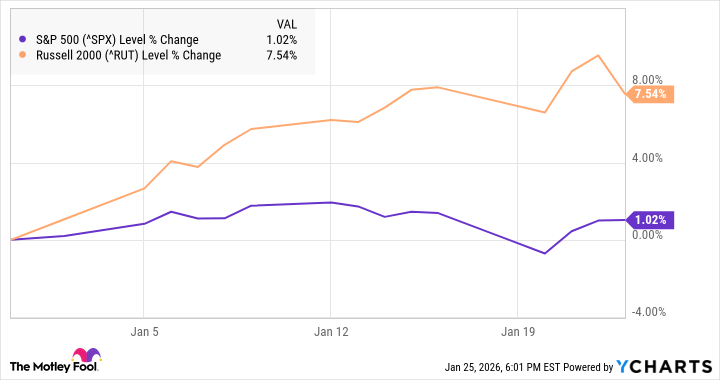

The year, still dewy with possibility, has already presented a curious spectacle: the Russell 2000, that index of diminutive ambitions, has been, for a fleeting fortnight, outperforming its more august cousin, the S&P 500. A brief, almost impertinent, streak – snapped, predictably, on the twenty-third of January with a decline of nearly two percent – but a streak nonetheless. One might almost suspect a mischievous impulse at work within the market’s mechanisms.

For five years, the S&P 500, that behemoth of established fortunes, has held sway. And, of course, the recent delirium over artificial intelligence has disproportionately benefited its most celebrated denizens. But the market, like a capricious lepidopterist, often shifts its affections. And the Russell 2000, after a promising start, appears poised to, shall we say, inconvenience the larger index. Two reasons, delicately interwoven, suggest this is more than mere happenstance.

The Valuation Paradox: A Matter of Proportion

The S&P 500, having enjoyed a rather exuberant three-year ascent—a climb exceeding seventy-five percent—now trades at a valuation that approaches the precipice of expensiveness. A price-to-earnings ratio of twenty-eight, according to those who track such things, hints at a certain… fragility. The anxieties surrounding an “AI bubble,” coupled with the unsettling concentration of power among the “Magnificent Seven” – a rather grandiose appellation, wouldn’t you agree? – and the expectation of a broadening bull market, all conspire to favor alternatives. And by “alternatives,” naturally, I refer to the smaller, more nimble, creatures of the small-cap realm.

The largest Russell 2000 ETF, the iShares Russell 2000 ETF (IWM), currently trades at a price-to-earnings ratio of nineteen and a half. A discount, roughly a third, compared to its larger counterpart. One might posit that the Russell 2000 would need to increase by approximately fifty percent to achieve parity. A rather substantial leap, but not, I assure you, entirely implausible. Such a differential invariably encourages a rotation, a subtle shifting of capital from the overstuffed coffers of the large-cap world into the more modestly appointed dwellings of the small-cap universe.

The Interest Rate Rhapsody: A Delicate Resonance

Small-cap stocks, unlike their more robust brethren, possess a certain sensitivity to macroeconomic currents, particularly the ebb and flow of interest rates. Indeed, the Russell 2000 has experienced a rather gratifying surge—a seventeen percent increase—over the last six months, coinciding with the Federal Reserve’s modest series of rate cuts—a reduction of seventy-five basis points. A gentle nudge, you might say, to encourage a bit of market frolic.

The current forecast anticipates a single additional rate cut this year. A rather pedestrian prediction. However, given the near-flatness of job growth over the last eight months, and the impending change in leadership at the Federal Reserve in May – and, of course, the insistent pressures from certain quarters to lower rates – the possibility of further cuts is not merely plausible, but increasingly probable. Such unexpected adjustments, like a sudden shift in the wind, are likely to favor the more agile, the more responsive, small-cap stocks.

Capitalizing on the Shift: A Portfolio Promenade

The most straightforward path to exposure to small-cap stocks is, naturally, through an ETF that tracks the Russell 2000. The iShares Russell 2000 ETF (IWM), with its substantial net assets of approximately seventy-five billion dollars, is the obvious choice. However, for those with a more discerning palate, a more focused ETF—such as the Vanguard Russell 2000 Growth ETF (VTWG) or the Vanguard Russell 2000 Value ETF (VTWV)—may prove more appealing.

For those who prefer the thrill of individual stock selection, a few possibilities merit consideration. Amplitude (AMPL), a software stock poised to blossom in 2026, is one such candidate. Its introduction of AI agents last year suggests a potential for accelerated growth. And Innodata (INOD), a specialist in data-labeling—a crucial step in the AI process—has demonstrated strong growth and profitability.

While the initial burst of Russell 2000 outperformance is unlikely to be sustained indefinitely, the conditions appear favorable for a breakout year. Between ETFs and individual stocks, there are ample opportunities to capitalize on the expected rotation. A discreet flutter, perhaps, on the smaller, more intriguing creatures of the market menagerie.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

2026-01-27 05:33