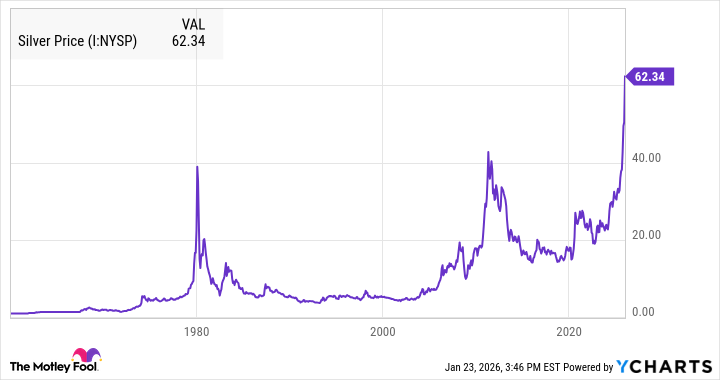

One does tire of these little panics, don’t you? Silver, it seems, has been having a most enthusiastic moment. A 144% surge in a year! Quite the performance, though one suspects it’s less about inherent value and more about a certain… speculative fever. The usual suspects are, naturally, involved: anxieties about Chinese exports, the perpetually tiresome Trump administration, and a general air of uncertainty. Honestly, it’s all rather predictable, isn’t it?

Why the Fuss?

Apparently, silver has breached the hundred-dollar mark. A milestone, I suppose, though one wonders if it’s worth the bother. The Americans, in their typically dramatic fashion, seem to be causing a stir with tariffs. One imagines international investors are beginning to feel a touch… unloved. The dollar, predictably, is looking a little peaked. It’s all frightfully dull, really. A bit like watching paint dry, only with rather more shouting.

And then there’s the matter of Mr. Trump and his ongoing attempts to bully the Federal Reserve. One does wish people would simply behave. This constant meddling is hardly conducive to a stable financial climate. Though, admittedly, stability is a rather overrated virtue these days.

China, of course, is adding to the drama with its export restrictions. Forty-four companies allowed to export silver! The market, naturally, is in a flutter. But Bloomberg assures us this is all rather old hat. A similar system has been in place for years without causing a collapse. They exported a perfectly respectable amount last year, too. The highest in sixteen years, no less. One suspects the panic is a touch… exaggerated.

History, Darling, Always Repeats Itself

Silver, you see, has a rather unfortunate habit of indulging in these little bubbles. The last one burst in 2011, after the Great Recession. Similar anxieties were swirling about then – credit downgrades, eurozone debt, the ever-present threat of inflation. It was all dreadfully tiresome. And, as one might expect, the bubble burst rather spectacularly. A 70% drop in value! One trusts the current investors are prepared for a similar fate.

These rallies, you see, are rarely based on anything substantial. Silver isn’t just a pretty metal, it has industrial uses. Solar panels and electric vehicles require it. But when the price gets too high, they simply find alternatives. Copper or aluminum, for instance. It’s frightfully practical, really.

Bloomberg reports that a major Chinese solar cell manufacturer, LONGi Green Energy Technology, has already started replacing silver with base metals. One anticipates this trend will continue until prices return to something resembling sanity. And, of course, mining output will eventually increase, adding further downward pressure. It’s all rather inevitable, isn’t it?

A Word to the Wise

Whenever a commodity reaches these absurd levels, people start believing that “this time it’s different.” It rarely is, darling. Silver, like oil and cobalt before it, is simply indulging in another little fantasy.

The current rally appears to be fuelled by speculation and hype. When that dies down, and industrial demand asserts itself, the price will inevitably fall. My advice? Take profits, or simply avoid the whole tiresome affair. One has better things to worry about, you know. Like finding a decent martini.

Read More

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Hawaiian Electric: A Most Peculiar Decline

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

2026-01-27 15:03