The matter of Nvidia, you see, has become a peculiar obsession amongst those who track the dance of digits. Each year, they ask, with a growing anxiety that borders on the comical, whether this purveyor of silicon and light might yet again defy gravity. It has, after all, ascended these past three years with a velocity that would shame a runaway troika, accumulating gains exceeding one thousand one hundred percent. A most unsettling spectacle for those accustomed to the predictable plodding of the market.

The reason, naturally, is not magic, though some whisper of such things in the dimly lit corners of brokerage houses. No, it is merely the relentless march of artificial intelligence, a beast of burgeoning appetite. Analysts predict a realm of two trillion dollars within the decade, a sum so vast it threatens to swallow entire economies. And Nvidia, dear reader, has positioned itself as the chief cook and bottle washer for this digital leviathan. They sell the very brains – the chips – that fuel the ambitions of the largest tech companies, and do so with a disconcerting efficiency. They even promise innovation, a word so often bandied about, yet rarely delivered with such consistency.

One cannot, of course, guarantee the future. The stock market is a capricious mistress, easily offended by a poorly worded tweet or a sudden outbreak of geopolitical absurdity. Any number of unforeseen events – a rogue comet, a particularly stubborn bureaucrat – could disrupt the carefully laid plans. But by observing the company’s past performance, and attempting to extrapolate its potential revenue, one might, with a degree of cautious optimism, arrive at a plausible prediction. And so, with a sigh and a heavy heart, I shall venture to do just that.

The Early Days of a Digital Empire

Nvidia, it must be understood, is not some overnight sensation. Its founder, a certain Mr. Jensen Huang, began his labors over thirty years ago. In those days, the company’s principal business was the creation of graphics for… games. Yes, games! A frivolous pursuit, one might think, yet it provided the foundation for the company’s later triumphs. It was soon apparent that these ‘graphics processing units,’ or GPUs as they are known, possessed a peculiar aptitude for tasks beyond mere entertainment. Thus, a platform called CUDA was developed, a sort of digital forge in which these GPUs could be molded to serve a wider range of industries.

But the true stroke of genius, the moment of almost divine inspiration, was Mr. Huang’s decision to focus these GPUs on the burgeoning field of artificial intelligence. This allowed Nvidia to establish a commanding lead, to become the undisputed sovereign of this digital realm. The strategy, it must be said, worked with a terrifying efficiency, catapulting the company into the very center of the AI universe. And with a pledge to update these chips annually, they have effectively erected a fortress against their rivals, a fortress guarded by legions of transistors and algorithms.

Last year, Nvidia achieved a feat of considerable hubris, becoming the first company to surpass – and then comfortably exceed – a market value of four trillion dollars. A sum so large it could purchase several small countries, or at least a considerable number of goats. Still, one suspects there is room for further ascent.

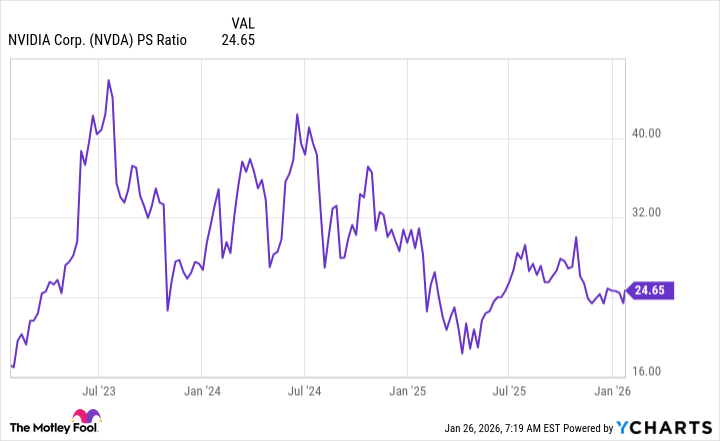

Currently, Nvidia trades at 24 times its sales. But in the past three years, it has often traded at a more extravagant 30 times. A clear indication that the market, in its infinite wisdom, believes there is still more value to be extracted.

Revenue Expectations: A Calculation of Possibilities

Analysts, those meticulous scribes of the financial world, estimate Nvidia’s revenue will reach 213 billion dollars by 2026. A staggering sum, enough to fund a small space program, or at least a very lavish office party. This would, in turn, bring Nvidia’s market value to six trillion dollars, leaving its price-to-sales ratio at a respectable 28 times. And this, my dear reader, translates to a stock price of 247 dollars by the end of the year. Thus, mathematically speaking, Nvidia’s stock could climb by more than 30 percent, securing a fourth consecutive year of gains for its shareholders. A most pleasing prospect, though one should always approach such calculations with a healthy dose of skepticism.

Moreover, Nvidia may benefit from several additional catalysts in the coming quarters. They are, it seems, on the verge of re-entering the Chinese AI chip market, a feat previously hindered by various export controls. The U.S. government, after much deliberation and bureaucratic maneuvering, has granted Nvidia permission to export its H200 system. Though, one must always be prepared for delays, for the whims of governments are as unpredictable as the weather in St. Petersburg.

And later this year, Nvidia intends to unveil the Rubin platform, fulfilling its annual promise of innovation. A pledge that, if fulfilled, will further solidify its position as the leader in this digital landscape.

Finally, data centers are aggressively expanding their AI infrastructure, and Nvidia’s GPUs are, naturally, at the very heart of this expansion. Each of these elements may contribute to Nvidia’s revenue in the near future, and as these stories unfold, Nvidia’s stock may continue to climb. Thus, my prediction is that Nvidia’s stock will end the year at around 247 dollars. A figure that, while not guaranteed, seems, at least to me, a reasonable expectation.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

- Ephemeral Engines: A Triptych of Tech

2026-01-27 02:22