The distribution of capital, a habit as old as commerce itself, continues to shape the contours of the investment landscape. In the year recently past, the Real Estate Investment Trusts, those peculiar entities dedicated to the tangible world of brick and mortar and, increasingly, of digital infrastructure, disbursed over seventy billion dollars in dividends. A considerable sum, one might observe, a veritable river of income flowing into the hands of those who patiently await its arrival. The current year appears poised to continue this trend, with certain players demonstrating a particular aptitude for rewarding their shareholders.

One anticipates, with a degree of cautious optimism, that the coming year, 2026, will witness a further expansion of these distributions. Two names, in particular, stand out as likely leaders in this quiet ascent: Prologis, a titan of industrial real estate, and American Tower, a purveyor of the unseen networks that bind our modern world. These are not merely companies; they are, in a sense, custodians of the physical and digital foundations upon which so much of our prosperity rests.

The Steadfast Growth of Prologis

Prologis, with a market capitalization approaching one hundred and twenty billion dollars, is a presence one cannot ignore. It is a behemoth, certainly, but one that moves with a discernible purpose. Last year, it returned nearly four billion dollars to its shareholders, a sum comfortably supported by its core funds from operations, which totaled approximately five and a half billion. A healthy margin, one might say, a sign of a business operating with a degree of resilience.

The quarterly dividend currently stands at one dollar and one cent per share, or four dollars and four cents annualized. A modest increase of five percent was enacted last February, a gesture of confidence in the company’s continued performance. One observes, however, that such increments are rarely dramatic; the world rarely rewards boldness, preferring instead the steady accumulation of small gains.

The outlook for 2026 appears promising. Prologis anticipates a rise in core funds from operations per share, ranging from six dollars and five cents to six dollars and twenty-five cents – a three to seven percent increase. Given its prudent payout ratio, one expects another dividend increase, perhaps of a similar magnitude. This would translate to approximately four point one billion dollars in total dividends, a substantial sum, yet one that seems entirely within reach.

American Tower: A Network of Distributions

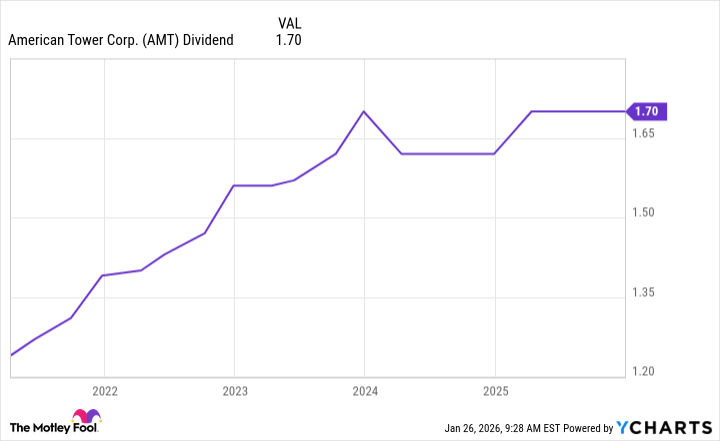

American Tower, with a market capitalization nearing eighty-four billion dollars, is a different sort of giant. It does not deal in tangible goods, but in the ethereal realm of radio waves and data transmission. Yet its impact on the physical world is no less profound. It currently distributes one dollar and seventy cents per share in dividends, amounting to nearly eight hundred million dollars each quarter – a total of three and a half billion dollars annually. A significant figure, placing it among the leaders in the sector.

However, the path has not been without its complexities. In recent years, dividend growth has stagnated, constrained by the company’s focus on debt reduction and balance sheet strengthening. A prudent strategy, to be sure, but one that has left some shareholders yearning for more immediate returns. The company, having achieved its target leverage ratio, now appears poised to revisit its dividend policy.

One anticipates a return to more robust dividend growth, perhaps in the mid-single digits. A five percent increase would push total dividend payments to nearly three and a half billion dollars. A modest sum, perhaps, but one that reflects a renewed commitment to rewarding shareholders.

A Quiet Confidence in the Future

Prologis and American Tower were the leading dividend payers last year, and one expects them to maintain their position in 2026. Their strong financial profiles, coupled with their ability to consistently increase dividends, suggest a continued commitment to delivering value to shareholders. A quiet confidence, one might say, in the enduring power of tangible assets and essential infrastructure. It is a world where patience and prudence are rewarded, and where the steady accumulation of small gains often proves more enduring than fleeting bursts of speculation.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

2026-01-27 10:55