Author: Denis Avetisyan

New research demonstrates how machine learning, particularly neural networks and optimized control, can significantly enhance the efficiency and risk management of corporate share repurchase initiatives.

This paper presents a unified framework for optimal share repurchase program design and deep hedging, incorporating realistic trading constraints and advanced risk measures.

Successfully executing share repurchase programs presents a challenge due to the complexities of hedging market exposure while adhering to realistic trading constraints. This paper, ‘Optimal strategy and deep hedging for share repurchase programs’, introduces a novel machine learning framework leveraging neural networks to jointly optimize execution and hedging strategies for these programs. The resulting policy demonstrably improves performance by accounting for actual trading capabilities and utilizing risk measures for indifference pricing, offering a feasible and realistic approach. Could this unified treatment of execution and risk management unlock further efficiencies in corporate finance and algorithmic trading strategies?

The Illusion of Control in Asset Repurchase

Conventional asset repurchase agreements (repos) frequently employ static models-mathematical representations that assume consistent market conditions-creating vulnerabilities in rapidly changing financial landscapes. These static approaches fail to account for shifts in interest rates, credit risk, or market liquidity, potentially leading to inaccurate collateral valuations and increased counterparty risk. Consequently, financial institutions relying on these models may underestimate their exposure to losses, especially during periods of market stress or unexpected economic events. The inherent rigidity of static models limits their effectiveness in proactively managing risk and adapting to the dynamic interplay of factors influencing repurchase agreement transactions, ultimately increasing the potential for financial instability.

Successfully navigating the complexities of asset repurchase demands more than just predicting market trends; it necessitates a sophisticated grasp of volatility’s inherent unpredictability. Financial instruments are rarely static, and their risk profiles shift continuously, requiring repurchase and hedging strategies to be equally fluid. Rather than relying on pre-defined schedules, adaptive approaches monitor real-time market data, factoring in variables like implied volatility and correlation to dynamically adjust the timing and volume of repurchases. This allows for a more precise calibration of hedging instruments, mitigating exposure to sudden price swings and reducing the potential for substantial financial losses. The capacity to respond to evolving conditions, rather than react to them, is therefore crucial for maintaining portfolio stability and maximizing returns in today’s volatile financial landscape.

Current financial models often treat asset repurchase and hedging as separate, sequential processes, creating a critical vulnerability in dynamic markets. This disconnect prevents a holistic optimization of risk management, frequently resulting in strategies that minimize immediate repurchase costs while inadvertently increasing overall financial exposure. The inherent trade-off between these two functions-reducing repurchase price versus mitigating potential losses-demands a simultaneous approach, yet existing methodologies typically lack the capacity to balance these competing priorities effectively. Consequently, institutions face suboptimal outcomes, including unnecessarily high hedging costs, missed opportunities for favorable repurchase timing, and a heightened susceptibility to significant financial losses during periods of market volatility. This limitation underscores the need for innovative frameworks capable of integrating repurchase and hedging decisions into a unified, dynamically adjusted strategy.

Intelligent Repurchase: The Emergence of Adaptive Strategies

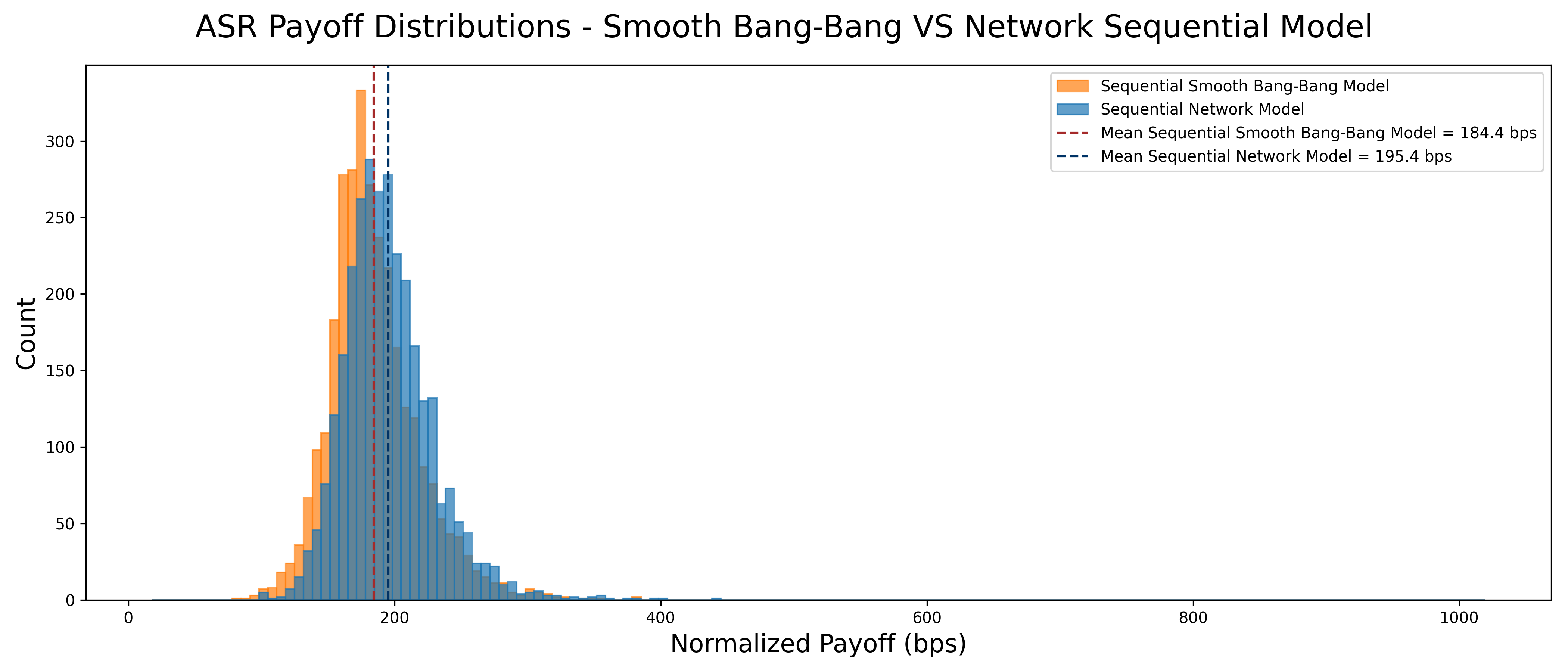

Traditional repurchase policies often rely on pre-defined rules or reactive adjustments to market changes. A neural network-based dynamic repurchase policy addresses these limitations by leveraging machine learning to continuously adapt to evolving market conditions. This approach utilizes algorithms capable of identifying complex, non-linear relationships within financial data, enabling more precise and timely repurchase decisions than rule-based systems. The neural network learns from historical data, incorporating variables such as price movements, trading volume, and order book dynamics, to predict future market behavior and optimize repurchase strategies accordingly. This adaptability allows for a proactive, rather than reactive, approach to repurchase, potentially improving execution prices and reducing transaction costs.

The Neural Network Policy functions by incorporating current market signals – including price fluctuations, volume, and order book data – alongside comprehensive risk assessments derived from volatility metrics, correlation analyses, and historical performance. These inputs are processed by a trained neural network to generate repurchase decisions at discrete time intervals. The network’s architecture enables simultaneous evaluation of multiple variables, allowing it to identify complex relationships and predict optimal repurchase quantities that minimize execution costs and maximize returns, effectively operating in real-time based on constantly updated data streams. This differs from rule-based systems by dynamically adjusting to changing conditions without requiring manual recalibration.

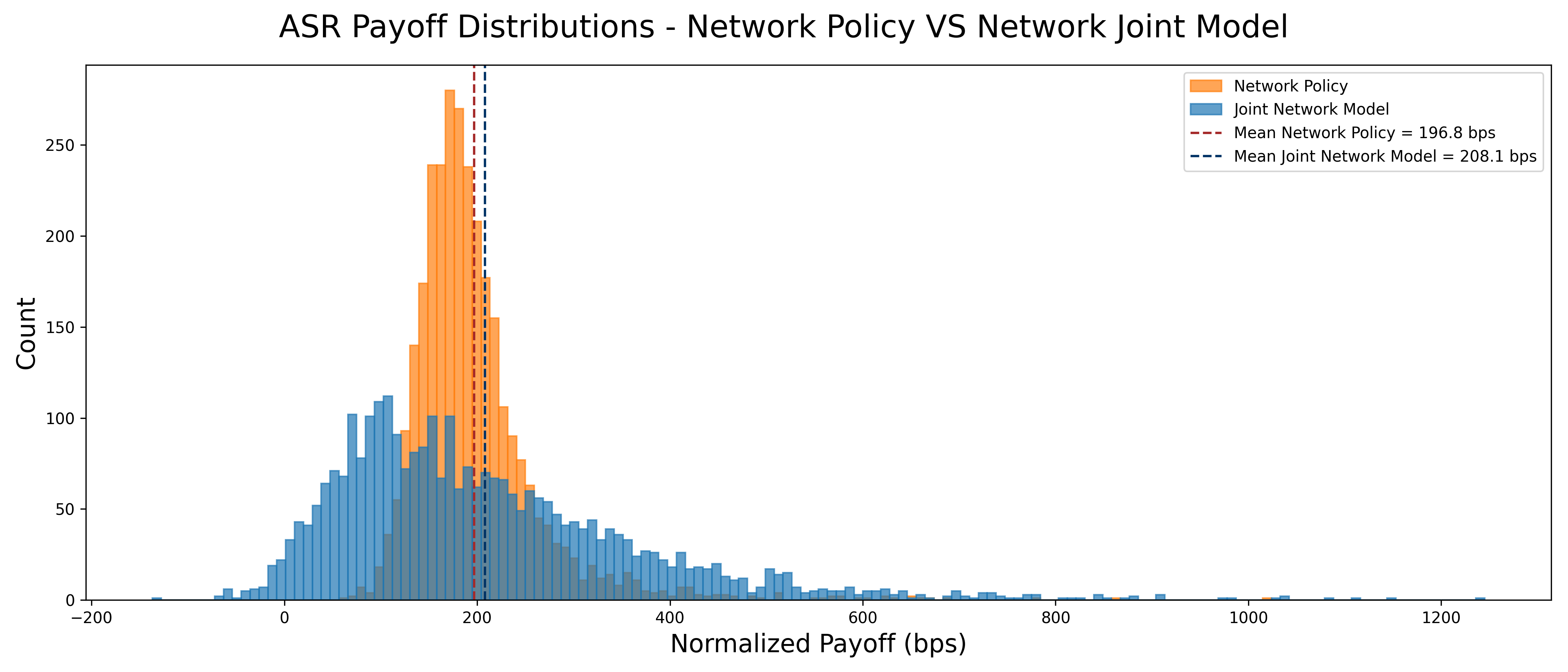

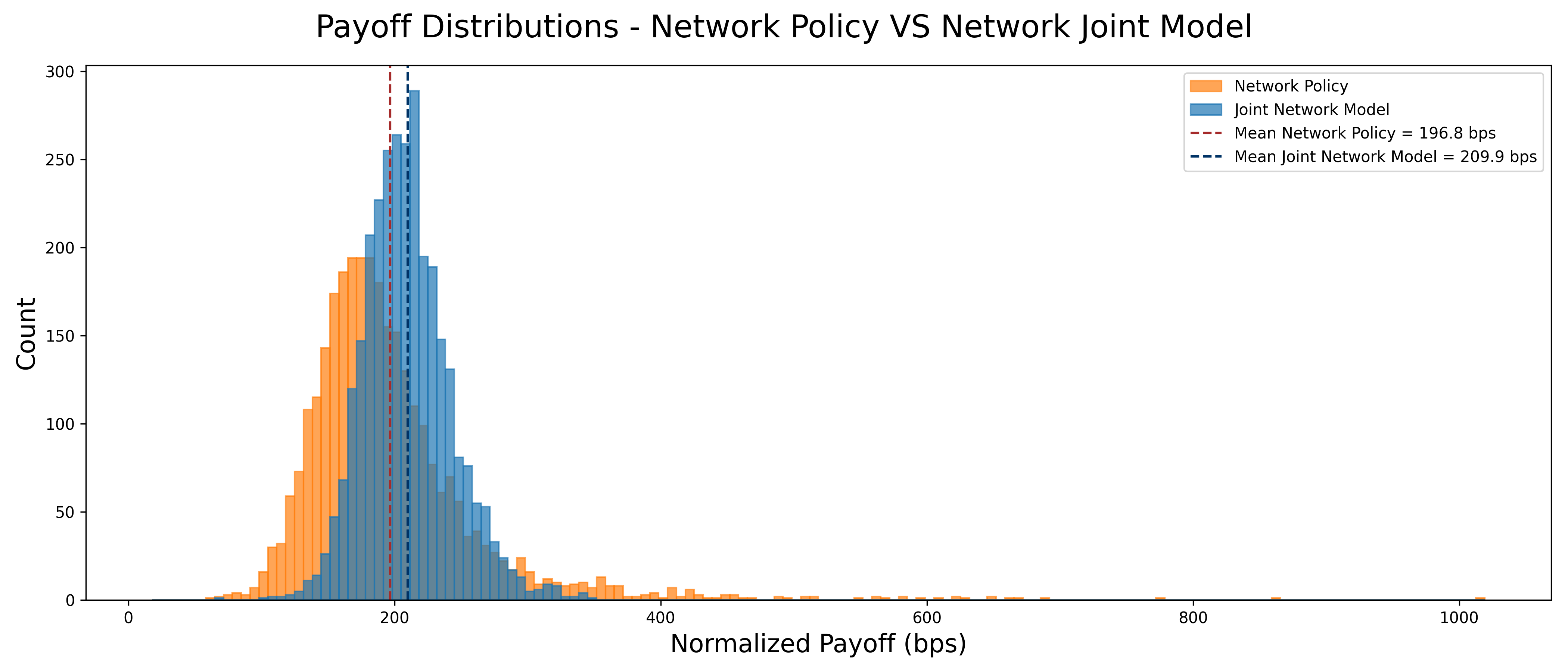

Traditional repurchase strategies often employ sequential hedging, wherein risk parameters are assessed and hedging actions are implemented in discrete steps. This contrasts with the neural network framework which performs simultaneous optimization; instead of sequentially reacting to market changes, the network integrates multiple variables – including real-time market signals and risk assessments – within a unified computational process. This allows for the identification of optimal repurchase decisions across the entire hedging space concurrently, leading to potentially more efficient and responsive risk management compared to the step-by-step approach of sequential hedging. The simultaneous nature minimizes latency and enables the network to capitalize on subtle market dynamics that might be missed by sequential methods.

Grounding Repurchase in Statistical Reality

Integration of the Black-Scholes Model and Indifference Pricing into the ASR Contract framework provides a statistically grounded approach to valuation and risk assessment. The Black-Scholes Model, traditionally used for option pricing, allows for the determination of a fair value for the ASR component based on underlying asset price, volatility, risk-free rate, and time to maturity. Indifference Pricing then establishes a price at which the issuer is indifferent between issuing the ASR contract and alternative financing options, effectively creating a benchmark for the contract’s economic terms. This combination yields a robust valuation methodology by incorporating market-derived pricing with the issuer’s cost of capital, facilitating more accurate risk management and contract structuring. The resulting framework allows for the calculation of sensitivities, such as delta and gamma, providing insights into the contract’s price behavior under varying market conditions.

The incorporation of a Greenshoe Option into the ASR contract model accounts for over-allotment by the underwriters, allowing for the issuance of additional shares to cover short positions arising from the initial offering; this feature improves model accuracy by reflecting real-world offering practices. Simultaneously, the consideration of trading constraints – such as limitations on repurchase volumes or frequency, and transaction costs – enhances the model’s applicability to complex financial scenarios by acknowledging practical limitations faced by financial institutions. These constraints prevent unrealistic optimal strategies and ensure the model’s output aligns with feasible implementation, resulting in more reliable valuation and risk assessment under realistic market conditions.

The Bellman Equation provides a recursive approach to solving dynamic programming problems inherent in ASR contract modeling. Specifically, it allows for the determination of an optimal repurchase and hedging strategy by maximizing the expected value of future cash flows at each point in time. This involves defining a value function V(S_t) representing the maximum expected value attainable given the current state S_t of the contract, and then iteratively solving for this function using the Bellman optimality principle. The equation considers all possible actions – repurchase quantities and hedging instruments – and selects the action that yields the highest expected value, effectively establishing a policy for dynamically adjusting these strategies in response to changing market conditions and contract parameters. This contrasts with static hedging approaches and enables a more nuanced and potentially more efficient risk management framework.

Joint Hedging: A Shift Towards Holistic Risk Management

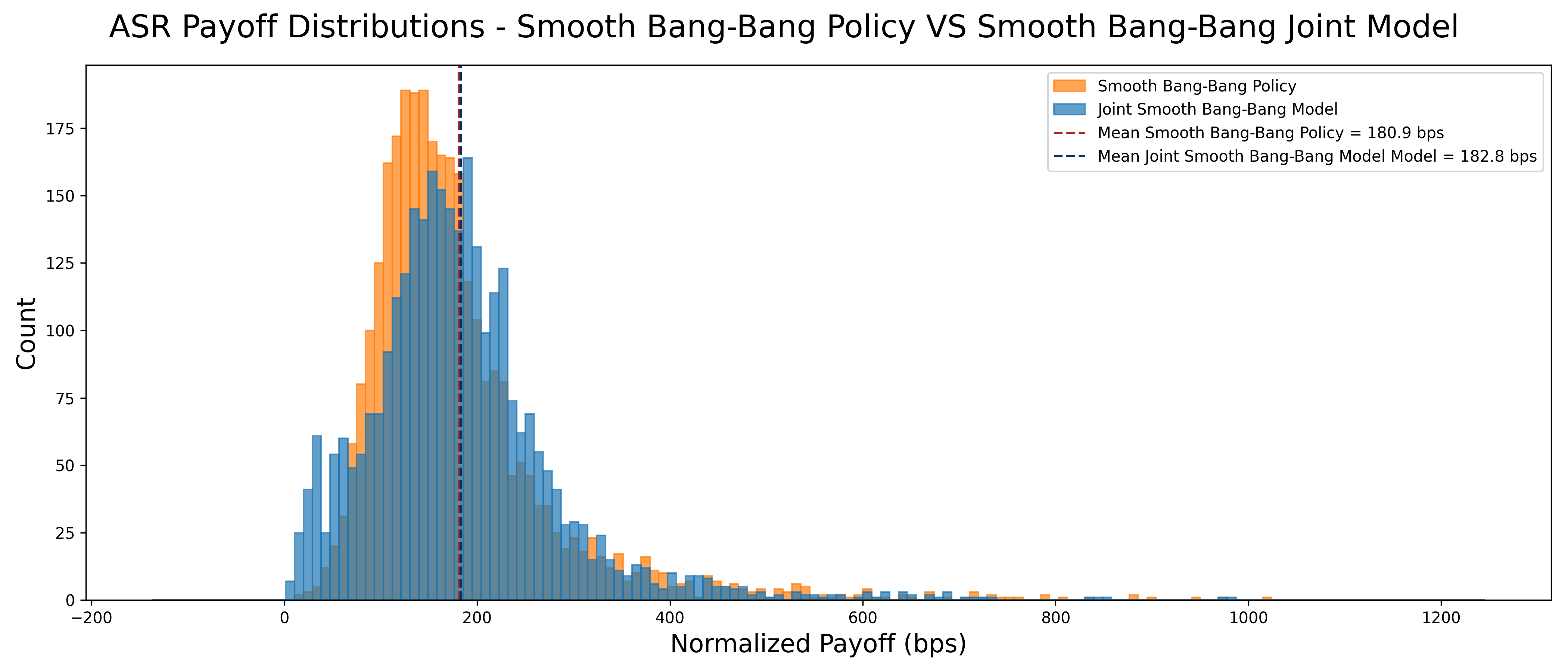

Traditional financial strategies often treat repurchase agreements and hedging as separate processes, potentially leading to suboptimal outcomes. The Joint Hedging approach, however, represents a paradigm shift by integrating these two crucial elements into a unified optimization framework. This simultaneous optimization allows for a more holistic assessment of risk and return, identifying opportunities that would be missed when considered in isolation. Consequently, the strategy demonstrably improves risk-adjusted returns by intelligently balancing the costs of hedging with the benefits of repurchase agreements, ultimately delivering superior performance compared to conventional methods. The model achieves this by dynamically adjusting both strategies in response to changing market conditions, creating a more resilient and profitable portfolio.

Traditional risk assessment often relies on metrics like Value at Risk (VaR), which estimates the maximum loss within a given confidence level. However, Expected Shortfall (ES), also known as Conditional Value at Risk, offers a more nuanced perspective by calculating the average loss exceeding the VaR threshold. This distinction proves critical, as ES provides a clearer picture of tail risk – the potential for extreme, yet infrequent, losses. Analyses demonstrate that incorporating ES as a primary risk measure within a joint hedging framework results in a significant reduction in potential downside, surpassing the protective capabilities of strategies focused solely on VaR minimization. The findings reveal that portfolios optimized using ES exhibit a demonstrably lower exposure to catastrophic losses, offering a more robust and reliable assessment of overall risk compared to conventional methodologies.

The integration of deep neural networks, termed ‘Deep Hedging’, represents a significant refinement within the joint hedging approach, allowing for a more nuanced response to the intricacies of real-world market behavior. This technology enhances the model’s capacity to dynamically adjust hedging strategies, moving beyond static, rule-based systems to anticipate and mitigate risk more effectively. Analysis demonstrates that this enhanced adaptability translates to a measurable increase in the Indifference Discount – the maximum sustainable discount a financial institution can offer clients while maintaining profitability – signifying a considerable improvement in overall financial performance and a greater capacity to attract and retain business through competitive pricing.

When faced with real-world trading limitations, the joint hedging approach demonstrates a marked advantage over traditional strategies. Analysis reveals that constrained models – those operating within specific boundaries on trade size or frequency – consistently outperform capped models, which simply impose absolute limits. This superiority isn’t merely theoretical; constrained models exhibit superior risk mitigation capabilities, effectively reducing potential losses in volatile markets. Furthermore, the resulting increase in the indifference discount – the sustainable discount offered to clients – suggests a tangible benefit to implementing these strategies, as it reflects a greater capacity to absorb market shocks while maintaining profitability. This performance boost in constrained scenarios highlights the practical applicability and robustness of the joint hedging framework, demonstrating its ability to deliver enhanced outcomes even under challenging conditions.

The pursuit of optimal strategies within share repurchase programs, as detailed in this work, reveals a complex interplay of variables. The application of neural networks and joint optimization isn’t about imposing control, but rather about discerning the emergent order within market dynamics. It echoes Leonardo da Vinci’s observation: “Simplicity is the ultimate sophistication.” The sophistication lies not in attempting to dictate market behavior, but in building models that accurately reflect its inherent complexities. The effect of the whole – a smoothly executed repurchase program minimizing risk – is not always evident from the parts, but emerges from the interaction of locally optimized hedging strategies. Sometimes, it’s better to observe than intervene, allowing the system to reveal its natural tendencies.

What’s Next?

The pursuit of ‘optimal’ repurchase strategies, as explored within this work, invariably reveals the illusion of direct control. The framework presented doesn’t dictate market behavior; rather, it navigates the emergent properties arising from the interplay of numerous, individually rational, trading decisions. Future work should acknowledge this fundamental tenet, shifting focus from seeking precise control to influencing the probabilistic landscape of execution. The inherent limitations of any model – the imperfect representation of market microstructure, the ever-shifting investor sentiment – are not bugs to be fixed, but features to be understood.

A natural extension lies in explicitly modeling the feedback loops between the repurchase program itself and the broader market impact. The system isn’t static; the act of buying shares alters the very conditions upon which the optimal strategy is predicated. Furthermore, the integration of alternative risk measures, beyond those traditionally employed, could offer a more nuanced understanding of program vulnerability. Deep hedging, while computationally powerful, remains susceptible to unforeseen correlations; a truly robust system must account for the unknowable.

Ultimately, the greatest advancements may not come from more sophisticated algorithms, but from a more humble approach to financial modeling. The market isn’t a puzzle to be solved; it’s a complex adaptive system that evolves independently of any single actor’s intentions. The art lies not in believing one can master it, but in learning to flow with its inherent unpredictability.

Original article: https://arxiv.org/pdf/2601.18686.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Top 15 Movie Cougars

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- Ephemeral Engines: A Triptych of Tech

- Enduring Yields: A Portfolio’s Quiet Strength

2026-01-28 01:39