Right. Nike. The swoosh. Forty years of athletic dominance, and let’s be honest, a frankly unsettling amount of cultural influence. You’d think that translates to a perpetually soaring stock price, wouldn’t you? Except…it hasn’t. Not since 2021, anyway. A 60% drop? Ouch. That’s the kind of number that keeps a market watcher up at night, fuelled by lukewarm coffee and a growing sense of existential dread.

Everyone’s looking for a bargain, naturally. A steal. But let’s not mistake a price drop for actual value. It’s like finding a designer handbag on sale – thrilling, until you realize it’s missing a strap and smells faintly of regret. A stock trading at $100 that should be worth $20 is still…overvalued if it’s currently at $50. Basic math, people. I feel like I’m talking to ghosts.

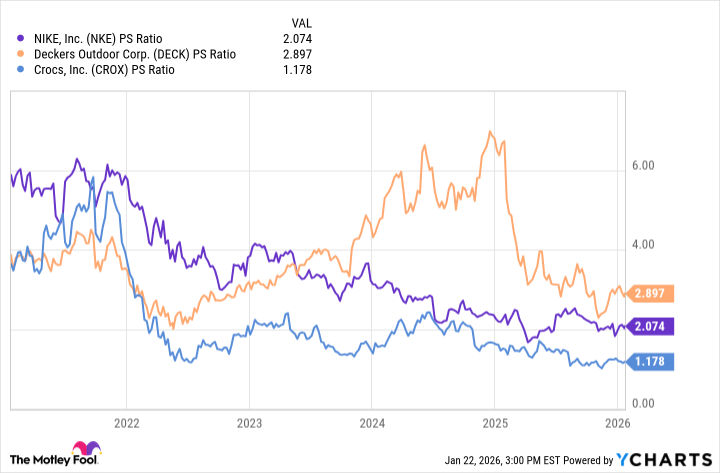

Okay, the valuation is cheaper. Five years ago, a price-to-sales ratio of 6. Now? A measly 2. Progress, I suppose. Though I’m starting to suspect the market is just politely ignoring them, hoping they’ll go away. It’s a passive-aggressive strategy, but honestly? I get it.

But a bargain? I’m not convinced. It feels…average. Like a perfectly acceptable pair of trainers. Functional, reliable, but lacking that certain je ne sais quoi. I’ve been comparing it to Deckers and Crocs. Deckers is growing faster, justifying the higher price tag. Crocs, though…Crocs is the dark horse. Cheaper, higher operating margin. Don’t look at me like that. Sometimes the ugliest duckling wins the race. It’s unsettling, but true.

So, is Nike a screaming buy? No. Not really. It’s…fairly valued. Which, in this market, feels almost scandalous. It needs a kick. A jolt. A reason to believe again. And frankly, I’m not seeing it yet.

That said, it’s not a disaster. It’s not going to bankrupt you. It just needs to…grow up. Find some margins. Remember what it was good at. Which, admittedly, is a lot to ask of a company with a nearly $100 billion market cap. It’s like trying to turn a supertanker with a canoe paddle.

What Nike Needs to Stop Flailing

Growth is the problem. One percent year-over-year revenue increase? Seriously? That’s the kind of number that makes me question all my life choices. They’re spending more on demand creation – 13% more, in fact – and getting barely any return. It’s like throwing money into a very stylish, very expensive black hole.

Costs are up, margins are down, and everyone’s looking increasingly panicked. It’s a beautiful mess, really. A slow-motion train wreck with excellent branding. And, honestly, I’m starting to feel a little bit sorry for them.

But then, there’s the new CEO, Elliott Hill. Worked for Nike for thirty years, retired, then dragged back in to save the day. A bit dramatic, isn’t it? But, credit where it’s due, he seems to genuinely care. And he’s put his money where his mouth is – a $1 million investment on December 29th. That’s a statement. Either he’s incredibly optimistic, or he’s a very good poker player. I’m leaning towards optimistic. Because, let’s face it, we all need a little bit of hope, don’t we? Even when staring into the abyss of a stagnant stock price.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Best TV Shows to Stream this Weekend on AppleTV+, Including ‘Stick’

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

2026-01-26 21:23