. Tesla bulls may tout their AI and software capabilities, but it’s unclear if that translates into a tangible advantage. (After all, a brilliant algorithm is useless if the robot can’t actually walk.)

It’s becoming increasingly clear that Tesla has some serious competition in the humanoid robotics space. And there’s a strong argument to be made that they’re currently behind. (Which, in the fast-moving world of robotics, is a significant disadvantage.)

And let’s not forget: Boston Dynamics was valued at just $1.1 billion five years ago. Which means either investors are wildly overvaluing Tesla’s Optimus, or Hyundai got an incredible deal. (The laws of economics, it seems, are often suspended when dealing with robots and electric cars.)

What It Means for Hyundai

Hyundai Motor Group, which includes Kia and Genesis, is currently the world’s third-largest automaker, trailing only Toyota and Volkswagen. They’re also the third-largest EV maker, thanks to the success of the Ioniq line. (A remarkable achievement, considering the fierce competition in the electric vehicle market.)

If Hyundai were a U.S.-listed stock, it would likely be attracting a lot more attention from investors. But it’s listed in South Korea, which means you either have to purchase it over-the-counter or through a brokerage that allows investing in the Korea Exchange. (A minor inconvenience, perhaps, but a barrier to entry nonetheless.)

Hyundai currently has a market cap of roughly $90 billion and trades at a price-to-earnings ratio of just 12. For a company that’s emerging as a leader in autonomous robots and is a top producer of both combustion and electric vehicles, that looks like a bargain price. (A ridiculously good bargain, even. One might even suspect foul play. But let’s not go there.)

Rather than pay a sky-high premium for Tesla, Hyundai offers exposure to a strong and growing auto manufacturer with a thriving robotics business at an excellent price. (It’s a bit like choosing a sensible pair of shoes over a rocket-powered unicycle. Both will get you there, but one is significantly less likely to result in catastrophic failure.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

- Enduring Yields: A Portfolio’s Quiet Strength

2026-01-28 07:52