So, Berkshire Hathaway. A company. A rather large company. It recently underwent a… transition. Warren Buffett, a man who appears to have single-handedly defied the laws of compound interest for several decades (a feat requiring, one suspects, a pact with entities best left unnamed), has stepped down. Greg Abel now occupies the captain’s chair. This is, naturally, causing a certain amount of consternation amongst those whose primary investment strategy involves closing their eyes and hoping for the best. Which, let’s be honest, is a surprisingly effective strategy… sometimes.

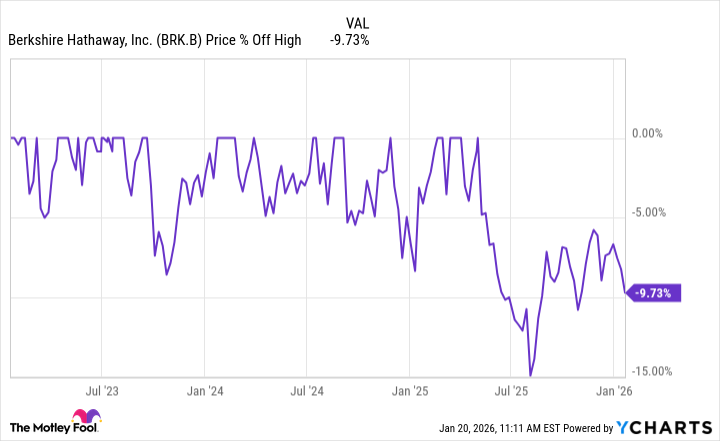

The stock, predictably, has wobbled a bit. Down roughly 10% from its recent high. Which, in the grand scheme of cosmic events, is less than the margin of error when calculating the probability of a slightly used toaster spontaneously achieving sentience. But it is enough to provoke the usual chorus of panicked pronouncements. Is this a buying opportunity? Well, that depends. Are you, in fact, a buyer? (A surprisingly difficult question, when you think about it. What does it even mean to ‘buy’ something? Is it merely the exchange of symbolic tokens? Or a deeper existential commitment?)

Abel: The Quiet Executor

Greg Abel. A Canadian. This is significant, mostly because Canada is a very large country, and it’s difficult to keep track of everything that’s happening there. He took over the reins after a period of apprenticeship, having previously managed Berkshire’s energy division, and everything else that didn’t involve Mr. Buffett staring intently at financial statements. Essentially, he was running the bits that kept the lights on, the trains running, and the candy flowing. Which, one might argue, is the important stuff. The rest is just… numbers. (Numbers, of course, are a human construct. A particularly persistent delusion, if you ask me.)

These operations generate around $25 billion in earnings annually. A substantial sum. Enough to purchase a small moon, or perhaps a really, really nice collection of paperclips. It’s this operational engine, not the stock picking, that’s increasingly become the core of Berkshire. A fact that many seem to conveniently overlook while fretting over the latest market fluctuations.

The $380 Billion Problem (Or: Where Does All the Money Go?)

Buffett’s legacy is, undeniably, his investment acumen. Berkshire’s portfolio – a staggering $300 billion-plus – is a testament to that. Apple, American Express, Occidental Petroleum – the usual suspects. But here’s the rub: what do you do with that much money? It’s like trying to find a parking space for a planet. (And good luck with the meter.) The sheer weight of capital becomes a problem in itself. Todd Combs has departed for JPMorgan, leaving Ted Weschler to shoulder a significant burden. A burden, one suspects, that would require the structural integrity of a small mountain range.

And then there’s the cash pile. $380 billion. Earning… relatively little. It’s a monument to financial prudence, yes. But also, a rather large, inert lump of potential. The temptation to issue a special dividend is obvious. A tax-free distribution of wealth. A fleeting moment of joy for shareholders. (Followed, inevitably, by the usual existential angst.) It’s a perfectly sensible solution, really. Unless, of course, you believe that hoarding capital is a virtue in itself. Which, admittedly, is a perfectly valid position. If you’re a dragon.

So, Should You Buy? (The Incredibly Difficult Question)

Berkshire’s market cap is around $1.05 trillion. Its equity portfolio: $300 billion. Cash: $400 billion. Debt: $82 billion. Subtract, add, and you arrive at an enterprise value of $432 billion for the operating businesses. In 2024, those businesses generated $34 billion in earnings. That puts the price-to-earnings ratio at around 13. Which, in the current market, is… reasonable. Not spectacular. But reasonable. (Reasonable is, of course, a deeply underrated quality.)

Berkshire isn’t going to double overnight. It’s not a hypergrowth stock. It’s a steady, reliable, slightly ponderous behemoth. But it has a huge cash cushion. And a new management team. If you believe in that team – and you’re willing to ignore the inherent unpredictability of the universe – then a dip in the price might just be a buying opportunity. Or it might not. It’s really all a matter of perspective. And, of course, luck. (Luck, as any seasoned investor will tell you, is vastly overrated. Except when you have it.)

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

2026-01-27 12:02