It has ever been the case that those possessed of capital seek opportunities for its judicious employment, and in recent years, the pursuit of novelty has proven particularly enticing. One recalls the eager embrace of the telegraph, and later, the motorcar, each promising a transformation of fortunes. Now, a new sphere of speculation has captured the attention of discerning investors: the realm of quantum computing. The promise is substantial, though, as with any venture into the unknown, a degree of circumspection is most assuredly warranted.

Quantum computing, one is informed, offers the possibility of resolving problems beyond the capacity of even the most advanced calculating engines currently at our disposal. A most intriguing prospect, to be sure. Rigetti Computing, a company dedicated solely to this pursuit, thus presents itself as a potential beneficiary of this technological advancement. But is an investment in its shares a prudent course, or merely a gamble upon a distant and uncertain future?

Classical vs Quantum Computing

The distinction between the computing methods of the present and those proposed by quantum mechanics is, for those unversed in such matters, somewhat complex. Classical machines, as we know them, operate upon the principle of bits, representing information as either a 0 or a 1. Quantum computers, however, employ qubits, which possess the rather remarkable ability to exist as both simultaneously. This allows for a scale of calculation that surpasses the limitations of current technology, though achieving such a state is, one gathers, not without its difficulties.

Numerous established houses, including the formidable Microsoft, are engaged in this field, but Rigetti distinguishes itself as a specialist, wholly devoted to the advancement of quantum computing. Founded in 2013, the company has already constructed eighteen quantum systems, a feat not to be dismissed lightly. Its approach is notably comprehensive, encompassing the entire process from the initial design of the chip to its ultimate deployment in the cloud. This vertical integration, while demanding, affords Rigetti a degree of control and speed that may prove advantageous in the long run.

The company’s technology, based upon superconducting qubits, is known for its swift processing of information, though it is also acknowledged that error rates are somewhat higher than those encountered in the slower, though perhaps more stable, trapped ion method. A delicate balance, indeed, between speed and reliability.

The Quantum Computing Goal

Rigetti generates revenue by providing access to its quantum hardware, but, like many of its contemporaries, the ultimate goal – a universally useful quantum computer – remains some distance hence. Experts suggest that several years must yet pass before such a device becomes a reality.

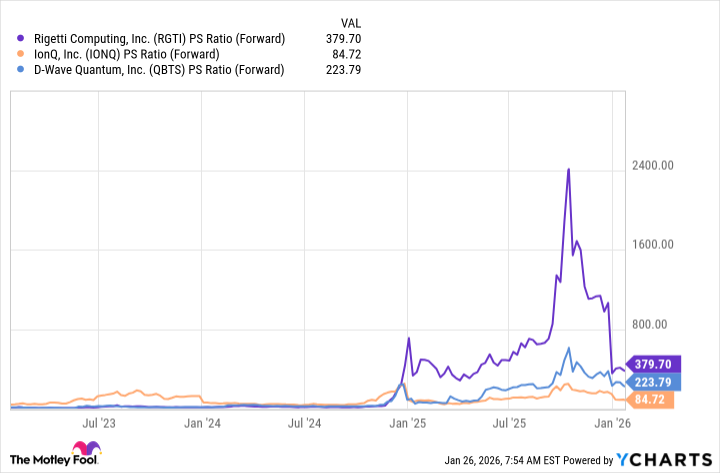

Thus, we return to the initial question: is Rigetti a suitable investment? The company, as a specialist in this nascent field, commands a valuation that is, shall we say, enthusiastic. The price-to-sales ratio is, to put it mildly, considerable, rendering traditional methods of assessment somewhat inadequate. One is forced to consider not merely the financial metrics, but the strength of the underlying technology, the company’s position within the competitive landscape, and, most importantly, one’s own tolerance for risk.

A cautious investor might well find this stock unsuitable, for it demands a degree of speculation that few can comfortably embrace. However, an investor of a more adventurous disposition, recognizing Rigetti’s comprehensive approach and demonstrable progress, might consider acquiring a modest holding. It is a venture fraught with uncertainty, to be sure, but one that may, in time, yield a most substantial return. The prudent investor, however, will always remember that even the most promising of ventures requires careful consideration and a clear understanding of the risks involved.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

2026-01-27 12:22