A year ago, an investment in Amazon (AMZN +0.43%) would have yielded a meager return of two percent. This, for a company so relentlessly promoted as a harbinger of the future, is a figure that invites scrutiny. The current enthusiasm for artificial intelligence, predictably, has been grafted onto Amazon’s narrative, yet the market’s response has been… restrained. The discrepancy deserves attention. On February 5th, the company will release its fourth-quarter results, and it is a moment for dispassionate assessment, not further hype.

The cloud computing division, Amazon Web Services (AWS), is the engine driving this renewed optimism. It is a vast, complex undertaking, offering businesses the tools they require to function in the digital age. More recently, it has become a focal point for those developing AI applications, drawn by the scale of its data centers and the associated infrastructure. This is not progress for its own sake; it is simply a matter of providing a service for which there is demonstrable demand.

AWS, like its competitors, relies heavily on specialized chips – notably those produced by Nvidia. However, Amazon has also invested in designing its own chips, the Trainium and Inferentia series. The claim that Trainium2 offers a forty percent performance advantage over competing hardware, while potentially accurate, should be treated with the caution it deserves. The fact that Anthropic, a prominent AI start-up, is utilizing up to one million of these chips is a significant detail, though it does not, in itself, guarantee future success.

The Bedrock platform, offering access to pre-trained AI models from companies like Mistral and Meta Platforms, is a pragmatic development. Building such models from scratch is both costly and time-consuming. The ability to offer a ready-made alternative allows businesses to adopt AI technologies more quickly. This is efficiency, not innovation.

AWS generated $93.1 billion in revenue during the first three quarters of 2025, an eighteen percent increase year-over-year. AI has undoubtedly contributed to this growth. The reported $200 billion order backlog, however, is a figure that requires careful consideration. It represents potential revenue, not guaranteed income, and is contingent on Amazon’s ability to expand its data center infrastructure. The backlog will be a key metric to watch on February 5th, though it is essential to remember that numbers, in themselves, are rarely the whole story.

Profitability and Efficiency

While AWS is the most profitable segment of Amazon’s business, accounting for sixty percent of operating income through the first nine months of 2025, the e-commerce division remains the primary driver of revenue. Its profit margins, however, are notoriously thin, a consequence of Amazon’s relentless pursuit of low prices. This is a deliberate strategy, designed to capture market share, but it is not without risk.

There have been improvements in efficiency within Amazon’s logistics network since 2023, which is a welcome development. The investment in technology for fulfillment centers, including the “Project Private Investigator” initiative – utilizing AI to identify product defects before shipment – is a sensible measure to reduce returns and refunds. These incremental improvements, combined with the growth of AWS, are contributing to an increase in overall profits. The company reported earnings of $5.22 per share during the first three quarters of 2025, a forty-two percent increase year-over-year. Furthermore, Amazon exceeded Wall Street’s earnings estimates in all three quarters, by an average of twenty-two percent. This is not a sign of exceptional performance, but of consistent, predictable growth.

The consensus estimate on Yahoo! Finance for fourth-quarter earnings is $1.95 per share. Whether Amazon can meet, or exceed, this figure remains to be seen. The market’s reaction will likely be determined not by the numbers themselves, but by the narrative surrounding them.

Valuation and Outlook

It is unwise to base investment decisions on a single quarterly report. Each report should be viewed in the context of the company’s long-term trajectory. Amazon is, undeniably, a high-quality company. The February 5th report is unlikely to fundamentally alter that assessment.

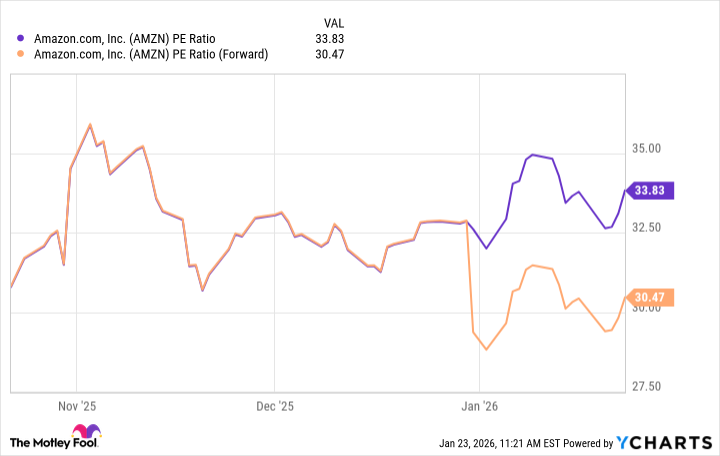

Amazon’s current valuation appears attractive, though the term is relative. The price-to-earnings (P/E) ratio of 33.8 is roughly in line with the Nasdaq-100’s P/E ratio of 32.6. This suggests that the stock is fairly valued compared to its peers. However, Wall Street anticipates annual earnings of $7.88 per share in 2026, placing the stock at a forward P/E ratio of 30.5. This projection, like all projections, is subject to change.

Given that Amazon exceeded earnings estimates by an average of twenty-two percent during the first three quarters of 2025, it is possible that the stock is currently undervalued. However, it is equally possible that the market has already factored in this potential upside. A dispassionate assessment of the company’s fundamentals, combined with a healthy dose of skepticism, is essential.

Read More

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Hawaiian Electric: A Most Peculiar Decline

- ‘Peacemaker’ Still Dominatees HBO Max’s Most-Watched Shows List: Here Are the Remaining Top 10 Shows

2026-01-27 17:52