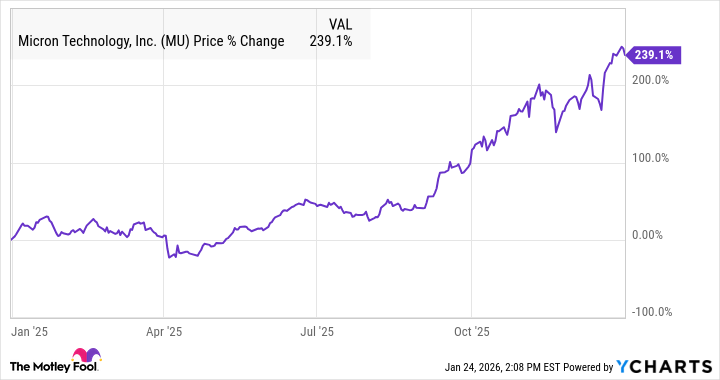

Micron (MU 2.64%). The very name sounds like a microscopic accountant, doesn’t it? A fellow who meticulously tallies the dust motes of profit. And profit, dear reader, has indeed been accumulating around this particular establishment, almost as if by some peculiar enchantment. Last year, it nearly topped the S&P 500, a feat of upward momentum—a full 239%—that would make even the most seasoned speculator raise a skeptical eyebrow. One might almost suspect a conspiracy involving trained pigeons and strategically placed breadcrumbs, but no, it was merely…memory.

The stock, it continues to climb, like a determined beetle scaling a particularly lucrative sunflower. Most of the gains, as one might expect, materialized towards the year’s end – a frantic scramble for digits, a last-minute accounting of fortunes. I ventured, some months ago, a prediction of considerable growth for Micron, and, remarkably, it has exceeded even my cautiously optimistic estimations—a jump of over 150% since then. This is not, of course, to suggest any particular prescience on my part, merely a fortunate alignment of celestial bodies and the insatiable human appetite for ever-increasing computational power.

The source of this effervescence? A shortage, naturally. A most delightful shortage of memory chips. As if the very fabric of digital existence were unraveling, demanding ever-higher prices. One imagines the chip manufacturers, huddled in darkened rooms, rubbing their hands with glee. And Micron, at the heart of it all, quietly amassing a fortune.

Where Micron is Going in 2026

Through January 23rd, Micron’s stock has already ascended a further 40%, fueled by whispers of an ever-worsening shortage. Intel, on its recent earnings call, lamented these constraints, calling them—and I quote—a “very big challenge.” A “challenge,” indeed! As if the laws of supply and demand were a personal affront. Wall Street analysts, those keen observers of the market’s whims, confirm the tightening dynamics, predicting further price escalations. It’s a delicate dance, this interplay of scarcity and desire.

Micron, with a cunning that would impress even a seasoned bureaucrat, has already secured its entire high-bandwidth memory supply for 2026. One wonders what machinations were involved in this feat of logistical prowess. Perhaps a secret pact with the gnomes who guard the silicon mines? Regardless, this secures their position, allowing them to dictate terms to the digital masses.

And now, a grand undertaking: a $100 billion memory manufacturing complex in upstate New York. Four fabs, no less! A monument to human ambition, rising from the fertile soil of…well, upstate New York. It is a project of such scale that one half expects to discover a hidden chamber filled with ancient scrolls detailing the secrets of memory itself.

It is worth noting that Micron is larger than Intel, both in revenue and market capitalization. While Intel receives much of the government’s attention, Micron quietly goes about its business, providing the very foundation upon which our digital lives are built. A silent, indispensable force.

Where Micron Stock Will Be at the End of the Year

Predicting the price of a share is a fool’s errand, akin to attempting to capture smoke with one’s bare hands. Market sentiment, global events, the whims of passing comets—all play a part. However, given the current momentum, the rising chip prices, and Micron’s still-reasonable valuation (a forward P/E of just 12), I believe a price of $600 by the end of the year is not an unreasonable expectation. A 50% increase from today’s level. A tidy sum, wouldn’t you agree? A testament to the enduring power of memory…and a little bit of luck.

Read More

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Hawaiian Electric: A Most Peculiar Decline

- ‘Peacemaker’ Still Dominatees HBO Max’s Most-Watched Shows List: Here Are the Remaining Top 10 Shows

2026-01-27 14:52