The current enthusiasm for all things Artificial Intelligence presents a predictably crowded field for the investor. Two contenders, SoundHound AI and Navitas Semiconductor, offer exposure to this burgeoning, if somewhat hysterical, market. One deals in the ethereal – the interpretation of human utterance – the other in the brutally practical matter of power delivery. A curious pairing, and one which, upon closer inspection, reveals a rather predictable disparity in prospects.

SoundHound, it appears, is attempting to build a business on the premise that people will willingly converse with machines. A charming notion, perhaps, but one which relies heavily on the assumption that these machines will, in fact, be able to understand them. Their focus is, ostensibly, on consumer-facing applications – ordering meals, arranging travel – the sort of tasks one might delegate to a particularly efficient, if somewhat impertinent, secretary. Navitas, by contrast, manufactures the silicon required to keep the data centres humming – the unglamorous, but essential, infrastructure upon which this digital fantasy is built.

Between the two, a degree of discernment is required. SoundHound, for all its talk of “agentic AI,” remains, at heart, a purveyor of novelty. Navitas, whilst currently experiencing a period of rather undignified retrenchment, at least occupies a position of demonstrable utility.

SoundHound: The Siren Song of Voice

The company’s technology is, admittedly, impressive. Its voice-activated bots can perform a variety of tasks, from the mundane to the mildly diverting. The recent introduction of “Vision AI” – a system which allows vehicles to “see” their surroundings and respond to verbal commands – is a particularly ambitious, if slightly unsettling, development. One imagines a future filled with automobiles issuing pronouncements on the state of the weather, or attempting to translate roadside advertisements. The partnership with Marriott and Toyota is, of course, a useful demonstration of market acceptance, though whether it translates into sustained profitability remains to be seen.

Revenue did, indeed, reach a record $42 million in the third quarter, a commendable 68% increase. However, this growth has been achieved, in part, through a series of acquisitions, which have, predictably, resulted in a corresponding surge in operating costs – a rather alarming 243% increase. Such profligacy is rarely a sign of long-term viability. The company is banking on continued rapid growth, forecasting sales of between $165 and $180 million for the full year – a figure which, whilst optimistic, is not entirely implausible.

Navitas: A Necessary, if Unpleasant, Correction

Navitas, for its part, manufactures gallium nitride integrated circuits – a rather technical term for a technology which allows for faster charging and greater energy efficiency. These are, undeniably, desirable qualities, particularly for the energy-hungry data centres which underpin the AI revolution. However, the company has recently undergone a rather abrupt strategic shift, abandoning its established business in the mobile and consumer electronics markets to focus entirely on AI. This has, inevitably, resulted in a significant decline in sales.

Revenue plummeted to $10.1 million in the third quarter, a stark contrast to the $21.7 million recorded in the same period last year. The company is currently unprofitable, posting a net loss of $19.2 million. Efforts are underway to reduce operating expenses, though the efficacy of these measures remains to be seen. Forecasts for the fourth quarter are equally bleak, with revenue expected to fall to $7 million. The company insists that a turnaround is imminent, but such pronouncements should be treated with a healthy dose of scepticism.

A Choice Between Hope and Pragmatism

Investing in either SoundHound or Navitas requires a leap of faith, albeit of differing magnitudes. SoundHound demands a belief in the enduring appeal of voice-activated technology and the company’s ability to control its escalating costs. Navitas, on the other hand, requires a faith in the efficacy of its strategic pivot and the eventual resurgence of its revenue. The valuation, as always, provides a useful, if imperfect, guide.

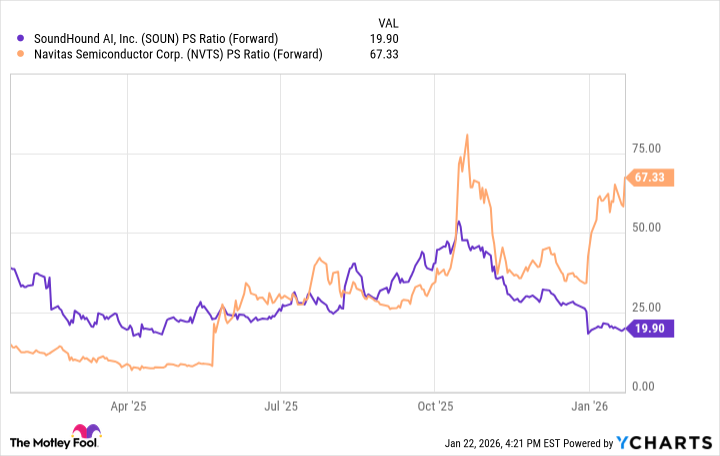

As the chart illustrates, Navitas currently commands a significantly higher price-to-sales ratio than SoundHound. This suggests that the market has already priced in a considerable degree of optimism regarding the company’s prospects. Given its declining sales and current lack of profitability, this valuation appears, shall we say, ambitious. Perhaps, in time, Navitas will emerge as a compelling AI investment. But for the present, a degree of caution is advisable.

SoundHound, despite its own shortcomings, presents a more attractive proposition. Its lower valuation and rising sales, however precarious, make it the more sensible choice. A calculated gamble, perhaps, but one grounded, at least, in a semblance of fiscal reality.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

2026-01-27 09:02